Region:Middle East

Author(s):Dev

Product Code:KRAC5137

Pages:89

Published On:January 2026

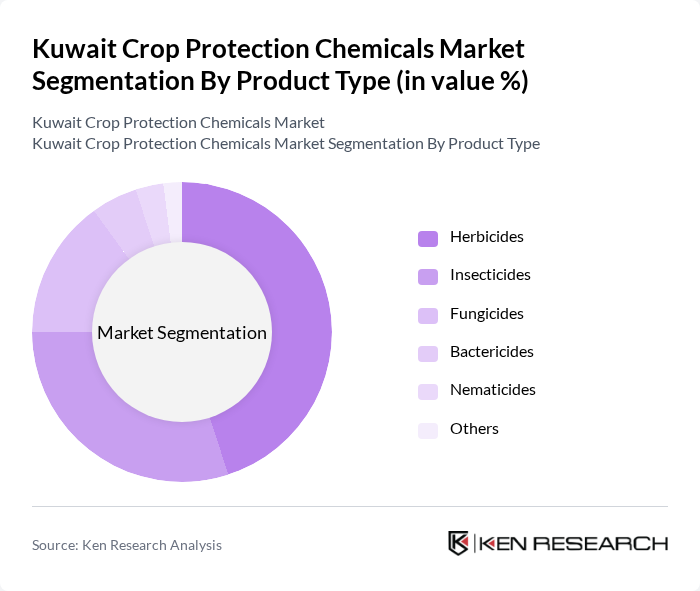

By Product Type:The product type segmentation includes various categories such as herbicides, insecticides, fungicides, bactericides, nematicides, and others. This structure is consistent with global and regional crop protection classification, where herbicides, insecticides, and fungicides form the core product groups. Among these, herbicides are the most widely used worldwide and in arid-field systems due to their effectiveness in controlling unwanted vegetation, which is crucial for crop yield and water-use efficiency. The increasing adoption of herbicides in Kuwait is driven by the need for efficient weed management in fodder crops, cereals, and large greenhouse complexes, where labor savings and consistent performance are important. Insecticides also hold a significant share, as they are essential for protecting vegetables, fruits, and date palms from key pests whose incidence is exacerbated by high temperatures and changing climatic conditions. The demand for fungicides is growing as well, particularly in fruit and vegetable cultivation and greenhouse production, where moisture and intensive cultivation can increase the prevalence of fungal and oomycete diseases that severely impact yield and quality.

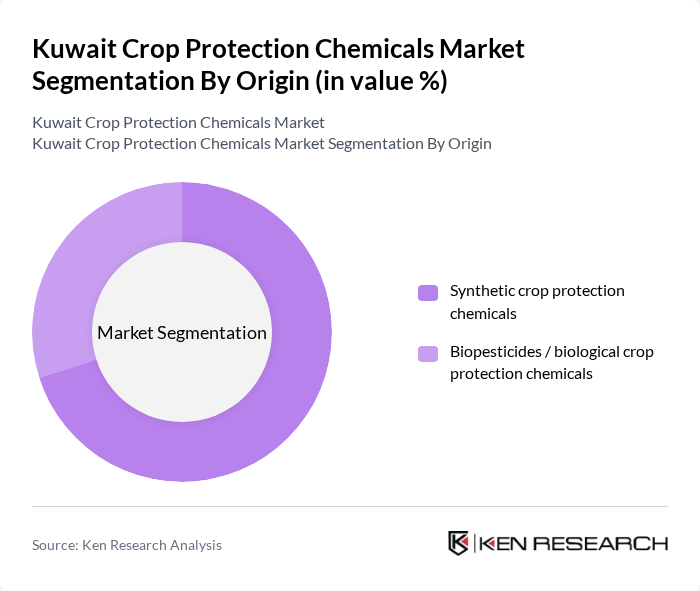

By Origin:The origin segmentation includes synthetic crop protection chemicals and biopesticides. This is aligned with standard international segmentation of crop protection markets into synthetic and biological/biopesticide categories. Synthetic chemicals currently dominate both the global and Middle East crop protection markets due to their broad-spectrum efficacy, ease of use, and established distribution networks, and farmers in Kuwait often prefer these options for their immediate and predictable results in pest and weed control. However, there is a growing trend towards biopesticides and other biological solutions, driven by increasing awareness of environmental sustainability, food safety requirements, and the rise of high?value greenhouse crops and export?oriented production where residue management is critical. This shift is encouraging manufacturers and distributors active in the Gulf region to expand their biological portfolios, including microbial and botanical products, which are perceived as safer alternatives and are often compatible with integrated pest management programs.

The Kuwait Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG (Crop Science Division), Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation (now part of UPL), Cheminova A/S (now part of FMC), Isagro S.p.A., Albaugh, LLC, Belchim Crop Protection, BioWorks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait crop protection chemicals market appears promising, driven by technological advancements and a shift towards sustainable practices. As farmers increasingly adopt integrated pest management and precision agriculture techniques, the demand for innovative crop protection solutions is expected to rise. Additionally, the government's commitment to enhancing agricultural productivity and sustainability will likely foster a conducive environment for market growth, encouraging investments in research and development to meet evolving consumer preferences and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Herbicides Insecticides Fungicides Bactericides Nematicides Others |

| By Origin | Synthetic crop protection chemicals Biopesticides / biological crop protection chemicals |

| By Crop Type | Cereals and grains Fruits and vegetables Oilseeds and pulses Other crops (forage, ornamental, etc.) |

| By Mode of Application | Foliar spray Soil treatment Seed treatment Other application methods |

| By Formulation | Liquid formulations Dry / solid formulations Others |

| By Distribution Channel | Direct sales to large farms and institutions Agro-dealers and retail outlets Online and digital platforms Distributors and importers Others |

| By Region | Northern Kuwait Southern Kuwait Central Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturers | 60 | Product Managers, Sales Directors |

| Agricultural Distributors | 60 | Distribution Managers, Supply Chain Coordinators |

| Farmers and Growers | 120 | Crop Producers, Farm Owners |

| Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| Agricultural Consultants | 50 | Agronomists, Crop Advisors |

The Kuwait Crop Protection Chemicals Market is valued at approximately USD 35 million, reflecting a historical analysis of the market and its share within the broader Middle East agrochemicals sector.