Region:Middle East

Author(s):Rebecca

Product Code:KRAD2918

Pages:99

Published On:November 2025

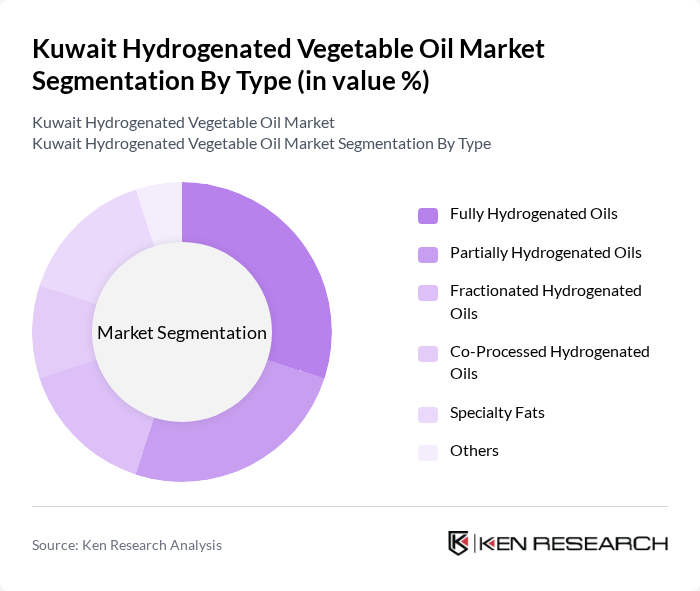

By Type:The market is segmented into various types of hydrogenated oils, including fully hydrogenated oils, partially hydrogenated oils, fractionated hydrogenated oils, co-processed hydrogenated oils, specialty fats, and others. Among these, fully hydrogenated oils are gaining traction due to their stability and health benefits, making them a preferred choice for food manufacturers. The demand for specialty fats is also on the rise, driven by the growing trend of health-conscious consumers seeking alternatives to traditional fats.

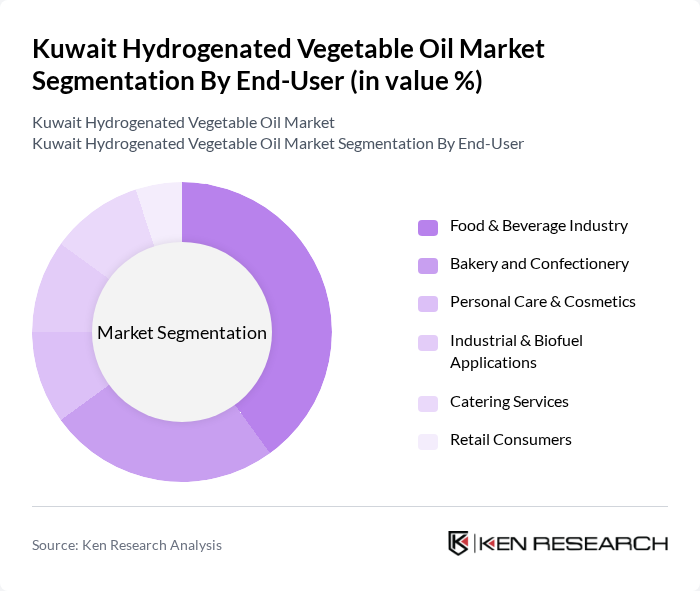

By End-User:The end-user segmentation includes the food and beverage industry, bakery and confectionery, personal care and cosmetics, industrial and biofuel applications, catering services, and retail consumers. The food and beverage industry is the leading segment, driven by the increasing demand for processed and convenience foods. Additionally, the bakery and confectionery sector is witnessing growth due to the rising popularity of baked goods, which require hydrogenated oils for texture and shelf life.

The Kuwait Hydrogenated Vegetable Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Flour Mills & Bakeries Company (KFMB), Al-Ahlia Vegetable Oil Company, United Foodstuff Industries Group Company (UFIG), Al-Muhalab Group, Al-Qatami Global for General Trading, Al-Safi Danone, Al-Homaizi Food Industries, Al-Babtain Group, Al-Masoud Group, Al-Jazeera Food Company, Al-Mutawa Group, Al-Saeed Group, Al-Mansour Group, Al-Khalij Vegetable Oil Company, Al-Mansour Al-Sabah Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrogenated vegetable oil market in Kuwait appears promising, driven by evolving consumer preferences and industry innovations. As health trends continue to shape purchasing decisions, manufacturers are likely to focus on developing healthier formulations that align with consumer demands. Additionally, the rise of e-commerce platforms will facilitate greater access to these products, enabling companies to reach a broader audience and adapt to changing market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Hydrogenated Oils Partially Hydrogenated Oils Fractionated Hydrogenated Oils Co-Processed Hydrogenated Oils Specialty Fats Others |

| By End-User | Food & Beverage Industry Bakery and Confectionery Personal Care & Cosmetics Industrial & Biofuel Applications Catering Services Retail Consumers |

| By Packaging Type | Bulk Packaging Retail Packaging Food Service Packaging Industrial Packaging Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Food Service Distributors Others |

| By Application | Cooking Oils Margarine and Spreads Shortenings Bakery Fats Cosmetics & Personal Care Industrial Lubricants & Biofuels Others |

| By Consumer Segment | Health-Conscious Consumers Budget-Conscious Consumers Gourmet Consumers Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Retail Distribution Channels | 80 | Supply Chain Managers, Retail Buyers |

| Food Service Industry | 70 | Restaurant Owners, Executive Chefs |

| Health and Nutrition Experts | 50 | Dietitians, Food Scientists |

| Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

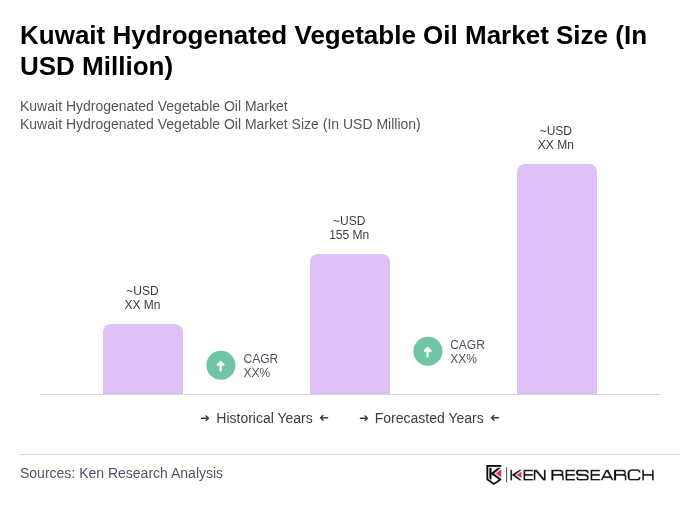

The Kuwait Hydrogenated Vegetable Oil Market is valued at approximately USD 155 million, reflecting a five-year historical analysis. This valuation is influenced by the growing demand for processed foods and a shift towards healthier cooking oils among consumers.