Region:Middle East

Author(s):Dev

Product Code:KRAA3898

Pages:87

Published On:January 2026

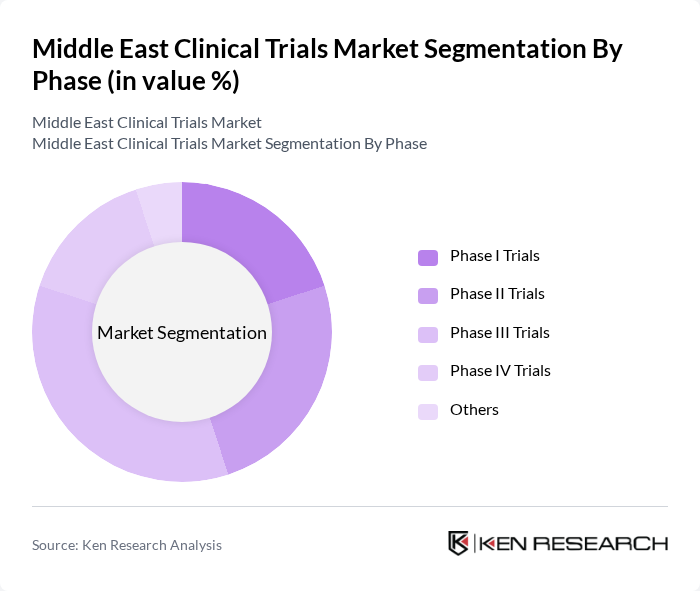

By Phase:The clinical trials in the Middle East are categorized into various phases, each serving a distinct purpose in the drug development process. Phase I trials focus on safety, tolerability, and dosage in small groups of healthy volunteers or patients. Phase II trials assess preliminary efficacy, optimal dosing ranges, and short-term side effects in a larger patient cohort. Phase III trials are pivotal for confirming effectiveness, comparing new interventions with standard treatments, and monitoring adverse reactions in larger and more diverse populations, and they account for the largest share of the Middle East clinical trials market. Phase IV trials are conducted post-marketing to gather additional information on long-term risks, benefits, use in broader real-world populations, and to generate real-world evidence requested by regulators and payers. The "Others" category includes various specialized trials that do not fit into the standard phases, such as observational studies, registries, adaptive and umbrella trials, and pragmatic real-world studies that support health technology assessment and market access.

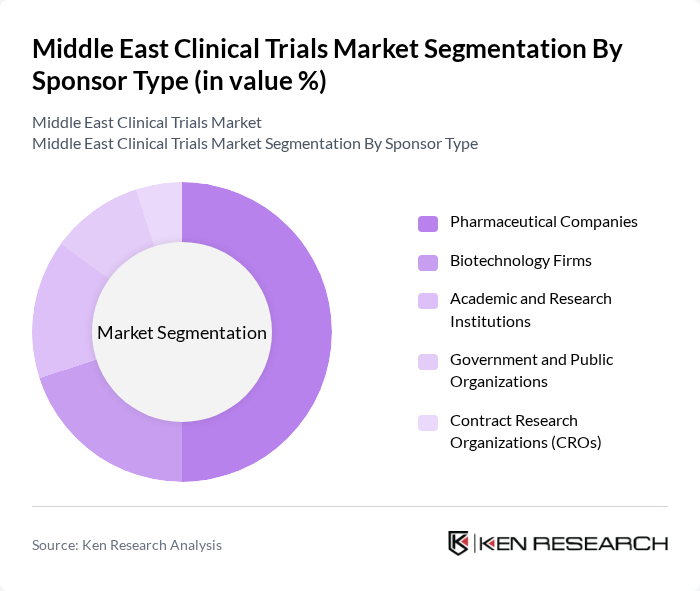

By Sponsor Type:The sponsorship of clinical trials in the Middle East is diverse, encompassing pharmaceutical companies, biotechnology firms, academic and research institutions, government and public organizations, and contract research organizations (CROs). Pharmaceutical companies are the primary sponsors, driven by the need to develop new drugs and therapies in key therapeutic areas such as oncology, metabolic diseases, and rare disorders. Biotechnology firms also play a significant role, particularly in innovative biologics, cell and gene therapies, and precision medicine platforms supported by new biotech hubs in Saudi Arabia, the UAE, and Qatar. Academic and research institutions contribute to investigator-initiated studies, public health research, and real-world evidence programs, while CROs provide essential services such as site management, patient recruitment, data management, and regulatory support, enhancing the overall efficiency and speed of clinical trials across the region.

The Middle East Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis, Pfizer, Roche, Sanofi, AstraZeneca, Merck & Co., GSK, Eli Lilly and Company, AbbVie, Amgen, Bayer, Johnson & Johnson, Takeda Pharmaceutical Company Limited, Biogen, UCB Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East clinical trials market appears promising, driven by technological advancements and a growing focus on patient-centric approaches. The integration of digital health technologies is expected to enhance trial efficiency and patient engagement. Additionally, the increasing emphasis on real-world evidence will likely shape trial designs, making them more relevant to patient needs. As regulatory frameworks continue to evolve, the region is poised to become a hub for innovative clinical research, attracting global stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Phase | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials Others |

| By Sponsor Type | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Government and Public Organizations Contract Research Organizations (CROs) Others |

| By Therapeutic Area | Oncology Cardiovascular Diseases Neurology Infectious Diseases Metabolic and Endocrine Disorders Rare and Orphan Diseases Others |

| By Study Design | Interventional Trials Observational Trials Expanded Access / Compassionate Use Trials Others |

| By Country / Region | Saudi Arabia United Arab Emirates Qatar Kuwait Bahrain Oman Levant Region North Africa Others |

| By Funding Source | Government-funded Trials Industry-funded Trials Non-profit and NGO-funded Trials International Collaborations Others |

| By Trial Setting | Hospital-based Trials Academic / Research Center-based Trials Community and Private Clinic-based Trials Decentralized / Virtual Trials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 110 | Oncologists, Clinical Trial Coordinators |

| Cardiovascular Research Studies | 90 | Cardiologists, Research Nurses |

| Diabetes Clinical Trials | 85 | Endocrinologists, Clinical Research Associates |

| Neurology Trials | 70 | Neurologists, Patient Advocacy Representatives |

| Rare Disease Studies | 55 | Specialists in Rare Diseases, Clinical Trial Managers |

The Middle East Clinical Trials Market is valued at approximately USD 640 million, reflecting a significant growth trend driven by increased healthcare investments, a rising number of pharmaceutical trials, and a growing patient population willing to participate in clinical studies.