Region:Middle East

Author(s):Dev

Product Code:KRAC1257

Pages:86

Published On:October 2025

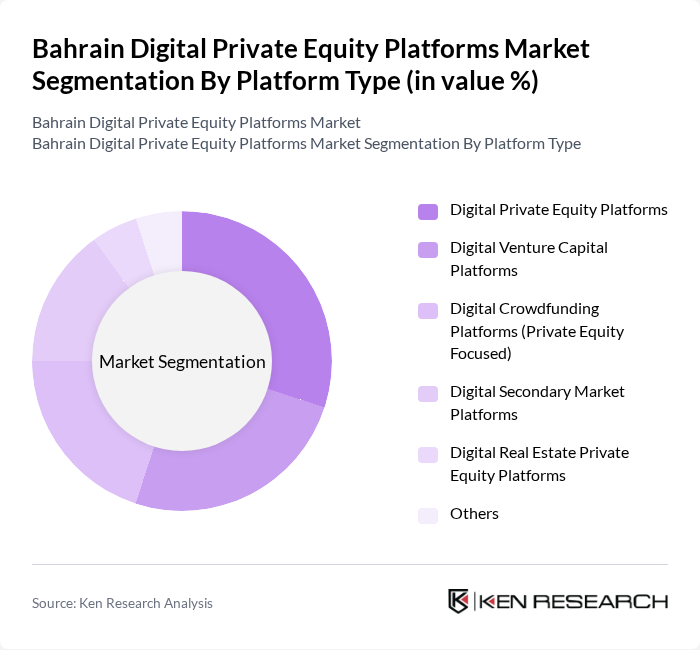

By Platform Type:The market is segmented into various platform types, including Digital Private Equity Platforms, Digital Venture Capital Platforms, Digital Crowdfunding Platforms (Private Equity Focused), Digital Secondary Market Platforms, Digital Real Estate Private Equity Platforms, and Others. Each of these segments caters to different investor needs and preferences, with varying levels of risk and return profiles. The Digital Private Equity Platforms segment leads due to its ability to provide direct access to private equity investments for a broader range of investors, including those with lower minimum investment thresholds. The increasing trend of digitalization in financial services has further propelled the growth of this segment, as platforms leverage technology to streamline investment processes and enhance user experience.

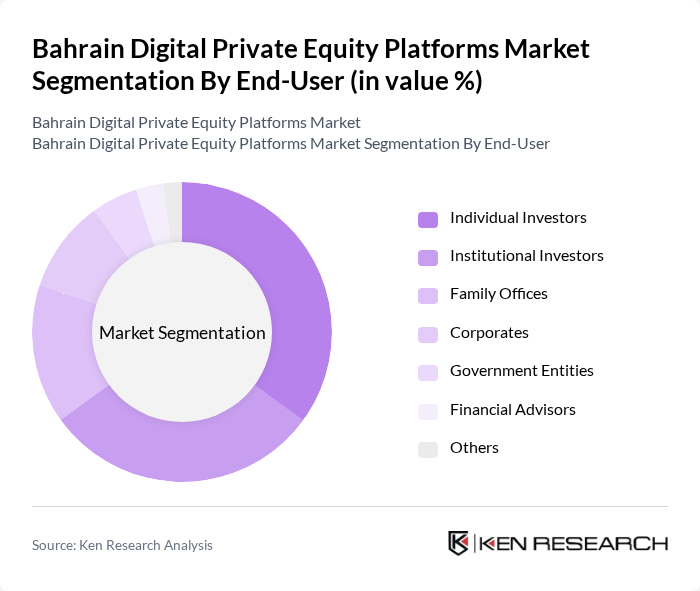

By End-User:The market is segmented by end-user into Individual Investors, Institutional Investors, Family Offices, Corporates, Government Entities, Financial Advisors, and Others. Each of these user categories has distinct investment strategies and objectives, influencing their participation in the digital private equity landscape. Individual Investors represent the largest segment, driven by the increasing interest in alternative investments and the accessibility provided by digital platforms. The rise of fintech solutions has empowered individual investors to diversify their portfolios beyond traditional assets, leading to a surge in participation in private equity investments. This trend is further supported by educational initiatives and marketing efforts aimed at demystifying private equity for retail investors.

The Bahrain Digital Private Equity Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Investcorp, Arcapita, SICO BSC, Bahrain Development Bank, Al Baraka Banking Group, Gulf International Bank, Bank of Bahrain and Kuwait, Bahrain Financial Exchange, BMB Investment Bank, KAMCO Investment Company, QInvest, EFG Hermes, Abu Dhabi Investment Authority, Mubadala Investment Company, Qatar Investment Authority contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's digital private equity platforms appears promising, driven by increasing digital adoption and a favorable regulatory environment. As institutional investors seek innovative avenues, the market is likely to witness a surge in alternative investment products. Additionally, the integration of advanced technologies such as AI and machine learning will enhance investment analysis, making platforms more attractive. The focus on ESG investments will also shape strategies, aligning with global trends and investor preferences for sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Digital Private Equity Platforms Digital Venture Capital Platforms Digital Crowdfunding Platforms (Private Equity Focused) Digital Secondary Market Platforms Digital Real Estate Private Equity Platforms Others |

| By End-User | Individual Investors Institutional Investors Family Offices Corporates Government Entities Financial Advisors Others |

| By Investment Size | Small Investments (Up to $1M) Medium Investments ($1M - $10M) Large Investments (Above $10M) Others |

| By Investment Stage | Seed Stage Early Stage Growth Stage Late Stage Others |

| By Geographic Focus | Bahrain-Focused Investments GCC Regional Investments International Investments Others |

| By Fund Structure | Closed-End Funds Open-End Funds Fund of Funds Syndicated Investments Others |

| By Exit Strategy | IPOs Mergers and Acquisitions Secondary Sales Buybacks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Private Equity Platforms | 60 | CEOs, Founders, and Managing Partners |

| Venture Capital Firms | 50 | Investment Analysts, Portfolio Managers |

| Startups Seeking Funding | 45 | Entrepreneurs, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Financial Advisors and Consultants | 40 | Financial Analysts, Investment Consultants |

The Bahrain Digital Private Equity Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital technology adoption and a rising interest in alternative investment options among both retail and institutional investors.