Region:Middle East

Author(s):Shubham

Product Code:KRAC3574

Pages:93

Published On:October 2025

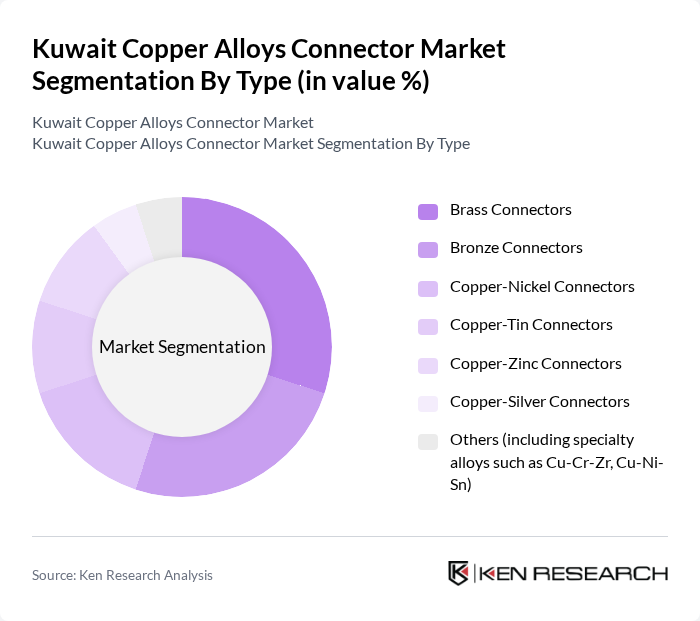

By Type:The market is segmented into various types of connectors, including Brass Connectors, Bronze Connectors, Copper-Nickel Connectors, Copper-Tin Connectors, Copper-Zinc Connectors, Copper-Silver Connectors, and Others (including specialty alloys such as Cu-Cr-Zr, Cu-Ni-Sn). Each type serves specific applications and industries, with varying demand based on performance characteristics such as electrical conductivity, corrosion resistance, and mechanical strength. Brass and bronze connectors are widely used for their balance of conductivity and durability, while specialty alloys like Cu-Cr-Zr and Cu-Ni-Sn are increasingly adopted in high-performance and miniaturized electronic systems .

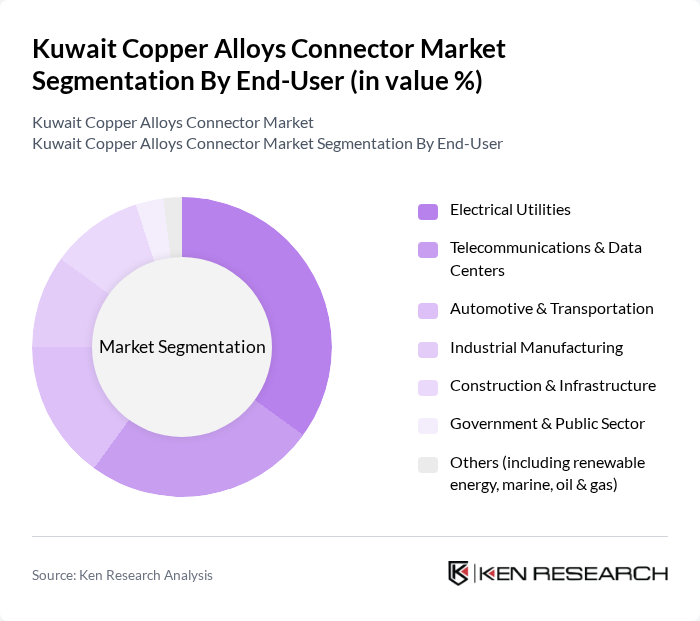

By End-User:The market is segmented by end-user industries, including Electrical Utilities, Telecommunications & Data Centers, Automotive & Transportation, Industrial Manufacturing, Construction & Infrastructure, Government & Public Sector, and Others (including renewable energy, marine, oil & gas). Electrical utilities and telecommunications remain the largest consumers due to the critical need for reliable, high-conductivity connectors in power distribution and data transmission. The automotive and renewable energy sectors are experiencing rapid growth, driven by electric vehicle adoption and new energy projects .

The Kuwait Copper Alloys Connector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Copper and Engineering Services, Kuwait Copper Industries, Alghanim Industries, Mehul Nickel Alloys, Repute Steel & Engineering Co., National Industries Group, Al-Bahar Group, Al-Khaldi Group, Al-Muhalab Group, Al-Sayer Group, Al-Mutawa Group, Al-Qatami Group, Al-Shaheen Group, KME Group, Materion Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Copper Alloys Connector Market appears promising, driven by increasing investments in infrastructure and the automotive sector. As the demand for electric vehicles and renewable energy solutions grows, manufacturers are likely to innovate and adapt their product offerings. Additionally, the focus on sustainability will push companies to explore eco-friendly materials and processes, aligning with global trends. Overall, the market is poised for growth, supported by technological advancements and government initiatives promoting local manufacturing.

| Segment | Sub-Segments |

|---|---|

| By Type | Brass Connectors Bronze Connectors Copper-Nickel Connectors Copper-Tin Connectors Copper-Zinc Connectors Copper-Silver Connectors Others (including specialty alloys such as Cu-Cr-Zr, Cu-Ni-Sn) |

| By End-User | Electrical Utilities Telecommunications & Data Centers Automotive & Transportation Industrial Manufacturing Construction & Infrastructure Government & Public Sector Others (including renewable energy, marine, oil & gas) |

| By Application | Power Distribution & Transmission Communication Systems Automotive Wiring & Electronics Industrial Equipment & Machinery Renewable Energy Systems (solar, wind) Others (including marine, oil & gas) |

| By Sales Channel | Direct Sales Distributors & Agents Online Retail & E-commerce Wholesale Others |

| By Distribution Mode | B2B Distribution B2C Distribution E-commerce Platforms Direct-to-Consumer Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Component | Connectors Terminals Adapters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Copper Connectors | 100 | Product Engineers, Procurement Managers |

| Telecommunications Equipment | 60 | Technical Directors, Supply Chain Analysts |

| Consumer Electronics | 70 | R&D Managers, Quality Assurance Specialists |

| Industrial Applications | 50 | Operations Managers, Maintenance Supervisors |

| Electrical Infrastructure | 40 | Project Managers, Electrical Engineers |

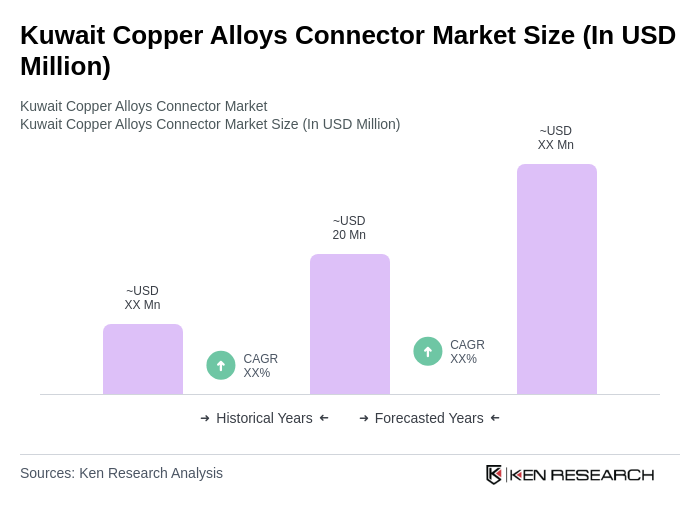

The Kuwait Copper Alloys Connector Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This valuation is influenced by the growing demand for electrical connectors across various industries, including telecommunications, automotive, and construction.