Region:Middle East

Author(s):Dev

Product Code:KRAA2217

Pages:81

Published On:August 2025

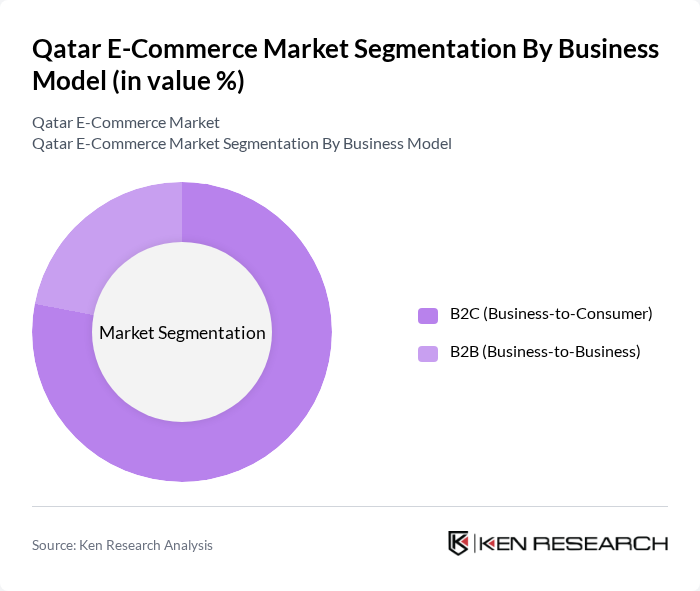

By Business Model:The e-commerce market in Qatar is primarily segmented into two business models: B2C (Business-to-Consumer) and B2B (Business-to-Business). The B2C segment is currently dominating the market, accounting for approximately 78% of total market revenue, due to the increasing number of consumers shopping online for various products, including fashion, electronics, and groceries. The convenience of online shopping, coupled with attractive discounts and promotions, has led to a significant rise in consumer spending in this segment. On the other hand, the B2B segment is also growing, driven by businesses seeking efficient supply chain solutions, digital procurement processes, and government initiatives supporting SME digitization .

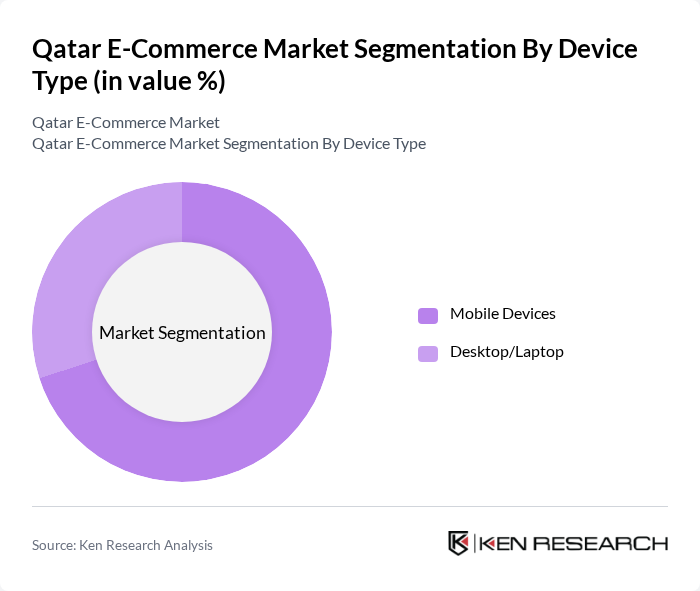

By Device Type:The device type segmentation in the Qatar E-Commerce Market includes mobile devices and desktop/laptop. Mobile devices are leading the market, accounting for approximately 70% of online transaction revenue. The increasing use of smartphones and mobile applications has made shopping more accessible and convenient for consumers. Desktop and laptop usage remains relevant, particularly for B2B transactions and larger purchases, but the trend is shifting towards mobile as consumers prefer the flexibility of shopping on-the-go .

The Qatar E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon (Souq.com), Carrefour Qatar, Lulu Hypermarket, Monoprix Qatar, Ounass, Jarir Bookstore, AlAnees Qatar, Baqaala, Talabat, Namshi, IKEA Qatar, Al Meera, Ourshopee Qatar, Ubuy Qatar, and Next Qatar contribute to innovation, geographic expansion, and service delivery in this space .

The future of Qatar's e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration and smartphone usage continue to rise, more consumers are expected to engage in online shopping. Additionally, the government's commitment to digital transformation will likely enhance infrastructure and regulatory frameworks. By addressing logistical challenges and improving payment security, the market can unlock its full potential, fostering a vibrant e-commerce ecosystem that meets evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Business Model | B2C (Business-to-Consumer) B2B (Business-to-Business) |

| By Device Type | Mobile Devices Desktop/Laptop |

| By Product Category | Fashion & Apparel Consumer Electronics Beauty & Personal Care Toys & Kids Supplies Home Decor & Furniture Food & Beverage Others |

| By Payment Method | Credit/Debit Cards Cash on Delivery Digital Wallets Bank Transfers |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect Same-Day Delivery |

| By Customer Demographics | Age Group Gender Income Level Geographic Location |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-commerce Behavior | 120 | Online Shoppers, Frequent Buyers |

| SME E-commerce Adoption | 60 | Business Owners, E-commerce Managers |

| Logistics and Delivery Services | 50 | Logistics Coordinators, Operations Managers |

| Digital Payment Preferences | 70 | Finance Managers, Payment Solution Providers |

| Market Trends and Insights | 40 | Industry Analysts, Market Researchers |

The Qatar E-Commerce Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping among consumers.