Region:Asia

Author(s):Dev

Product Code:KRAC5141

Pages:93

Published On:January 2026

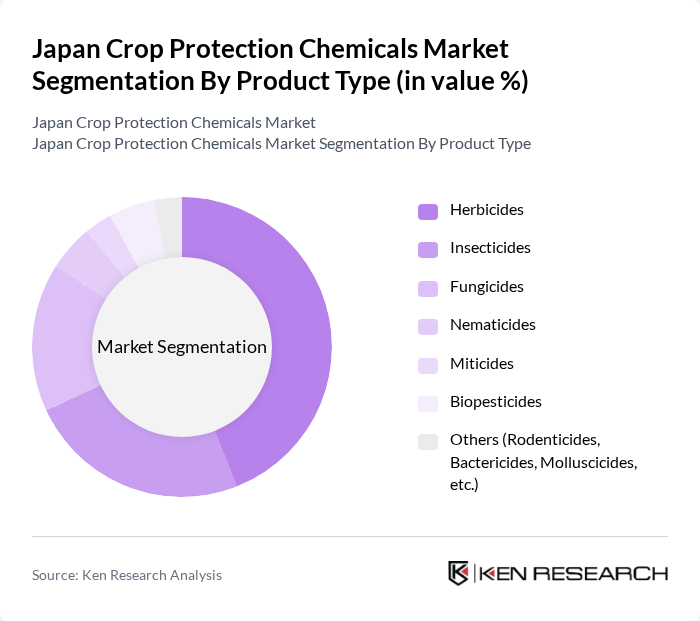

By Product Type:The product type segmentation includes various categories such as herbicides, insecticides, fungicides, nematicides, miticides, biopesticides, and others. Herbicides account for the largest share of crop protection chemicals use in Japan, in line with their leading revenue share of around the mid?40 percent range reported for the country, reflecting their effectiveness in controlling unwanted vegetation in rice, cereals, and specialty crops. The increasing adoption of herbicide?tolerant and weed?management?optimized cropping systems, along with labor shortages that favor chemical over manual weeding, has further fueled demand for herbicides, making them a dominant force in the market.

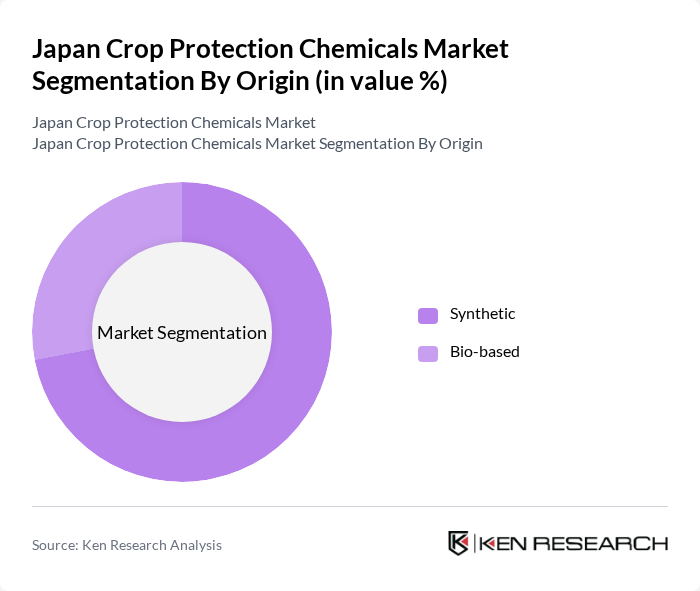

By Origin:The origin segmentation is divided into synthetic and bio-based products. Synthetic crop protection chemicals currently dominate the market, supported by their broad-spectrum efficacy, well-established registration dossiers, and generally lower unit cost compared to newer bio-based alternatives. However, bio-based and microbial products are gaining traction as regulatory incentives, retailer standards, and consumer preference for environmentally friendly and residue?reduced solutions drive the adoption of sustainable agricultural practices and integrated pest management in Japan.

The Japan Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience (Bayer AG), Syngenta Group, BASF SE, Corteva Agriscience, FMC Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., UPL Limited, Nufarm Limited, ADAMA Ltd., Nihon Nohyaku Co., Ltd., Kumiai Chemical Industry Co., Ltd., SDS Biotech K.K., Nippon Soda Co., Ltd., and other emerging local players contribute to innovation, geographic expansion, and service delivery in this space.

The Japan crop protection chemicals market is poised for transformation as it adapts to evolving agricultural practices and consumer preferences. The integration of digital technologies in farming, such as data analytics and IoT, is expected to enhance pest management strategies. Additionally, the increasing focus on sustainability will drive innovation in biopesticides and eco-friendly formulations, aligning with government initiatives aimed at promoting organic farming and reducing chemical dependency in agriculture.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Herbicides Insecticides Fungicides Nematicides Miticides Biopesticides Others (Rodenticides, Bactericides, Molluscicides, etc.) |

| By Origin | Synthetic Bio-based |

| By Crop Type | Grains and cereals Pulses and oilseeds Fruits and vegetables Commercial crops Ornamental and horticultural crops Others (turf, forestry, etc.) |

| By Application Method | Foliar spray Soil treatment Seed treatment Chemigation Aerial / drone application Others |

| By Formulation Type | Liquid concentrates Suspension concentrates Wettable powders Granules Microencapsulated formulations Others |

| By Distribution Channel | Direct sales Distributors and dealer networks Cooperatives Online / e-commerce Others |

| By Region | Hokkaido Tohoku Kanto Chubu Kansai / Kinki Chugoku Shikoku Kyushu–Okinawa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Rice Cultivation | 120 | Farmers, Agronomists |

| Insecticide Application in Vegetable Farming | 90 | Crop Protection Specialists, Agricultural Advisors |

| Fungicide Adoption in Fruit Orchards | 80 | Farm Managers, Horticulturists |

| Market Trends in Organic Crop Protection | 60 | Organic Farmers, Sustainability Experts |

| Distribution Channels for Crop Protection Chemicals | 100 | Distributors, Retailers |

The Japan Crop Protection Chemicals Market is valued at approximately USD 2.6 billion, reflecting a robust growth driven by the increasing demand for food safety, advancements in agricultural technologies, and the need for sustainable farming practices.