Region:Middle East

Author(s):Rebecca

Product Code:KRAC0173

Pages:85

Published On:August 2025

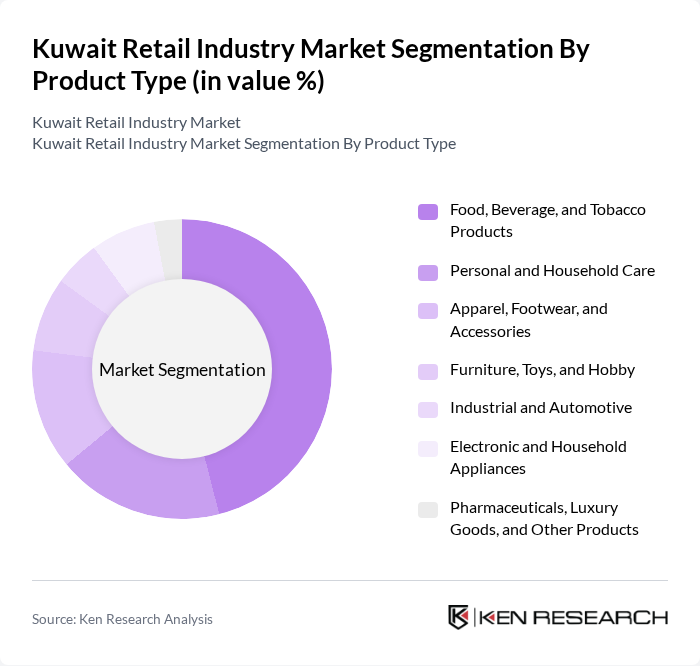

By Product Type:The product type segmentation includes various categories such as Food, Beverage, and Tobacco Products; Personal and Household Care; Apparel, Footwear, and Accessories; Furniture, Toys, and Hobby; Industrial and Automotive; Electronic and Household Appliances; and Pharmaceuticals, Luxury Goods, and Other Products. Among these, Food, Beverage, and Tobacco Products dominate the market due to the essential nature of these goods and the growing trend of dining out and convenience shopping.

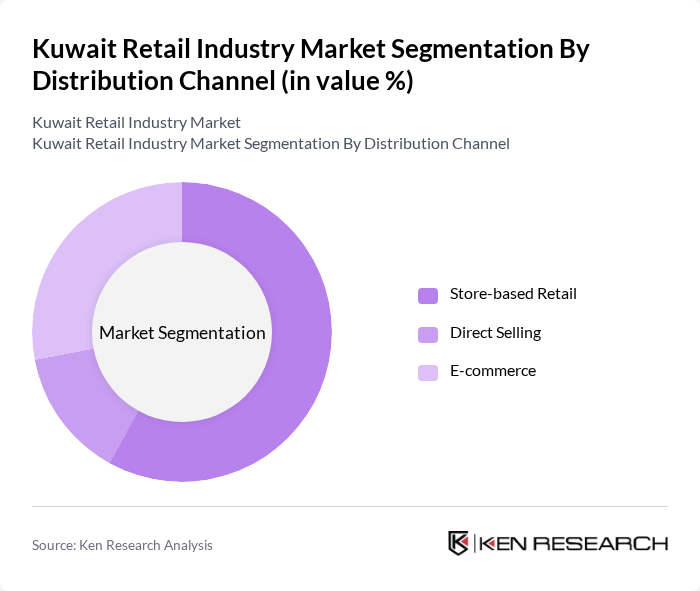

By Distribution Channel:The distribution channel segmentation encompasses Store-based Retail, Direct Selling, and E-commerce. Store-based retail remains the most significant channel, driven by the traditional shopping experience and the popularity of shopping malls. However, E-commerce is rapidly gaining traction, especially among younger consumers who prefer the convenience of online shopping. E-commerce is the fastest-growing channel, reflecting increased digital payment adoption and the integration of omnichannel strategies.

The Kuwait Retail Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alshaya Group, The Sultan Center (TSC), Carrefour (Majid Al Futtaim), Lulu Hypermarket, City Centre Kuwait, M.H. Alshaya Co., United Foodstuff Industries Group (UFIG), Al Mulla Group, Kout Food Group, Al-Homaizi Group, Al-Futtaim Group, Al-Manshar Group, Al-Bahar Group, Al-Muhalab Group, Al-Sayer Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait retail industry appears promising, driven by technological advancements and evolving consumer preferences. Retailers are increasingly adopting omnichannel strategies to enhance customer engagement, integrating online and offline experiences. Additionally, sustainability is becoming a focal point, with businesses exploring eco-friendly practices. As the market adapts to these trends, the emphasis on personalized shopping experiences is expected to grow, further shaping the retail landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Food, Beverage, and Tobacco Products Personal and Household Care Apparel, Footwear, and Accessories Furniture, Toys, and Hobby Industrial and Automotive Electronic and Household Appliances Pharmaceuticals, Luxury Goods, and Other Products |

| By Distribution Channel | Store-based Retail Direct Selling E-commerce |

| By Geography | Kuwait |

| By Consumer Demographics | Age Group Income Level Gender |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Retail Insights | 100 | Retail Managers, Store Owners |

| Consumer Shopping Behavior | 150 | General Consumers, Frequent Shoppers |

| Online Retail Trends | 80 | eCommerce Managers, Digital Marketing Specialists |

| Luxury Goods Market | 60 | Luxury Brand Managers, High-End Retailers |

| Food and Grocery Retail | 90 | Grocery Store Owners, Supply Chain Managers |

The Kuwait Retail Industry Market is valued at approximately USD 22.5 billion, reflecting significant growth driven by increasing consumer spending, rising disposable incomes, and a shift towards modern retail formats, including shopping malls and e-commerce platforms.