Region:Middle East

Author(s):Dev

Product Code:KRAC2006

Pages:99

Published On:October 2025

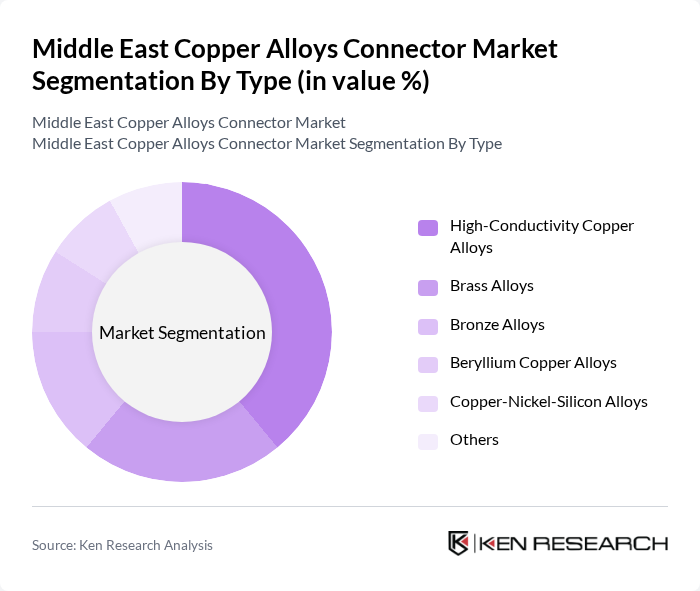

By Type:The market is segmented into various types of copper alloys, each serving distinct applications and industries. The primary types include High-Conductivity Copper Alloys, Brass Alloys, Bronze Alloys, Beryllium Copper Alloys, Copper-Nickel-Silicon Alloys, and Others. Each type has unique properties that cater to specific requirements in electrical conductivity, corrosion resistance, and mechanical strength. High-Conductivity Copper Alloys hold the largest share due to their widespread use in power transmission and data connectivity, while Copper-Nickel-Silicon Alloys are experiencing the fastest growth owing to their superior strength and durability in demanding environments .

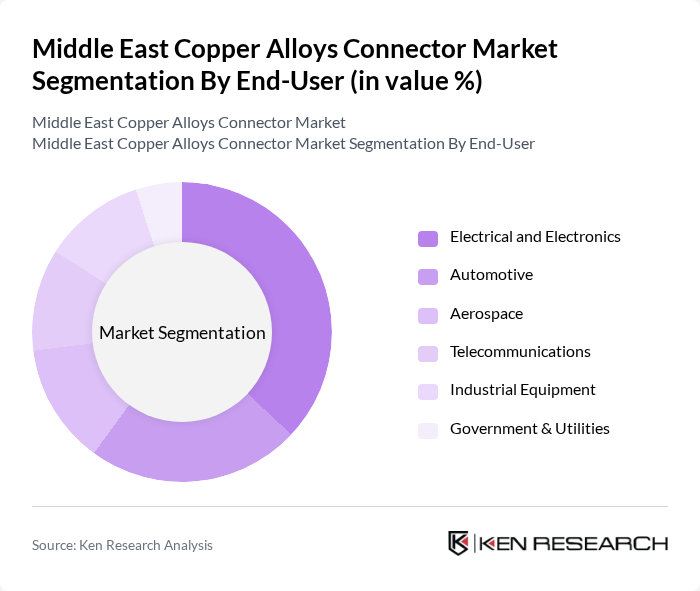

By End-User:The end-user segmentation includes various industries that utilize copper alloys in their operations. Key segments are Electrical and Electronics, Automotive, Aerospace, Telecommunications, Industrial Equipment, Government & Utilities, and Others. Each segment has specific requirements for copper alloys based on their applications, driving the demand for tailored solutions. The Electrical and Electronics segment leads the market, driven by the proliferation of consumer electronics, smart grids, and industrial automation .

The Middle East Copper Alloys Connector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aviva Metals, KME Group S.p.A., Aurubis AG, Mitsubishi Materials Corporation, Southwire Company, LLC, General Cable Corporation, Nexans S.A., Leoni AG, Sumitomo Electric Industries, Ltd., Amphenol Corporation, TE Connectivity Ltd., Belden Inc., Prysmian Group, Encore Wire Corporation, Eland Cables Ltd., Materion Corporation, PMX Industries Inc., Cadi Company, Inc., Electric Materials Company, IBC Advanced Alloys Corp., JX Advanced Metals Corporation, Copper Alloys Australia Pty Ltd, Swissmetal Industries SA, KME Germany GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East copper alloys connector market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt smart technologies and renewable energy solutions, the demand for high-performance copper alloys is expected to rise. Additionally, the integration of IoT in manufacturing processes will enhance efficiency and customization, allowing companies to meet specific application needs. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Conductivity Copper Alloys Brass Alloys Bronze Alloys Beryllium Copper Alloys Copper-Nickel-Silicon Alloys Others |

| By End-User | Electrical and Electronics Automotive Aerospace Telecommunications Industrial Equipment Government & Utilities Others |

| By Application | Power Generation Transmission and Distribution Consumer Electronics Automotive Wiring Industrial Automation Others |

| By Sales Channel | Direct Sales Distributors Online Retail Wholesalers Others |

| By Distribution Mode | B2B Distribution B2C Distribution E-commerce Platforms Retail Outlets Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range Others |

| By Region | GCC Countries Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing | 100 | Product Engineers, Supply Chain Managers |

| Automotive Components | 90 | Procurement Managers, Quality Assurance Specialists |

| Telecommunications Equipment | 70 | Technical Directors, Operations Managers |

| Construction and Infrastructure | 60 | Project Managers, Materials Engineers |

| Renewable Energy Sector | 50 | Research Analysts, Product Development Managers |

The Middle East Copper Alloys Connector Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by increasing demand in various sectors, including automotive and telecommunications.