Region:Middle East

Author(s):Dev

Product Code:KRAC2719

Pages:90

Published On:October 2025

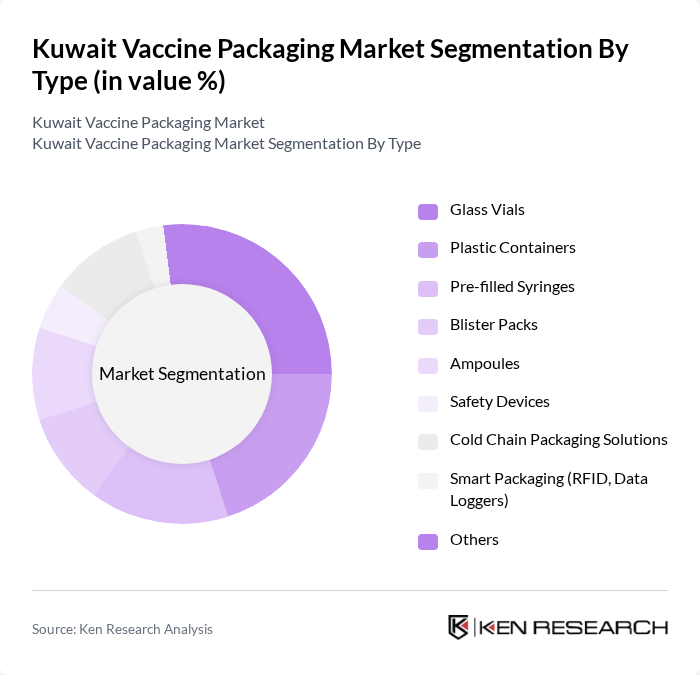

By Type:The market is segmented into various types of packaging solutions, including Glass Vials, Plastic Containers, Pre-filled Syringes, Blister Packs, Ampoules, Safety Devices, Cold Chain Packaging Solutions, Smart Packaging (RFID, Data Loggers), and Others. Each type serves specific needs in vaccine storage and distribution, with varying levels of demand based on the nature of the vaccines and logistical requirements.

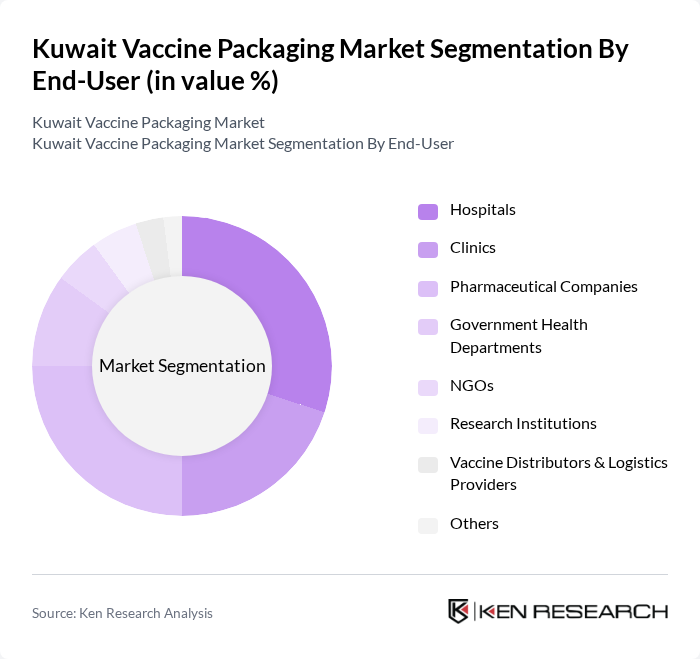

By End-User:The end-user segmentation includes Hospitals, Clinics, Pharmaceutical Companies, Government Health Departments, NGOs, Research Institutions, Vaccine Distributors & Logistics Providers, and Others. Each end-user category has distinct requirements for vaccine packaging, influenced by factors such as the scale of operations, regulatory compliance, and specific logistical challenges.

The Kuwait Vaccine Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Pfizer Inc., GlaxoSmithKline plc (GSK), Sanofi S.A., Johnson & Johnson, Moderna, Inc., AstraZeneca PLC, Merck & Co., Inc., Novartis AG, BioNTech SE, Serum Institute of India Pvt. Ltd., Sinovac Biotech Ltd., Bharat Biotech International Limited, Lonza Group AG, Catalent, Inc., Samsung Biologics Co., Ltd., WuXi Biologics, Thermo Fisher Scientific Inc., Aenova Group GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait vaccine packaging market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As the government continues to prioritize public health, the demand for innovative packaging solutions that ensure vaccine safety and efficacy will likely increase. Additionally, the growing trend towards sustainable packaging materials will shape the market landscape, encouraging manufacturers to adopt eco-friendly practices while meeting regulatory requirements and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Vials Plastic Containers Pre-filled Syringes Blister Packs Ampoules Safety Devices Cold Chain Packaging Solutions Smart Packaging (RFID, Data Loggers) Others |

| By End-User | Hospitals Clinics Pharmaceutical Companies Government Health Departments NGOs Research Institutions Vaccine Distributors & Logistics Providers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Hospitals Others |

| By Material Type | Glass Plastic Metal Composite Materials Others |

| By Packaging Type | Primary Packaging Secondary Packaging Tertiary Packaging Others |

| By Temperature Control | Ambient Temperature Refrigerated Frozen Ultra-low Temperature Others |

| By Application | Human Vaccines Animal Vaccines Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 60 | Production Managers, Quality Assurance Officers |

| Vaccine Distribution Companies | 50 | Logistics Coordinators, Supply Chain Analysts |

| Healthcare Providers | 40 | Pharmacists, Clinic Managers |

| Packaging Material Suppliers | 40 | Sales Managers, Product Development Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Kuwait Vaccine Packaging Market is valued at approximately USD 240 million, reflecting a significant growth driven by increased vaccine demand due to public health initiatives and the rising prevalence of infectious diseases.