Region:Asia

Author(s):Dev

Product Code:KRAC5136

Pages:86

Published On:January 2026

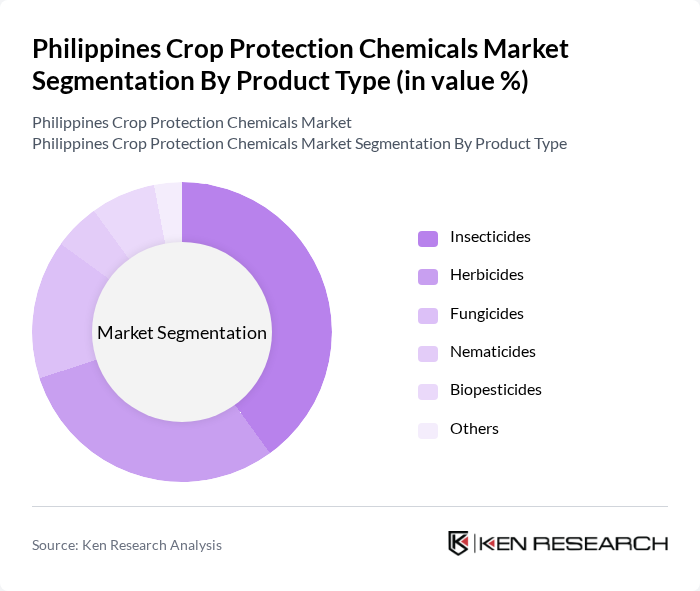

By Product Type:The product type segmentation includes various categories such as insecticides, herbicides, fungicides, nematicides, biopesticides, and others. In the Philippines context, insecticides and herbicides constitute the largest share of pesticide use, reflecting their critical role in managing insect pests and weeds in staple crops like rice and corn as well as vegetables and fruits. Fungicides are also important for high-value crops such as bananas, mangoes, and other horticultural products that are vulnerable to fungal diseases, while nematicides remain a more specialized segment. The increasing adoption of integrated pest management and demand for residue-safe produce are driving interest in biopesticides and other bio-based products, which are gradually gaining popularity due to their eco-friendly profile and alignment with sustainable agriculture initiatives.

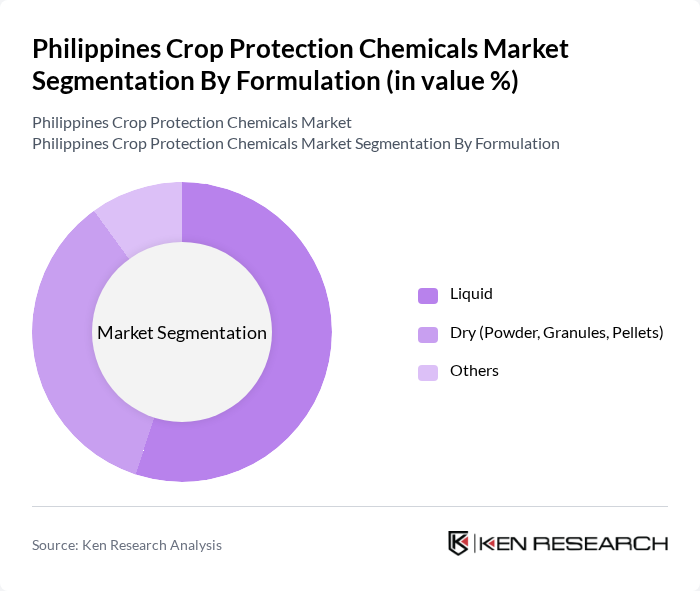

By Formulation:The formulation segmentation includes liquid, dry (powder, granules, pellets), and others. Liquid formulations dominate pesticide use in the Philippines, supported by their ease of dilution and application through knapsack sprayers and mechanized equipment commonly used by smallholders and commercial farms. Dry formulations such as powders and granules also play a significant role, particularly for seed treatments, soil applications, and situations where storage stability and transport convenience are priorities in more remote production areas. As sustainable practices and stewardship programs expand, there is increasing attention to formulations that improve user safety, reduce drift and environmental impact, and support the use of biopesticides in both liquid and solid forms.

The Philippines Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Philippines, Inc., Bayer CropScience, Inc. (Philippines), BASF Philippines, Inc., Corteva Agriscience Philippines, FMC Corporation (Philippines), ADAMA Agricultural Solutions Ltd., UPL Limited (Philippines), Sumitomo Chemical Philippines, Nufarm Philippines, Inc., East-West Seed Company, Inc., Jardine Distribution, Inc., Leads Agricultural Products Corporation, Philippine Crop Protection Association (PCPA), Arysta LifeScience Philippines, and other emerging local and regional players contribute to innovation, geographic expansion, stewardship programs, and service delivery in this space.

The Philippines crop protection chemicals market is poised for significant transformation as it adapts to evolving agricultural practices and consumer preferences. In future, the integration of digital technologies in farming is expected to enhance efficiency and sustainability. Additionally, the focus on biopesticides and organic solutions will likely reshape product offerings, aligning with global trends towards eco-friendly practices. As the government continues to support agricultural innovation, the market will see increased investment in research and development, fostering growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Insecticides Herbicides Fungicides Nematicides Biopesticides Others |

| By Formulation | Liquid Dry (Powder, Granules, Pellets) Others |

| By Mode of Application | Foliar application Seed treatment Soil application Others |

| By Crop Type | Cereals and grains (including rice and corn) Fruits and vegetables Oilseeds and pulses Plantation and commercial crops (e.g., sugarcane, banana, pineapple) Others |

| By Distribution Channel | Dealer and retail networks Direct sales to large farms and plantations Cooperatives and institutional procurement Online and digital platforms Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Protection Product Distributors | 60 | Sales Managers, Distribution Coordinators |

| Farmers Using Crop Protection Chemicals | 120 | Smallholder Farmers, Commercial Farmers |

| Agrochemical Retailers | 70 | Store Owners, Product Managers |

| Research and Development Experts | 50 | R&D Managers, Agronomists |

| Regulatory Authorities | 40 | Policy Makers, Compliance Officers |

The Philippines Crop Protection Chemicals Market is valued at approximately USD 520 million, reflecting a five-year historical analysis of pesticide usage trends and agricultural productivity demands.