Region:Middle East

Author(s):Rebecca

Product Code:KRAC1187

Pages:96

Published On:October 2025

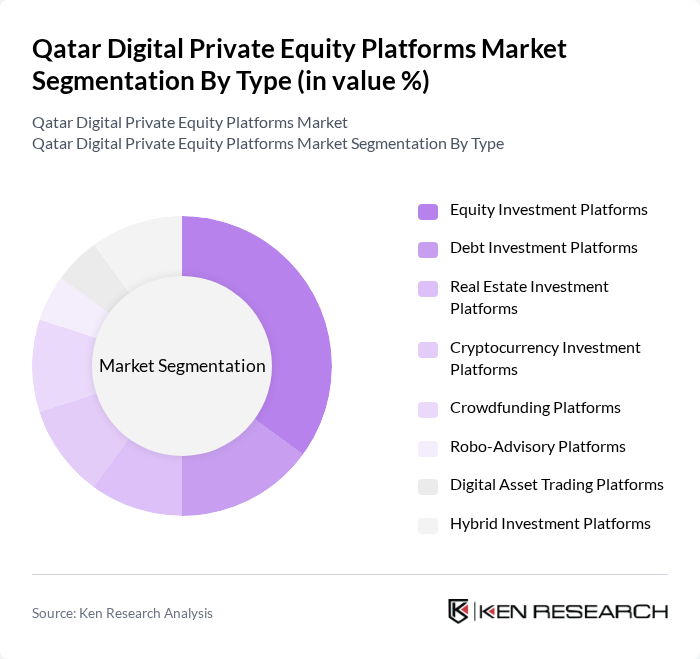

By Type:The market is segmented into a diverse range of digital investment platforms, each tailored to specific investor needs. The subsegments include Equity Investment Platforms, Debt Investment Platforms, Real Estate Investment Platforms, Cryptocurrency Investment Platforms, Crowdfunding Platforms, Robo-Advisory Platforms, Digital Asset Trading Platforms, and Hybrid Investment Platforms. Equity Investment Platforms currently lead the market, favored by individual and institutional investors seeking direct equity stakes in companies. Debt and real estate platforms are also gaining traction as investors diversify portfolios, while cryptocurrency and digital asset trading platforms benefit from rising interest in blockchain-based investments .

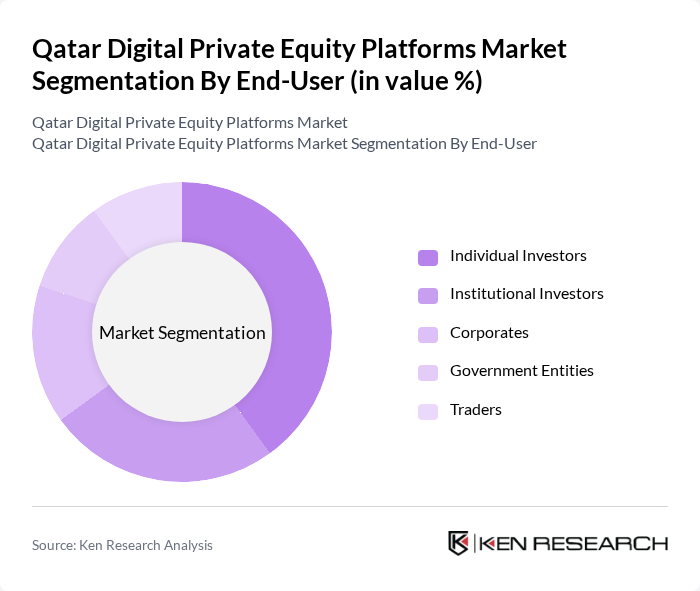

By End-User:The end-user segmentation comprises Individual Investors, Institutional Investors, Corporates, Government Entities, and Traders. Individual Investors are the largest segment, driven by the democratization of investment access and the popularity of self-directed digital platforms. Institutional Investors are increasingly active, leveraging advanced analytics and AI-driven tools for portfolio management. Corporates and government entities utilize platforms for strategic investments and capital allocation, while traders are drawn to digital asset and cryptocurrency platforms for their liquidity and market opportunities .

The Qatar Digital Private Equity Platforms Market features a dynamic mix of regional and international participants. Leading entities such as Qatar Investment Authority, QInvest LLC, Doha Venture Capital, Qatar Development Bank, Qatar Financial Centre, Qatar Science and Technology Park, Qatar Business Incubation Center, Qatar Holding LLC, Al Faisal Holding, Ooredoo Group, Qatari Diar Real Estate Investment Company, Gulf Capital, Amwal LLC, Qatari Investors Group, Barwa Real Estate Company, Qatar National Bank (QNB), Doha Bank, Qatar Islamic Bank (QIB), Al Rayan Investment, Dlala Brokerage and Investment Holding Company, Investment Holding Group, Qatar Insurance Company, Binance, BitOasis, CoinMENA, eToro, Cwallet, and Sarwa drive innovation, geographic expansion, and service delivery in the sector .

The future of the Qatar digital private equity platforms market appears promising, driven by increasing digital adoption and government initiatives aimed at fostering innovation. As the fintech ecosystem matures, platforms are likely to enhance their offerings, integrating advanced technologies such as AI and blockchain. Furthermore, the growing interest in sustainable investments will likely lead to the emergence of specialized platforms catering to environmentally conscious investors, creating new avenues for growth and diversification in the investment landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Investment Platforms Debt Investment Platforms Real Estate Investment Platforms Cryptocurrency Investment Platforms Crowdfunding Platforms Robo-Advisory Platforms Digital Asset Trading Platforms Hybrid Investment Platforms |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities Traders |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Personal Finance Management Wealth Management Retirement Planning Tax Optimization Digital Asset Trading |

| By User Experience | Mobile Applications Web Platforms Hybrid Solutions |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By Policy Support | Subsidies for Digital Platforms Tax Exemptions for Investors Regulatory Incentives for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Private Equity Platforms | 60 | Fund Managers, Investment Analysts |

| Startup Founders in Tech | 50 | CEOs, Co-founders, CTOs |

| Venture Capital Firms | 40 | Partners, Investment Directors |

| Regulatory Bodies | 40 | Policy Makers, Economic Advisors |

| Industry Experts and Analysts | 40 | Market Researchers, Consultants |

The Qatar Digital Private Equity Platforms Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by digital transformation in financial services, increased investor interest in alternative assets, and government support for innovation.