Region:Middle East

Author(s):Shubham

Product Code:KRAC3578

Pages:99

Published On:October 2025

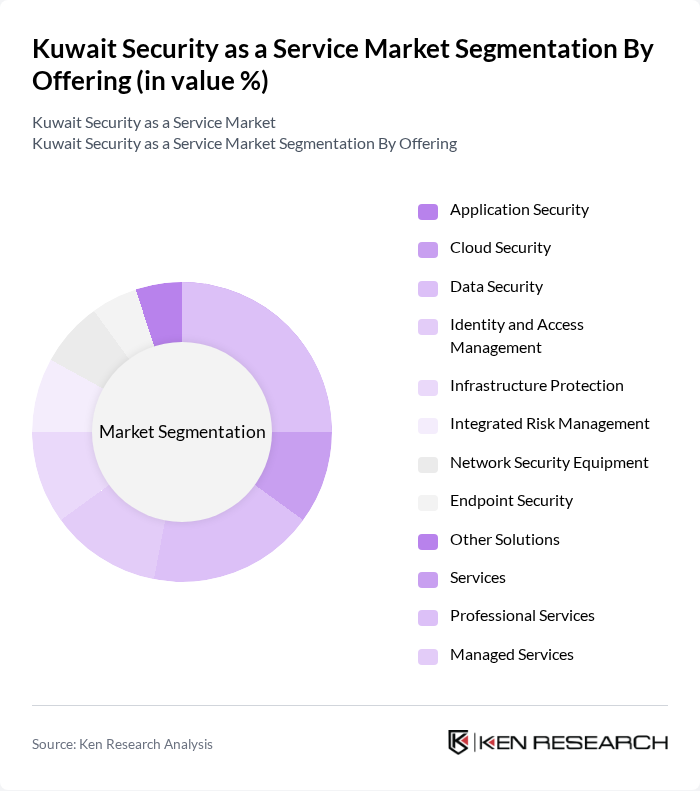

By Offering:The market is segmented into solutions and services. The solutions segment includes a comprehensive range of security offerings such as application security, cloud security, data security, identity and access management, infrastructure protection, integrated risk management, network security equipment, endpoint security, and other solutions. The services segment encompasses professional services and managed services, with managed detection and response services seeing increased adoption due to talent constraints and 24/7 protection needs .

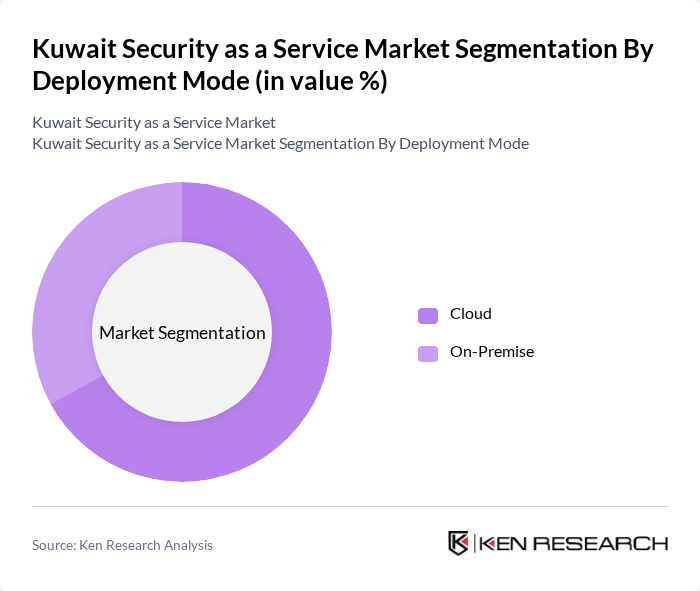

By Deployment Mode:The market is categorized into cloud and on-premise deployment modes. Cloud deployment is gaining traction, securing approximately 67% market share, driven by government cloud-first mandates, hyperscale region launches, and demand for scalable, cost-effective security. On-premise solutions remain preferred in critical infrastructure sectors where data sovereignty and process integrity are paramount .

The Kuwait Security as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Kuwait, Ooredoo Kuwait, STC Kuwait (Kuwait Telecommunications Company), Z Services, IBM Corporation, Cisco Systems, Inc., Fortinet, Inc., Secureworks Inc., Paladion Networks, BT Group plc, Honeywell International Inc., Johnson Controls International plc, Axis Communications AB, Check Point Software Technologies Ltd., Palo Alto Networks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Security as a Service market appears promising, driven by increasing investments in cybersecurity and a growing awareness of the importance of data protection. As organizations continue to face sophisticated cyber threats, the demand for innovative security solutions will likely rise. Additionally, the integration of advanced technologies such as artificial intelligence and machine learning will enhance the effectiveness of security measures, making them more appealing to businesses seeking robust protection against evolving threats.

| Segment | Sub-Segments |

|---|---|

| By Offering | Solutions Application Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Network Security Equipment Endpoint Security Other Solutions Services Professional Services Managed Services |

| By Deployment Mode | Cloud On-Premise |

| By Organization Size | Small and Medium Enterprises Large Enterprises |

| By End-User Vertical | Government BFSI (Banking, Financial Services, and Insurance) Healthcare IT and Telecom Industrial and Defense Retail Energy and Utilities Manufacturing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Security Services | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Solutions | 60 | Chief Information Officers, IT Directors |

| Government Agency Security Implementations | 50 | Cybersecurity Analysts, Risk Management Officers |

| Retail Sector SECaaS Adoption | 40 | Operations Managers, IT Administrators |

| Telecommunications Security Services | 70 | Network Security Engineers, Service Delivery Managers |

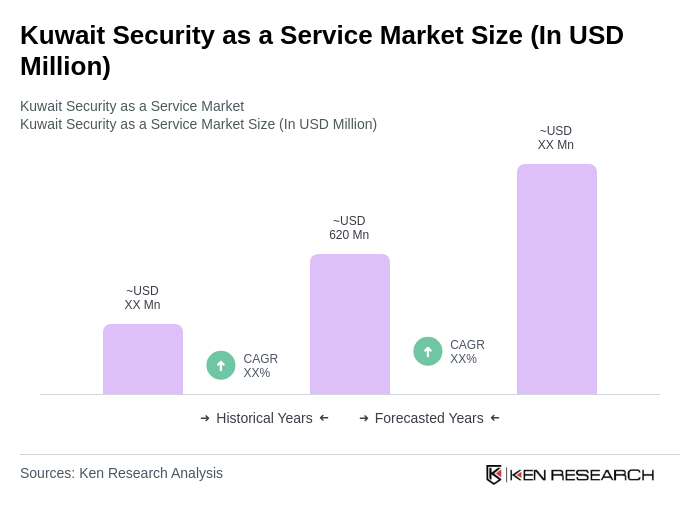

The Kuwait Security as a Service market is valued at approximately USD 620 million, reflecting significant growth driven by increasing cyber threats, government regulations, and the adoption of cloud-based security solutions.