Region:Middle East

Author(s):Rebecca

Product Code:KRAC1151

Pages:95

Published On:October 2025

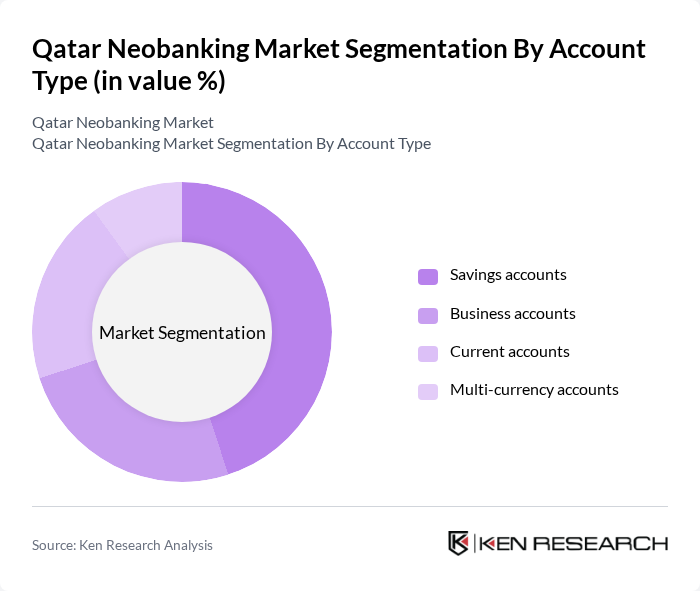

By Account Type:The account type segmentation includes various offerings tailored to meet the diverse needs of customers. The subsegments are savings accounts, business accounts, current accounts, and multi-currency accounts. Among these, savings accounts are currently dominating the market due to their appeal to both individual consumers and businesses seeking to manage their funds efficiently. The trend towards digital savings solutions, coupled with attractive interest rates, has led to increased adoption in this segment.

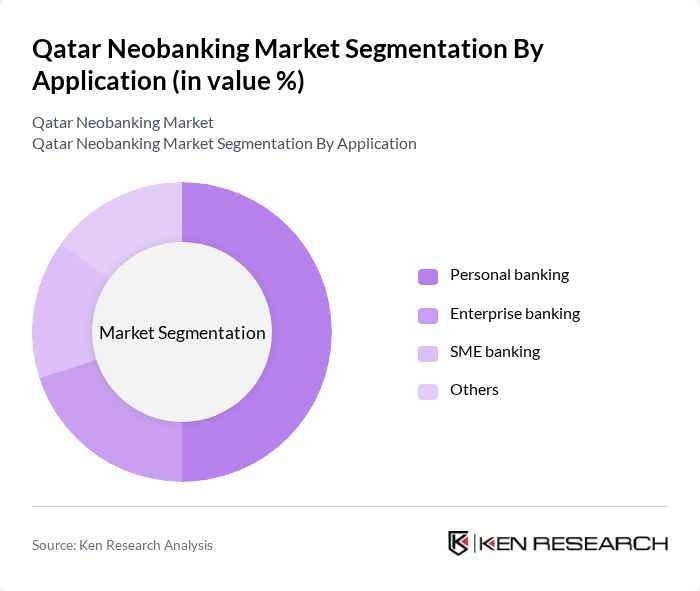

By Application:The application segmentation encompasses personal banking, enterprise banking, SME banking, and others. Personal banking is the leading subsegment, driven by the increasing number of individuals seeking convenient and accessible banking solutions. The rise of mobile banking applications has made it easier for consumers to manage their finances, leading to a significant uptick in personal banking services.

The Qatar Neobanking Market is characterized by a dynamic mix of regional and international players. Leading participants such as QNB Group, Qatar Islamic Bank (QIB), Commercial Bank of Qatar, Dukhan Bank, Masraf Al Rayan, Doha Bank, Al Khaliji Commercial Bank, Qatar Development Bank, Ahli Bank Q.P.S.C., International Bank of Qatar (IBQ), Qatar First Bank, Ooredoo Money (Digital Wallet Platform), Qatar Pay (National Payment System), Snoonu (Fintech with Embedded Banking), Al Maha Digital Banking (QIB Initiative) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar neobanking market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy continues to rise, neobanks are expected to enhance their service offerings, focusing on personalized banking experiences. Additionally, the integration of AI and machine learning will likely streamline operations and improve customer engagement. With a supportive regulatory environment, neobanks can innovate while ensuring compliance, positioning themselves as key players in Qatar's financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Account Type | Savings accounts Business accounts Current accounts Multi-currency accounts |

| By Application | Personal banking Enterprise banking SME banking Others |

| By Service Offering | Digital payments and transfers Digital lending Wealth management and investment services Financial planning and advisory Insurance and Takaful products |

| By Technology Platform | Mobile applications Web platforms Open banking APIs Embedded finance platforms |

| By Customer Segment | Millennials and Gen Z Expatriate population High-net-worth individuals Unbanked and underbanked populations |

| By Compliance Framework | Sharia-compliant offerings Conventional banking services Hybrid models |

| By Geographic Presence | Doha metropolitan area Other urban centers Regional GCC expansion International markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Neobanking | 120 | Retail Banking Customers, Digital Natives |

| Business Banking Solutions | 60 | Small Business Owners, Financial Managers |

| Regulatory Impact Assessment | 40 | Compliance Officers, Regulatory Analysts |

| Technological Innovations in Banking | 50 | IT Managers, Fintech Developers |

| Customer Experience in Neobanking | 70 | Customer Service Representatives, UX Designers |

The Qatar Neobanking Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital banking solutions, smartphone penetration, and a growing preference for cashless transactions among consumers.