Region:Middle East

Author(s):Rebecca

Product Code:KRAC1169

Pages:83

Published On:October 2025

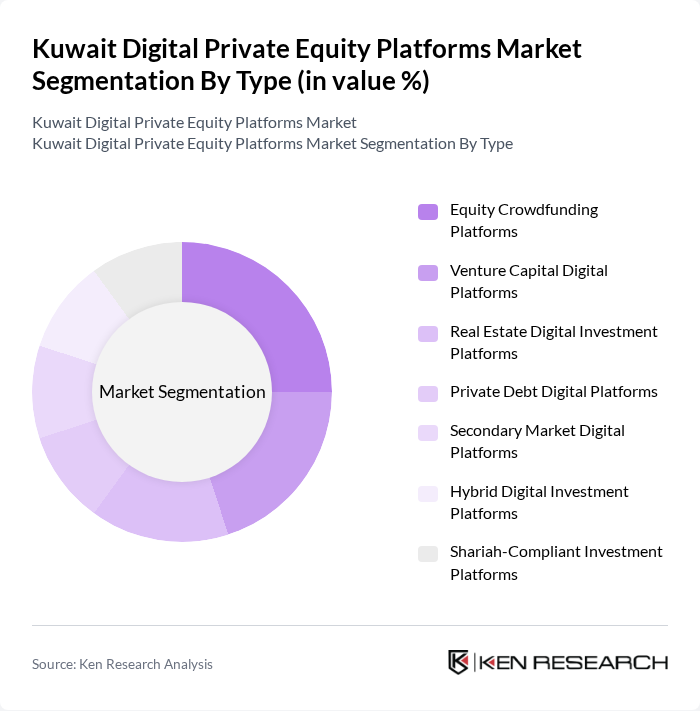

By Type:The market is segmented into various types of digital private equity platforms, including Equity Crowdfunding Platforms, Venture Capital Digital Platforms, Real Estate Digital Investment Platforms, Private Debt Digital Platforms, Secondary Market Digital Platforms, Hybrid Digital Investment Platforms, and Shariah-Compliant Investment Platforms. Each segment addresses distinct investor needs, with some platforms focusing on specific asset classes (e.g., real estate, private debt) or investment strategies (e.g., Shariah-compliant, hybrid models). The emergence of robo-advisory, tokenized assets, and ESG-focused platforms is also shaping the market’s evolution.

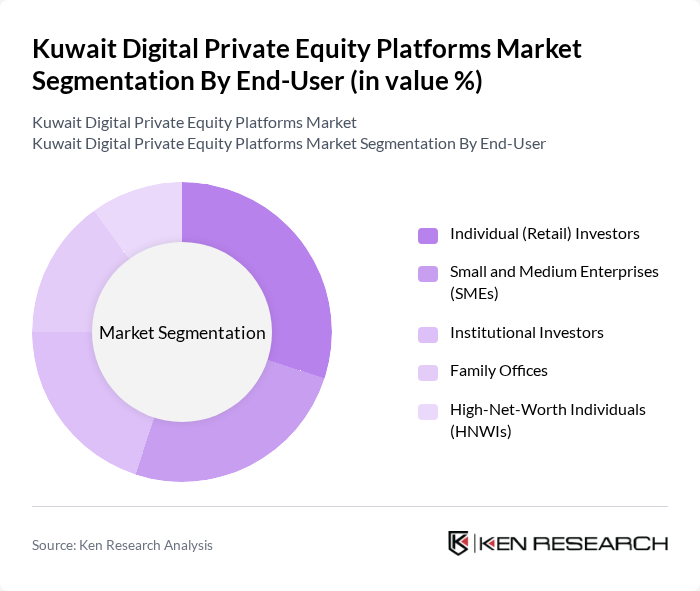

By End-User:The end-user segmentation includes Individual (Retail) Investors, Small and Medium Enterprises (SMEs), Institutional Investors, Family Offices, and High-Net-Worth Individuals (HNWIs). Each user group has distinct investment goals and risk appetites, influencing their choice of digital private equity platforms. Retail investors and SMEs are increasingly adopting digital platforms due to ease of access and tailored investment products, while institutional investors and family offices focus on diversification and advanced analytics.

The Kuwait Digital Private Equity Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Investment Authority, Wafra Inc., KAMCO Invest, Arzan Wealth, KFH Capital Investment Company, Noor Financial Investment Company, Al Mal Investment Company, Global Investment House (Merged with KAMCO Invest), Tharwa Investment Company, Faith Capital Holding, Boursa Kuwait, National Investments Company (NIC), Kuwait Financial Centre (Markaz), Al Mufeed Financial Services, Al-Dar Investment Company, Rasameel Investment Company, Beehive Kuwait, Eureeca Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the Kuwait digital private equity market appears promising, driven by increasing digital adoption and a favorable regulatory environment. As more investors seek alternative investment options, platforms that offer innovative solutions and educational resources will likely thrive. Additionally, the integration of advanced technologies, such as blockchain, is expected to enhance transparency and security, further attracting institutional and retail investors. Overall, the market is poised for significant growth as awareness and acceptance of digital investment platforms expand.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Crowdfunding Platforms Venture Capital Digital Platforms Real Estate Digital Investment Platforms Private Debt Digital Platforms Secondary Market Digital Platforms Hybrid Digital Investment Platforms Shariah-Compliant Investment Platforms |

| By End-User | Individual (Retail) Investors Small and Medium Enterprises (SMEs) Institutional Investors Family Offices High-Net-Worth Individuals (HNWIs) |

| By Investment Size | Micro Investments (Under $10,000) Small Investments ($10,000 - $100,000) Medium Investments ($100,000 - $1 Million) Large Investments (Over $1 Million) |

| By Investment Stage | Seed Stage Early Stage Growth Stage Late Stage |

| By Geographic Focus | Domestic (Kuwait) Investments GCC Regional Investments International Investments |

| By Platform Access Type | Web-Based Platforms Mobile App Platforms Multi-Channel (Hybrid) Platforms |

| By Regulatory Compliance Level | Fully Regulated Platforms Partially Regulated Platforms Unregulated Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Startup Founders | 60 | CEOs, Co-founders, and Business Development Managers |

| Private Equity Investors | 50 | Investment Managers, Analysts, and Portfolio Managers |

| Regulatory Bodies | 40 | Policy Makers, Economic Advisors, and Compliance Officers |

| Industry Experts | 40 | Consultants, Market Analysts, and Academic Researchers |

| Technology Providers | 40 | CTOs, Product Managers, and Business Strategists |

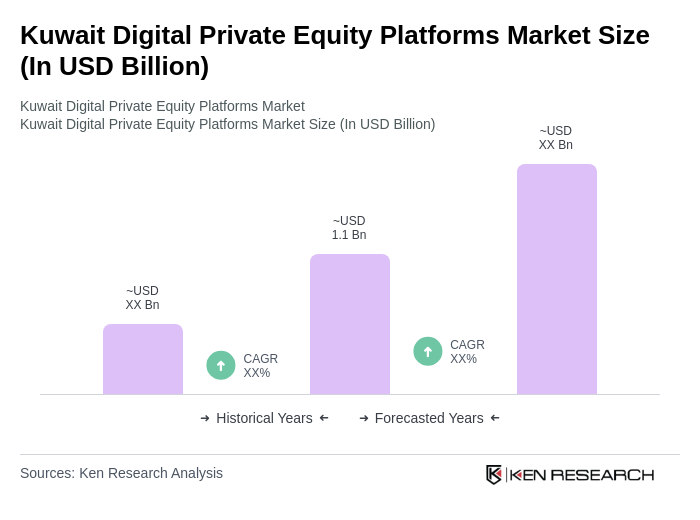

The Kuwait Digital Private Equity Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased digital investment solutions and a robust private equity landscape in the region.