Region:Middle East

Author(s):Dev

Product Code:KRAC5139

Pages:80

Published On:January 2026

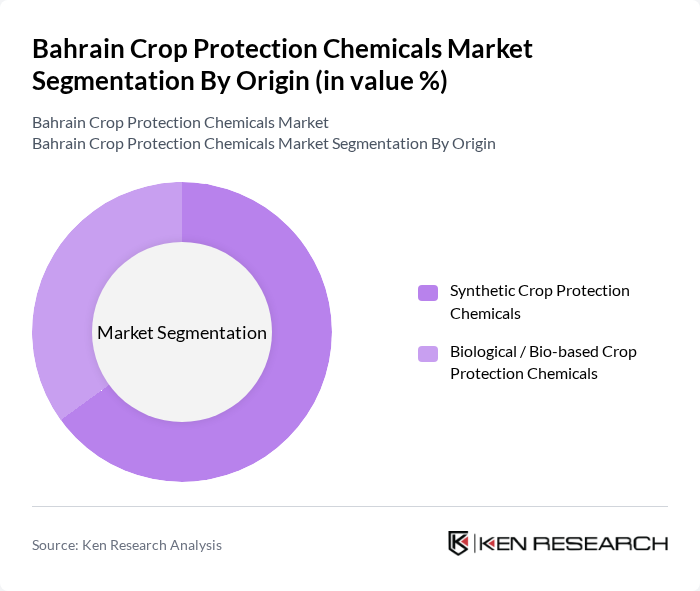

By Origin:The market is segmented into two primary origins: Synthetic Crop Protection Chemicals and Biological / Bio-based Crop Protection Chemicals. Synthetic chemicals have traditionally dominated the market due to their broad-spectrum effectiveness, faster knockdown, and generally lower cost per hectare, in line with global patterns where synthetic products account for the majority of pesticide use. However, there is a growing trend towards biological and bio-based products as consumers, regulators, and farmers become more environmentally conscious and seek lower-residue solutions, especially in high?value vegetables and greenhouse crops. This shift is driven by tightening rules on certain active ingredients, requirements to meet food safety standards on residues, and the demand for sustainable agricultural practices and integrated pest management (IPM).

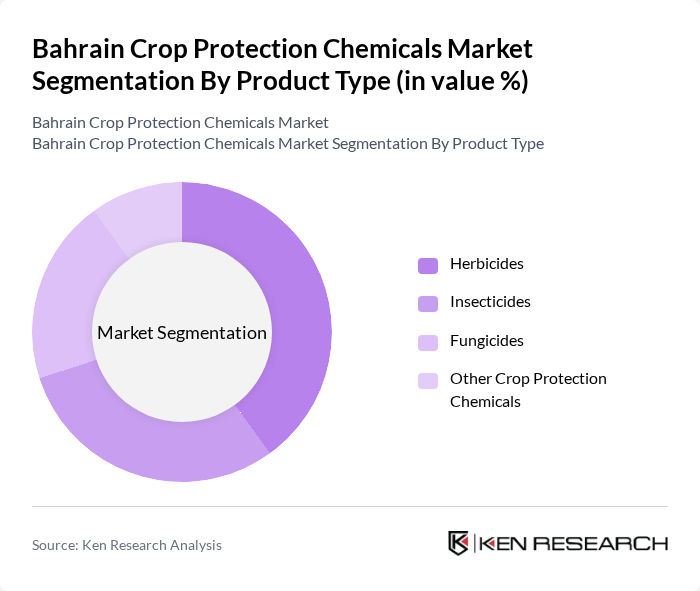

By Product Type:The product type segmentation includes Herbicides, Insecticides, Fungicides, and Other Crop Protection Chemicals. Herbicides are an important sub-segment, supporting weed management in fodder, field crops, and around perennial crops; globally, herbicides represent the largest share of pesticide consumption, which is reflected in product portfolios available in the Gulf region. Insecticides play a critical role in Bahrain’s horticulture?focused sector, addressing key pests in vegetables, fruits, and date palms, while fungicides are increasingly used to manage diseases in greenhouse and irrigated systems. The increasing adoption of integrated pest management practices, drip and greenhouse cultivation, and higher-value crops is contributing to the steady demand for fungicides and other specialized products, including seed treatments and biopesticides.

The Bahrain Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer CropScience AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Isagro S.p.A., Cheminova A/S, Albaugh, LLC, Rallis India Limited, BioWorks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain crop protection chemicals market appears promising, driven by technological advancements and a shift towards sustainable practices. In future, the integration of digital solutions in agriculture is expected to enhance efficiency, with precision agriculture technologies projected to increase crop yields by 18%. Additionally, the growing emphasis on biopesticides and organic farming will likely reshape product offerings, aligning with consumer preferences for eco-friendly solutions and ensuring compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Origin | Synthetic Crop Protection Chemicals Biological / Bio-based Crop Protection Chemicals |

| By Product Type | Herbicides Insecticides Fungicides Other Crop Protection Chemicals |

| By Formulation | Liquid Formulations Dry / Granular Formulations |

| By Mode of Application | Foliar Spray Seed Treatment Soil Treatment Other Modes of Application |

| By Crop Type | Fruits & Vegetables Cereals & Forage Crops Turf, Ornamentals & Landscape Plantation & Perennial Crops |

| By End-User | Commercial Farms and Agribusinesses Smallholder Farmers Government and Municipal Authorities Landscaping and Facility Management Companies |

| By Distribution Channel | Direct Sales to Large Farms and Agroholdings Agricultural Input Distributors Agro-Dealer & Cooperative Retail Outlets Online and Digital Agriculture Platforms |

| By Packaging Type | Bulk Packaging Mid-Size Packs Small Packs |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 100 | Farmers, Agronomists |

| Fruit and Vegetable Chemical Usage | 80 | Horticulturists, Agricultural Extension Officers |

| Distribution Channels for Agrochemicals | 70 | Distributors, Retailers |

| Regulatory Compliance Insights | 60 | Regulatory Affairs Specialists, Environmental Consultants |

| Market Trends and Innovations | 90 | Industry Experts, Research Scientists |

The Bahrain Crop Protection Chemicals Market is valued at approximately USD 25 million, reflecting its significance within the country's agricultural sector and global crop protection spending.