Region:Middle East

Author(s):Shubham

Product Code:KRAD5494

Pages:98

Published On:December 2025

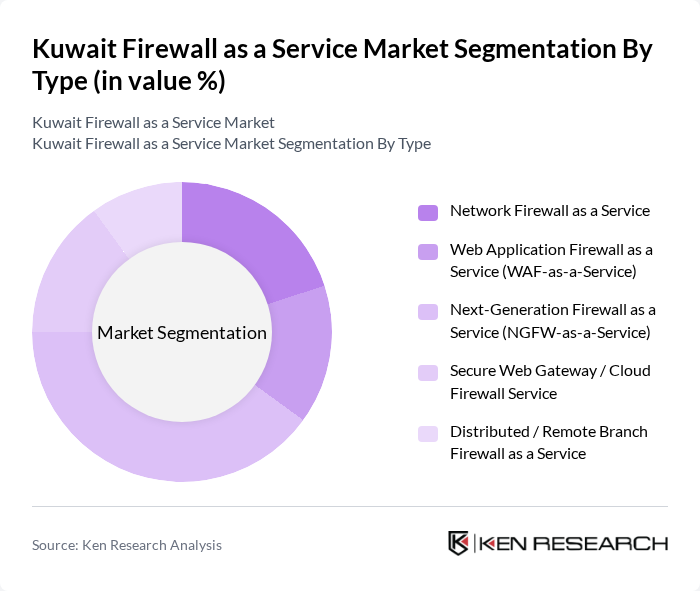

By Type:

The Kuwait Firewall as a Service market is segmented by type into several categories, including Network Firewall as a Service, Web Application Firewall as a Service (WAF-as-a-Service), Next-Generation Firewall as a Service (NGFW-as-a-Service), Secure Web Gateway / Cloud Firewall Service, and Distributed / Remote Branch Firewall as a Service. Among these, the Next-Generation Firewall as a Service (NGFW-as-a-Service) is currently dominating the market due to its advanced features such as integrated intrusion prevention, application awareness, and deep packet inspection. This segment is favored by enterprises looking for comprehensive security solutions that can adapt to evolving threats and provide enhanced visibility into network traffic.

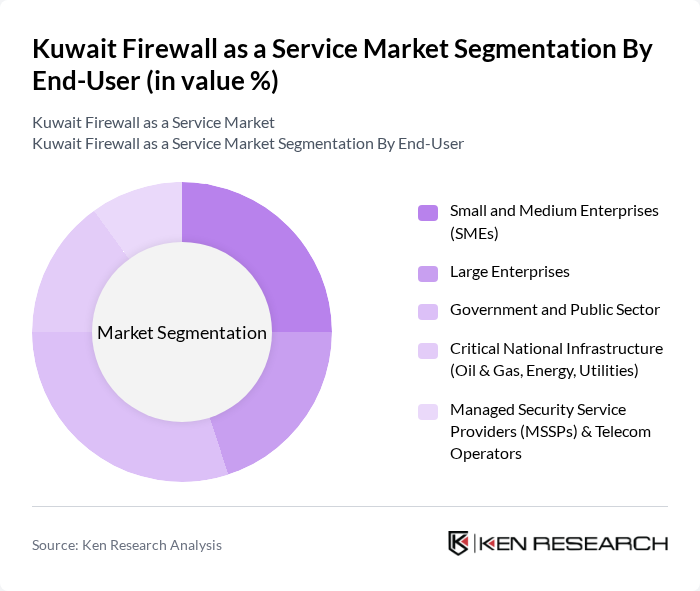

By End-User:

The market is also segmented by end-user, which includes Small and Medium Enterprises (SMEs), Large Enterprises, Government and Public Sector, Critical National Infrastructure (Oil & Gas, Energy, Utilities), and Managed Security Service Providers (MSSPs) & Telecom Operators. The Government and Public Sector segment is leading the market, driven by stringent regulatory requirements and the need for enhanced security measures to protect sensitive data. This segment's growth is further supported by government initiatives aimed at improving national cybersecurity posture.

The Kuwait Firewall as a Service market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Kuwait (Mobile Telecommunications Company), Ooredoo Kuwait, stc Kuwait (Solutions by stc), Qualitynet (part of stc Kuwait), KEMS-Zajil Telecom, Gulf Business Machines (GBM Kuwait), Huawei Technologies Kuwait, Fortinet, Palo Alto Networks, Check Point Software Technologies, Cisco Systems, Trend Micro, FireEye (Trellix), DarkMatter Group / Digital14 (regional cybersecurity provider), Injazat (regional managed security services provider) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait Firewall as a Service market is poised for significant growth as organizations increasingly recognize the importance of cybersecurity in a digital-first world. With government support and rising awareness of cyber threats, businesses are likely to adopt FWaaS solutions more aggressively. Additionally, the integration of advanced technologies such as artificial intelligence and machine learning into FWaaS offerings will enhance security capabilities, making them more attractive to organizations seeking comprehensive protection against evolving cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Firewall as a Service Web Application Firewall as a Service (WAF-as-a-Service) Next-Generation Firewall as a Service (NGFW-as-a-Service) Secure Web Gateway / Cloud Firewall Service Distributed / Remote Branch Firewall as a Service |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector Critical National Infrastructure (Oil & Gas, Energy, Utilities) Managed Security Service Providers (MSSPs) & Telecom Operators |

| By Deployment Model | Public Cloud FWaaS Private / Virtual Private Cloud FWaaS Hybrid FWaaS On-Premises Gateway Managed as a Service |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Healthcare Retail and E-commerce IT and Telecommunications Government, Defense, and Public Services Oil & Gas, Energy, and Industrial |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Jahra & Mubarak Al-Kabeer Governorates |

| By Security Features | Intrusion Prevention and Detection (IPS/IDS) Virtual Private Network (VPN) and Remote Access Advanced Threat Protection & Sandboxing Data Loss Prevention (DLP) and Content Filtering Centralized Policy Management, Reporting & Analytics |

| By Pricing Model | Subscription-Based (Per User / Per Site) Pay-As-You-Go / Consumption-Based Tiered Bundled Plans (Basic, Standard, Premium) Enterprise Custom / SLA-Driven Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Firewall Solutions | 110 | IT Security Managers, Network Administrators |

| SME Firewall Adoption | 85 | Business Owners, IT Consultants |

| Government Cybersecurity Initiatives | 60 | Government IT Officials, Cybersecurity Policy Makers |

| Healthcare Sector Security Needs | 65 | Healthcare IT Directors, Compliance Officers |

| Financial Services Cybersecurity | 95 | Risk Management Officers, IT Compliance Managers |

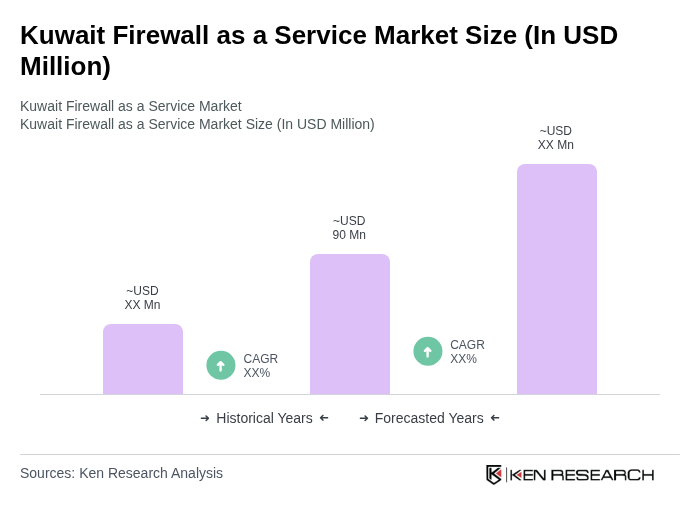

The Kuwait Firewall as a Service market is valued at approximately USD 90 million, reflecting significant growth driven by increasing cybersecurity threats and the digital transformation initiatives within the region.