Region:Middle East

Author(s):Rebecca

Product Code:KRAA9416

Pages:86

Published On:November 2025

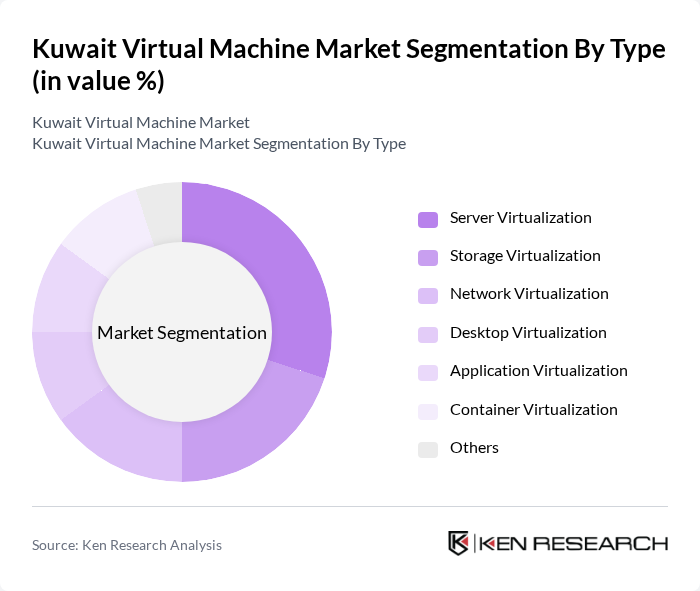

By Type:The market is segmented into various types of virtualization technologies, including server virtualization, storage virtualization, network virtualization, desktop virtualization, application virtualization, container virtualization, and others. Each of these segments plays a crucial role in optimizing IT resources and enhancing operational efficiency.

The server virtualization segment is currently leading the market due to its ability to maximize server utilization and reduce hardware costs. Organizations are increasingly adopting server virtualization to enhance their IT infrastructure's flexibility and scalability. This trend is driven by the growing need for efficient resource management and the rising demand for cloud services, making server virtualization a critical component of modern IT strategies.

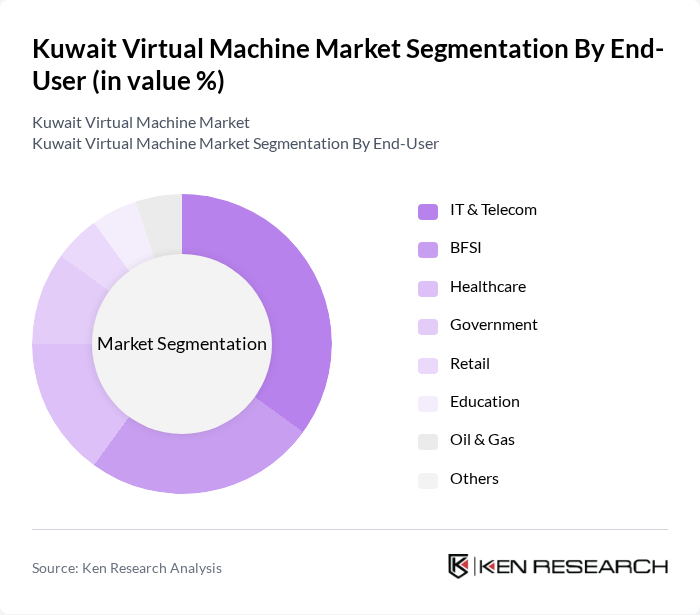

By End-User:The end-user segmentation includes various sectors such as IT & Telecom, BFSI (Banking, Financial Services, and Insurance), healthcare, government, retail, education, oil & gas, and others. Each sector utilizes virtualization technologies to enhance operational efficiency and service delivery.

The IT & Telecom sector is the largest end-user of virtualization technologies, driven by the need for efficient data management and service delivery. The increasing demand for cloud services and the necessity for robust IT infrastructure are propelling the adoption of virtualization solutions in this sector. Additionally, the BFSI sector follows closely, leveraging virtualization for enhanced security and operational efficiency.

The Kuwait Virtual Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Group, Gulf Business Machines (GBM), KEMS (QualityNet), Khazna Data Centers, Ooredoo Kuwait, KNET (Kuwait Network Electronic Technology Company), STC Kuwait (Saudi Telecom Company - Kuwait), Gulf Data Hub, Kuwait Data Center Company (KDCC), Amazon Web Services (AWS) Kuwait, Microsoft Kuwait, Oracle Kuwait, Google Cloud (Kuwait Region), Boubyan Bank, Kuwait Finance House contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait virtual machine market appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses continue to embrace multi-cloud strategies and edge computing, the demand for virtual machines is expected to grow. Additionally, the integration of AI and machine learning into virtual environments will enhance operational efficiencies, making these solutions more attractive to organizations seeking competitive advantages in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Server Virtualization Storage Virtualization Network Virtualization Desktop Virtualization Application Virtualization Container Virtualization Others |

| By End-User | IT & Telecom BFSI (Banking, Financial Services, and Insurance) Healthcare Government Retail Education Oil & Gas Others |

| By Industry Vertical | Manufacturing Energy & Utilities Transportation & Logistics Media & Entertainment Oil & Gas Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud On-Premises Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Managed Services Others |

| By Geographic Distribution | Kuwait City Al Ahmadi Hawalli Farwaniya Others |

| By Customer Size | Small Businesses Medium Enterprises Large Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Virtual Machine Usage | 100 | IT Managers, Cloud Architects |

| Healthcare Sector Cloud Adoption | 80 | System Administrators, CIOs |

| Education Sector Virtualization Trends | 70 | IT Coordinators, Network Administrators |

| Government Digital Transformation Initiatives | 60 | Policy Makers, IT Directors |

| SME Virtual Machine Deployment | 90 | Business Owners, IT Consultants |

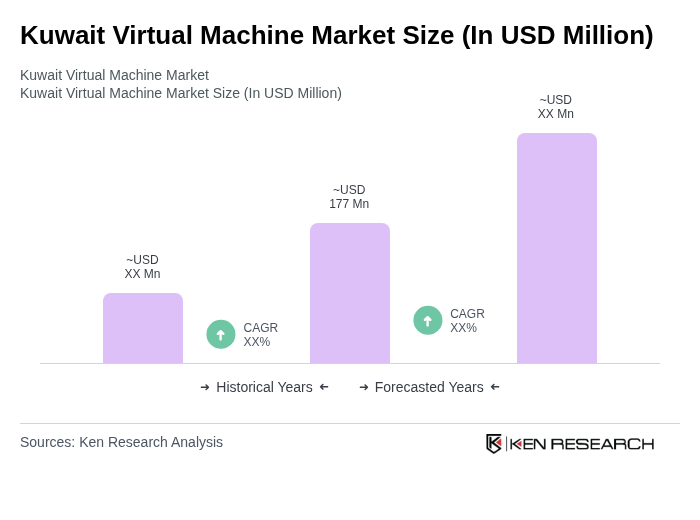

The Kuwait Virtual Machine Market is valued at approximately USD 177 million, reflecting a significant growth trend driven by the increasing adoption of cloud computing solutions and virtualization technologies across various sectors, including IT, healthcare, and finance.