Region:Middle East

Author(s):Dev

Product Code:KRAA9569

Pages:97

Published On:November 2025

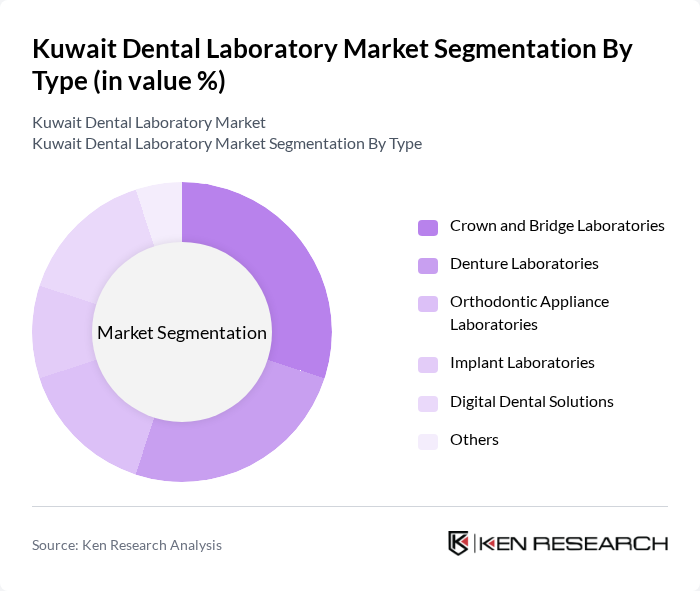

By Type:The market is segmented into various types, including Crown and Bridge Laboratories, Denture Laboratories, Orthodontic Appliance Laboratories, Implant Laboratories, Digital Dental Solutions, and Others. Each of these segments caters to specific dental needs and preferences, with varying levels of demand based on consumer behavior and technological advancements. Crown and Bridge Laboratories lead due to the high demand for restorative dental procedures, while Digital Dental Solutions are gaining traction with the adoption of CAD/CAM and 3D printing technologies. Orthodontic Appliance and Implant Laboratories are also experiencing growth, driven by increasing cosmetic and functional dental needs.

The Crown and Bridge Laboratories segment is currently dominating the market due to the high demand for restorative dental procedures. This segment benefits from advancements in materials and technology, allowing for more durable and aesthetically pleasing solutions. The increasing number of dental procedures related to crowns and bridges, coupled with the growing adoption of digital workflows, has led to a significant rise in consumer preference for these services, making it the leading sub-segment in the market.

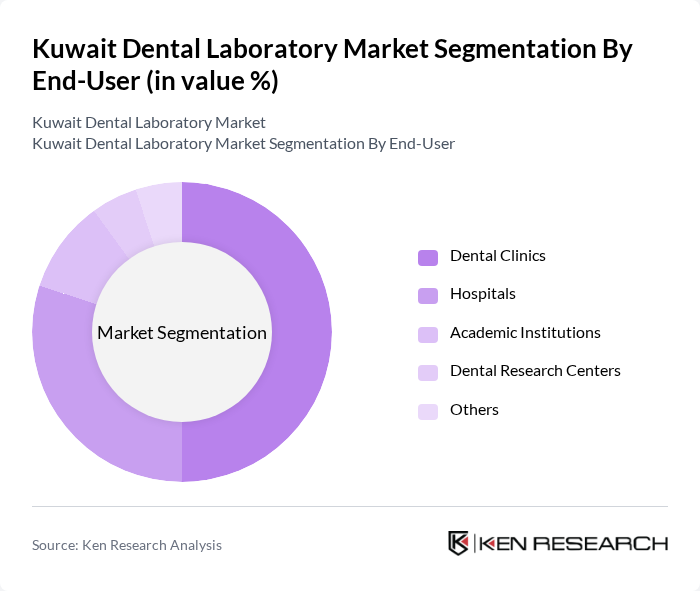

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Academic Institutions, Dental Research Centers, and Others. Each of these end-users plays a crucial role in the demand for dental laboratory services, with varying needs and preferences that influence market dynamics. Dental Clinics remain the largest end-user, driven by the high volume of dental procedures and the expansion of private practices. Hospitals are increasing their share through advanced restorative and cosmetic procedures, while Academic Institutions and Research Centers contribute to innovation and training in dental technology.

The Dental Clinics segment is the largest end-user in the market, accounting for a significant share due to the high volume of dental procedures performed. These clinics require a steady supply of dental products and services, driving demand for laboratory services. The increasing number of dental clinics, expansion of private dental practices, and the growing focus on preventive and cosmetic dental care further contribute to the dominance of this segment.

The Kuwait Dental Laboratory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Hadi Dental Laboratory, Al-Mansour Dental Lab, Gulf Dental Lab, Kuwait Dental Lab, Al-Sabah Dental Laboratory, Dental Art Lab, Al-Farabi Dental Lab, Al-Jazeera Dental Lab, Al-Muhalab Dental Lab, Al-Nasr Dental Lab, Al-Qabas Dental Lab, Al-Rai Dental Lab, Al-Salam Dental Lab, Al-Tamimi Dental Lab, Al-Zahra Dental Lab, Al-Mutairi Dental Laboratory, Al-Watan Dental Lab, Al-Ahli Dental Laboratory, Al-Mowasat Dental Lab, Al-Shifa Dental Laboratory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait dental laboratory market appears promising, driven by technological advancements and a growing emphasis on oral health. As digital dentistry continues to evolve, laboratories that adopt innovative solutions will likely gain a competitive edge. Additionally, the increasing focus on personalized dental care is expected to shape service offerings, catering to the unique needs of patients. Collaborations with dental clinics will further enhance service delivery, ensuring that laboratories remain integral to the dental care ecosystem in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Crown and Bridge Laboratories Denture Laboratories Orthodontic Appliance Laboratories Implant Laboratories Digital Dental Solutions Others |

| By End-User | Dental Clinics Hospitals Academic Institutions Dental Research Centers Others |

| By Material Type | Ceramic-based Products Metal-based Products Composite Materials Biodegradable Materials Others |

| By Service Type | Restorative Services Cosmetic Dentistry Orthodontic Services Prosthetic Fabrication Others |

| By Technology Used | CAD/CAM Technology D Printing Laser Technology Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Laboratory Services | 60 | Laboratory Owners, Operations Managers |

| Orthodontic Products | 50 | Orthodontists, Dental Technicians |

| Prosthetic Dental Solutions | 40 | Prosthodontists, Dental Assistants |

| Dental Equipment Supply | 45 | Supply Chain Managers, Procurement Officers |

| Dental Technology Innovations | 55 | Dental Researchers, Technology Developers |

The Kuwait Dental Laboratory Market is valued at approximately USD 177 million, reflecting significant growth driven by increasing dental disease prevalence, heightened oral health awareness, and advancements in dental technology.