Region:Middle East

Author(s):Rebecca

Product Code:KRAC1070

Pages:85

Published On:October 2025

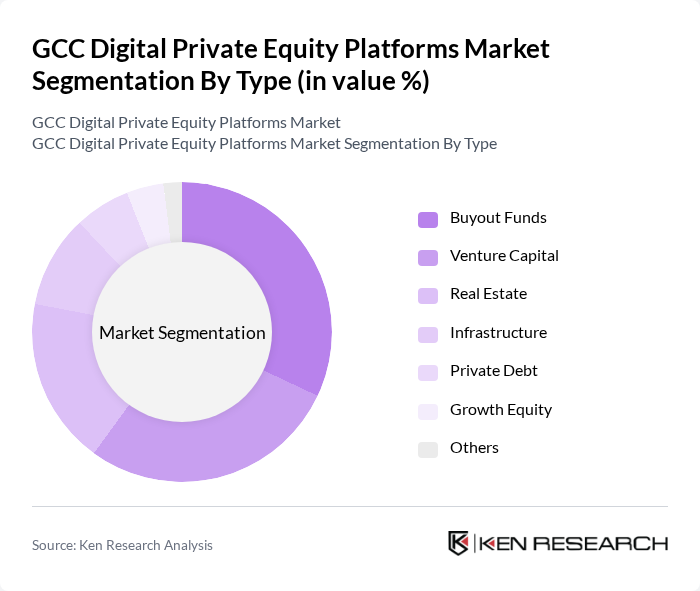

By Type:The market is segmented into Buyout Funds, Venture Capital, Real Estate, Infrastructure, Private Debt, Growth Equity, and Others. Buyout Funds currently command the largest share, reflecting the maturity of the financial services and energy sectors, while Venture Capital is rapidly growing due to the surge in technology and innovation-driven enterprises, particularly in Saudi Arabia and the UAE. Real Estate and Infrastructure segments are also expanding, supported by mega-projects and tourism initiatives. Investors are increasingly seeking high-growth opportunities, especially in technology and healthcare, which has led to a notable increase in venture capital deployment .

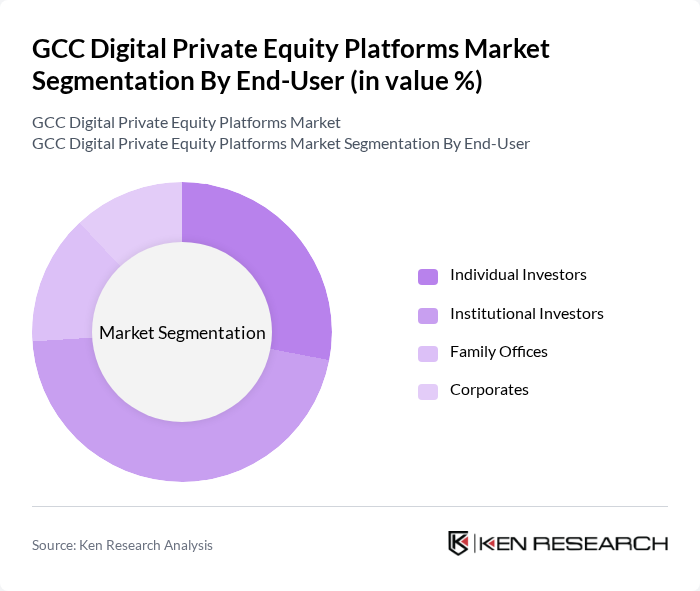

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Family Offices, and Corporates. Institutional Investors are the dominant segment, leveraging their financial capacity and expertise to engage in larger investments. However, the share of Individual Investors is increasing, driven by the accessibility of digital platforms and growing digital literacy. Family Offices and Corporates also play a significant role, especially in co-investments and sector-focused funds .

The GCC Digital Private Equity Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Investcorp, Gulf Capital, Waha Capital, Fajr Capital, Alkhabeer Capital, QInvest, Arqaam Capital, Saudi Arabia Public Investment Fund (PIF), Abu Dhabi Investment Authority (ADIA), Dubai Investments, Bahrain Mumtalakat Holding Company, KIPCO (Kuwait Projects Company), Sarwa, Stake, Edfundo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC digital private equity platforms market appears promising, driven by technological advancements and evolving investor preferences. As digitalization continues to reshape investment processes, platforms that leverage AI and machine learning for enhanced decision-making will likely gain a competitive edge. Additionally, the increasing focus on sustainable investing will drive demand for innovative products that align with environmental, social, and governance (ESG) criteria, further expanding market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Buyout Funds Venture Capital Real Estate Infrastructure Private Debt Growth Equity Others |

| By End-User | Individual Investors Institutional Investors Family Offices Corporates |

| By Investment Size | Small Investments (Under $1M) Medium Investments ($1M - $10M) Large Investments (Over $10M) |

| By Investment Strategy | Growth Capital Buyouts Venture Capital Private Debt Real Assets Others |

| By Geographic Focus | Domestic Investments Regional Investments (GCC) International Investments |

| By Platform Type | Online Platforms Mobile Applications Hybrid Platforms |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Venture Capital Firms | 60 | Investment Managers, Analysts |

| Private Equity Platforms | 50 | Founders, CEOs, and Senior Executives |

| Fintech Startups | 45 | Product Managers, Business Development Leads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Institutional Investors | 55 | Portfolio Managers, Investment Analysts |

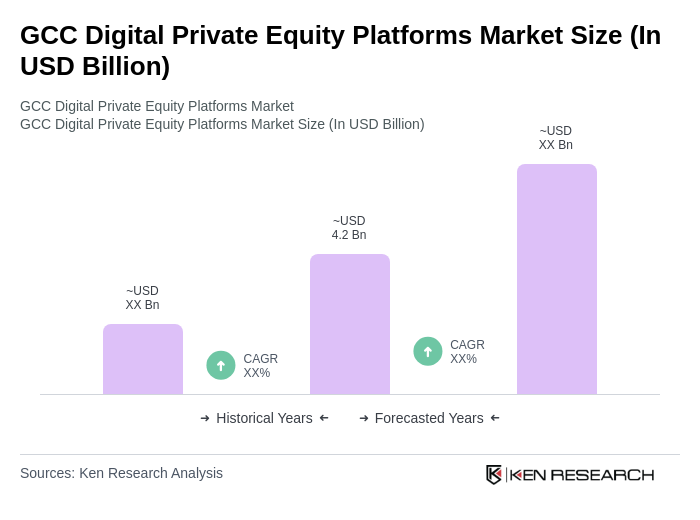

The GCC Digital Private Equity Platforms Market is valued at approximately USD 4.2 billion, reflecting significant growth driven by the adoption of digital technologies, AI-driven tools, and increased investor engagement in alternative investment opportunities.