Region:Middle East

Author(s):Rebecca

Product Code:KRAC1125

Pages:95

Published On:October 2025

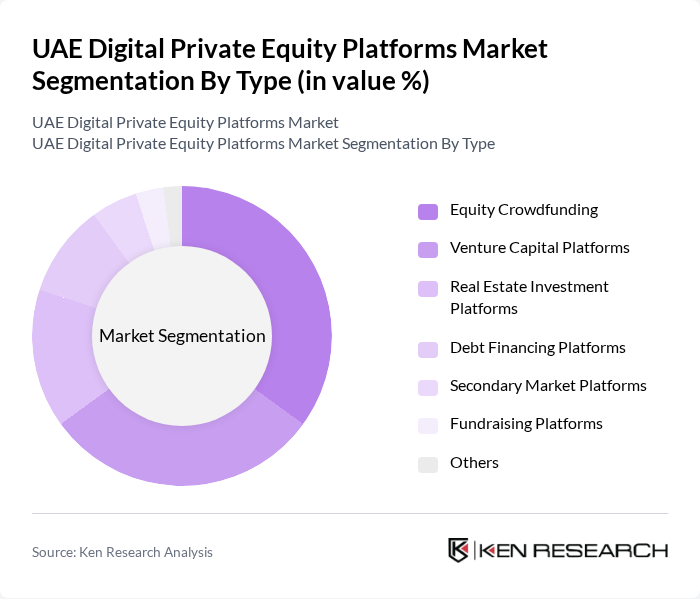

By Type:The market is segmented into various types, including Equity Crowdfunding, Venture Capital Platforms, Real Estate Investment Platforms, Debt Financing Platforms, Secondary Market Platforms, Fundraising Platforms, and Others. Among these, Equity Crowdfunding has emerged as a leading segment due to its accessibility for small investors and the growing trend of democratizing investment opportunities. Venture Capital Platforms also play a significant role, particularly in funding innovative startups and technology-driven businesses. The technology sector is experiencing rapid growth with investments such as the USD 25 billion data center initiative and increasing focus on digital transformation across the region .

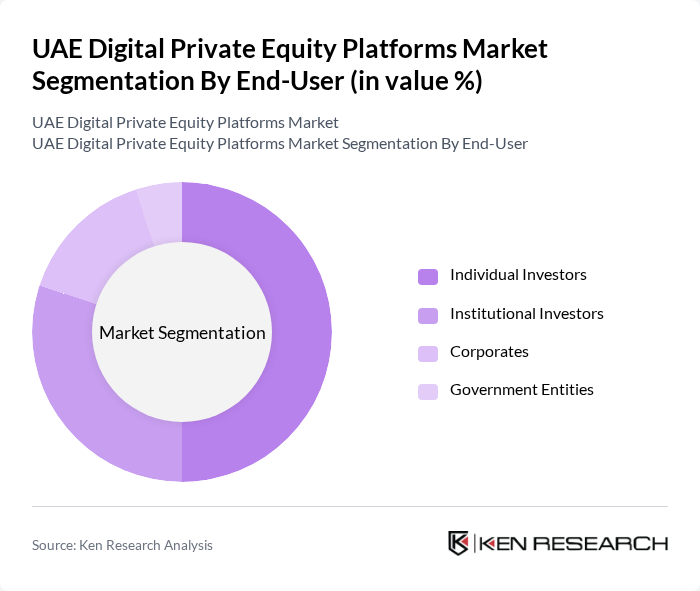

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, and Government Entities. Individual Investors are the most significant segment, driven by the increasing interest in alternative investments and the ease of access provided by digital platforms. Institutional Investors also contribute significantly, as they seek diversified portfolios and higher returns through private equity investments. Almost half of institutional investors in the Middle East are already allocating more than 20% of assets under management to private equity, reflecting the strong institutional appetite for alternative investment opportunities .

The UAE Digital Private Equity Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, Eureeca, FundedHere, YAPILI, Crowd1, Seeders, SmartCrowd, Nabbesh, Fintech Galaxy, Shurooq Partners, VentureSouq, Dubai Angel Investors, Wamda Capital, Abu Dhabi Investment Authority (ADIA), Mubadala Investment Company, Gulf Capital, Fajr Capital, Waha Capital, Shuaa Capital, Ithmar Capital, Arqaam Capital, Al Qudra Holding, Al-Futtaim Group, Emirates Investment Authority, Noor Investment Group, DIFC FinTech Hive contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital private equity platforms market appears promising, driven by ongoing digital transformation and increasing investor interest in alternative assets. As the regulatory environment continues to evolve, platforms will likely benefit from enhanced legitimacy and investor confidence. Additionally, the integration of advanced technologies such as AI and blockchain will facilitate more efficient investment processes, attracting a diverse range of investors and fostering innovation within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Crowdfunding Venture Capital Platforms Real Estate Investment Platforms Debt Financing Platforms Secondary Market Platforms Fundraising Platforms Others |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities |

| By Investment Size | Small Investments (Under AED 100,000) Medium Investments (AED 100,000 – AED 1,000,000) Large Investments (Over AED 1,000,000) |

| By Platform Model | Direct Investment Platforms Managed Investment Platforms Hybrid Platforms |

| By Geographic Focus | UAE Focused Investments GCC Region Investments Global Investments |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By User Experience | User-Friendly Platforms Advanced Analytical Tools Platforms Basic Functionality Platforms |

The UAE Digital Private Equity Platforms Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by digital technology adoption and increasing interest in alternative investments among both retail and institutional investors.