Region:Middle East

Author(s):Shubham

Product Code:KRAC4220

Pages:81

Published On:October 2025

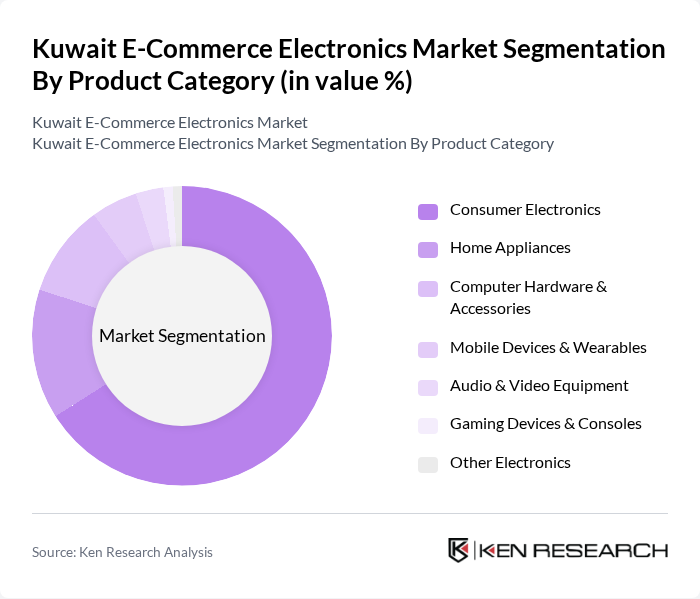

By Product Category:The product category segmentation includes various subsegments such as Consumer Electronics, Home Appliances, Computer Hardware & Accessories, Mobile Devices & Wearables, Audio & Video Equipment, Gaming Devices & Consoles, and Other Electronics. Among these, Consumer Electronics is the leading subsegment, driven by the high demand for smartphones, laptops, and tablets. The increasing reliance on technology for daily activities and the trend of upgrading devices frequently contribute to its dominance.

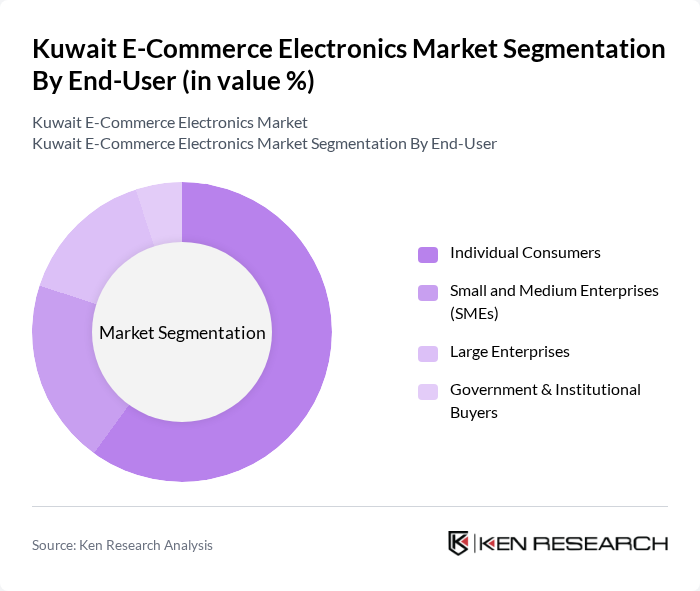

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Enterprises, and Government & Institutional Buyers. Individual Consumers dominate this segment, driven by the increasing trend of online shopping for personal electronics. The convenience of home delivery and the variety of options available online cater to the preferences of individual buyers, making them the largest consumer group in the market.

The Kuwait E-Commerce Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Xcite by Alghanim Electronics, Carrefour Kuwait, Lulu Hypermarket, Amazon (Souq.com), Jarir Bookstore, Best Al-Yousifi Electronics, Eureka Electronics, Axiom Telecom, Sharaf DG, E-City, Alghanim Industries, Al-Homaizi Group, Al-Sayer Group, Baitak Holding, Al-Manshar Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait e-commerce electronics market appears promising, driven by technological advancements and changing consumer behaviors. As digital literacy increases, more consumers are expected to embrace online shopping, particularly through mobile platforms. Additionally, the integration of artificial intelligence and machine learning in e-commerce operations will enhance personalization and customer engagement. These trends indicate a robust growth trajectory, with businesses likely to invest in innovative solutions to meet evolving consumer demands and preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Consumer Electronics (e.g., smartphones, laptops, tablets, cameras) Home Appliances (e.g., refrigerators, washing machines, air conditioners) Computer Hardware & Accessories (e.g., desktops, monitors, peripherals) Mobile Devices & Wearables (e.g., smartwatches, fitness trackers) Audio & Video Equipment (e.g., TVs, speakers, headphones) Gaming Devices & Consoles Other Electronics (e.g., smart home devices, drones) |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Government & Institutional Buyers |

| By Sales Channel | Online Marketplaces (e.g., Amazon, Xcite, Carrefour) Brand E-Commerce Websites Social Commerce Platforms Omnichannel Retailers |

| By Payment Method | Credit/Debit Cards Digital Wallets (e.g., Kuwait Pay) Buy Now Pay Later (BNPL) Cash on Delivery |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Lifecycle Stage | New Products Growth Stage Products Mature Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 100 | Online Shoppers, Tech Enthusiasts |

| Smartphone Market Insights | 80 | Mobile Users, Retail Sales Associates |

| Laptop Buying Trends | 60 | Students, Professionals, IT Managers |

| Online Shopping Experience Feedback | 90 | Frequent Online Buyers, Customer Service Representatives |

| Electronics Return Policies | 40 | Retail Managers, E-commerce Operations Heads |

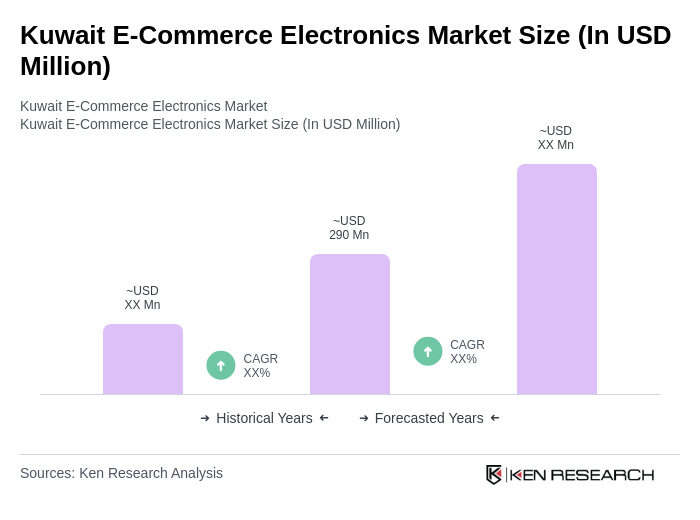

The Kuwait E-Commerce Electronics Market is valued at approximately USD 290 million, reflecting significant growth driven by the adoption of digital wallets, mobile commerce, and consumer preferences for online shopping.