Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8494

Pages:91

Published On:December 2025

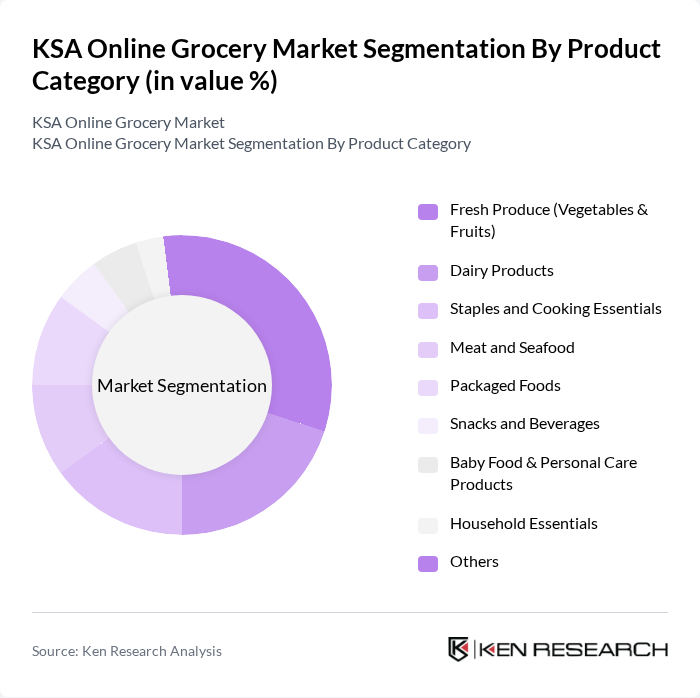

By Product Category:The product category segmentation of the KSA Online Grocery Market includes various subsegments such as Fresh Produce (Vegetables & Fruits), Dairy Products, Staples and Cooking Essentials, Meat and Seafood, Packaged Foods, Snacks and Beverages, Baby Food & Personal Care Products, Household Essentials, and Others. Among these, Fresh Produce is the leading subsegment, driven by the increasing consumer demand for healthy and organic food options. The trend towards healthier eating habits has significantly influenced purchasing behavior, with consumers prioritizing fresh fruits and vegetables in their grocery lists.

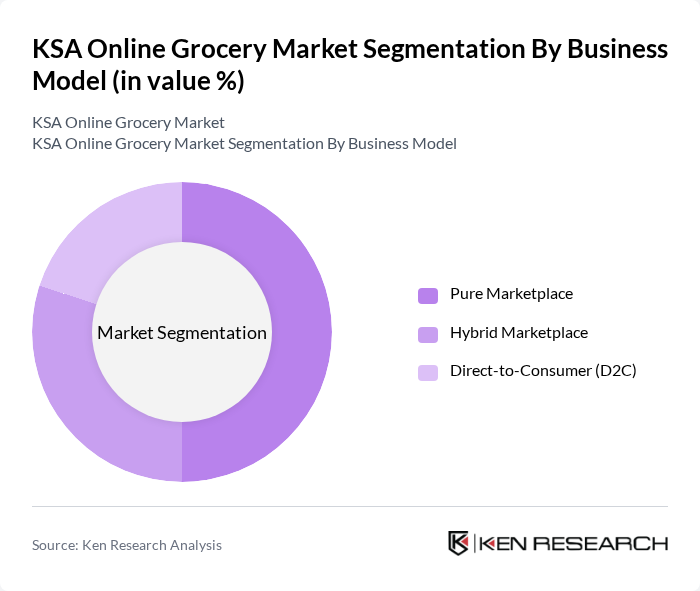

By Business Model:The business model segmentation of the KSA Online Grocery Market includes Pure Marketplace, Hybrid Marketplace, and Direct-to-Consumer (D2C). The Pure Marketplace model is currently the most dominant, as it allows various sellers to list their products on a single platform, providing consumers with a wide range of options. This model has gained traction due to its ability to offer competitive pricing and convenience, appealing to a broad consumer base.

The KSA Online Grocery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour, Lulu Hypermarket, Tamimi Markets Online, Nana, Danube, Noon, Zomato, Talabat, Carrefour Express, Monoprix, Al Nahdi Medical Company, Fadfed contribute to innovation, geographic expansion, and service delivery in this space.

The KSA online grocery market is poised for continued growth, driven by technological advancements and evolving consumer preferences. As mobile commerce becomes increasingly prevalent, businesses will need to enhance their digital platforms to meet customer expectations. Additionally, the integration of AI and machine learning will enable personalized shopping experiences, further attracting consumers. Companies that prioritize sustainability and eco-friendly practices will likely gain a competitive edge, appealing to the growing segment of health-conscious and environmentally aware shoppers in the Kingdom.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fresh Produce (Vegetables & Fruits) Dairy Products Staples and Cooking Essentials Meat and Seafood Packaged Foods Snacks and Beverages Baby Food & Personal Care Products Household Essentials Others |

| By Business Model | Pure Marketplace Hybrid Marketplace Direct-to-Consumer (D2C) |

| By Delivery Speed | Same-day Delivery Next-day Delivery Scheduled Delivery Instant/Q-Commerce (10-30 minutes) |

| By Platform Type | App-Based Web-Based |

| By Payment Method | Digital Wallets Credit/Debit Cards Cash on Delivery Buy Now Pay Later |

| By Geographic Distribution | Northern and Central Region Western Region Eastern Region Southern Region |

| By Purchase Type | One-Time Purchase Subscription-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Online Grocery Shopping | 120 | Regular online grocery shoppers, aged 18-65 |

| Retailer Insights | 60 | Owners and managers of online grocery stores |

| Logistics and Delivery Services | 50 | Logistics managers and delivery service operators |

| Market Trends and Consumer Behavior | 80 | Market analysts and consumer behavior researchers |

| Technology Adoption in Online Grocery | 40 | IT managers and technology providers in the grocery sector |

The KSA Online Grocery Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by digital payment adoption, smartphone penetration, and changing consumer preferences towards convenience and time-saving shopping solutions.