Region:Asia

Author(s):Dev

Product Code:KRAB0948

Pages:99

Published On:October 2025

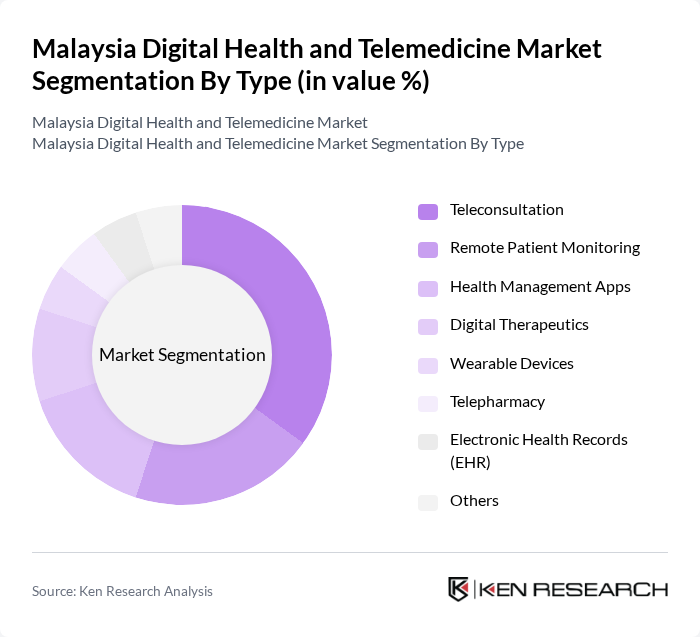

By Type:The market is segmented into teleconsultation, remote patient monitoring, health management apps, digital therapeutics, wearable devices, telepharmacy, electronic health records (EHR), and others. Teleconsultation is the leading sub-segment due to its convenience and accessibility, enabling patients to consult healthcare professionals remotely. The surge in demand for remote healthcare services, especially during the pandemic, has further solidified its position. The growth of mobile health applications and wearable devices is also notable, reflecting consumer demand for real-time health monitoring and personalized care .

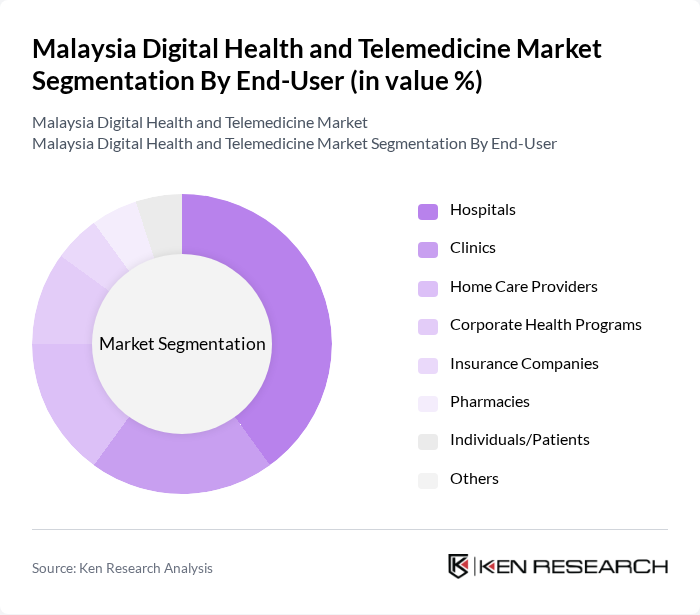

By End-User:The end-user segmentation includes hospitals, clinics, home care providers, corporate health programs, insurance companies, pharmacies, individuals/patients, and others. Hospitals are the dominant end-user segment, as they increasingly adopt digital health solutions to enhance patient care and streamline operations. Integration of telemedicine into hospital services has proven beneficial in managing patient flow and reducing wait times. Clinics and home care providers are also expanding their use of digital health platforms to improve service reach and efficiency .

The Malaysia Digital Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as DoctorOnCall, BookDoc, Teleme, Doctor2U (by BP Healthcare Group), GetDoc, HealthMetrics, Naluri, Qualitas Health, Alpro Pharmacy, Speedoc, Caring Pharmacy, MyDocLab, Homage Malaysia, MedKad, Pulse by Prudential contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's digital health and telemedicine market appears promising, driven by technological advancements and evolving consumer preferences. As the government continues to invest in digital health infrastructure, the integration of AI and machine learning into healthcare services is expected to enhance patient outcomes. Furthermore, the increasing focus on mental health and wellness will likely lead to the development of innovative solutions, ensuring that digital health services remain relevant and accessible to all segments of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Remote Patient Monitoring Health Management Apps Digital Therapeutics Wearable Devices Telepharmacy Electronic Health Records (EHR) Others |

| By End-User | Hospitals Clinics Home Care Providers Corporate Health Programs Insurance Companies Pharmacies Individuals/Patients Others |

| By Application | Chronic Disease Management (e.g., diabetes, hypertension) Mental Health Services Preventive Healthcare Emergency Services Rehabilitation Services Maternal & Child Health Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Mobile Applications Pharmacies Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Bundled Services Insurance-Covered Others |

| By Technology | Cloud-Based Solutions Mobile Health Technologies Artificial Intelligence Blockchain Technology Internet of Medical Things (IoMT) Others |

| By User Demographics | Age Groups Gender Socioeconomic Status Geographic Location Digital Literacy Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Users | 120 | Patients, Caregivers |

| Healthcare Providers | 90 | Doctors, Nurses, Telehealth Coordinators |

| Health Technology Developers | 60 | Product Managers, Software Developers |

| Regulatory Bodies | 40 | Policy Makers, Health Administrators |

| Insurance Companies | 50 | Underwriters, Claims Adjusters |

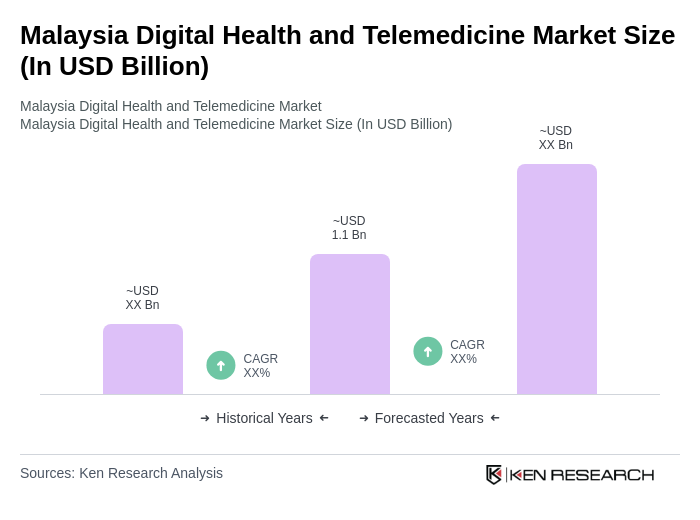

The Malaysia Digital Health and Telemedicine Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital health solutions and the impact of the COVID-19 pandemic on healthcare delivery.