Region:Africa

Author(s):Dev

Product Code:KRAB3119

Pages:90

Published On:October 2025

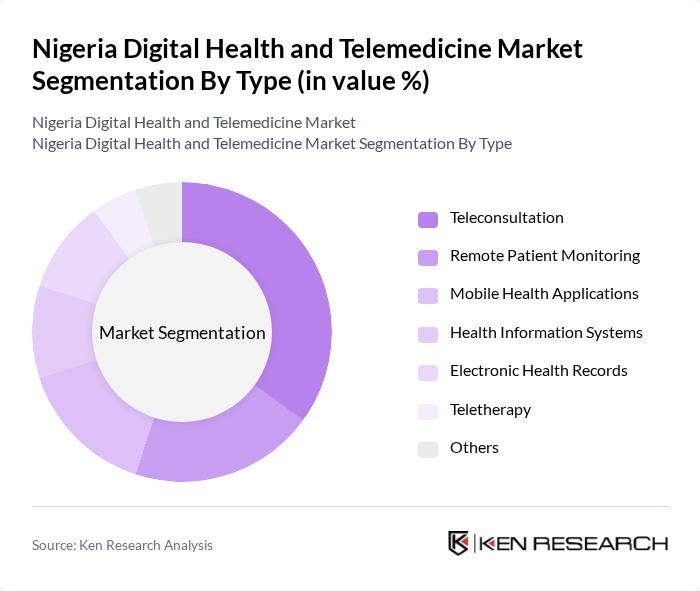

By Type:The market is segmented into various types, including Teleconsultation, Remote Patient Monitoring, Mobile Health Applications, Health Information Systems, Electronic Health Records, Teletherapy, and Others. Among these, Teleconsultation is currently the leading sub-segment due to its convenience and the growing acceptance of virtual consultations among patients. The increasing smartphone penetration and internet access have further fueled the demand for teleconsultation services, making it a preferred choice for many healthcare providers and patients alike.

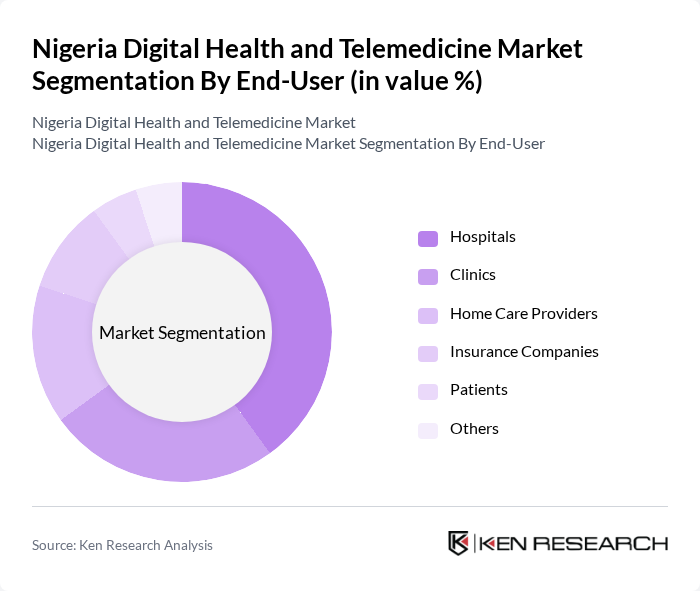

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Providers, Insurance Companies, Patients, and Others. Hospitals are the dominant end-user segment, as they are increasingly adopting digital health solutions to enhance patient care and streamline operations. The need for efficient patient management systems and the integration of telemedicine services into hospital workflows are driving this trend, making hospitals the primary consumers of digital health technologies.

The Nigeria Digital Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as mDoc, Vezeeta, LifeBank, 54gene, DabaDoc, HealthPlus, Jumia Health, Doctoora, Medsaf, The Biovac Company, DrugStoc, Ziva Health, MyMedic, HealthConnect, Wellvis Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's digital health and telemedicine market appears promising, driven by technological advancements and increasing consumer acceptance. By future, the integration of artificial intelligence in healthcare solutions is expected to enhance diagnostic accuracy and patient engagement. Additionally, the focus on mental health services is likely to grow, with more platforms emerging to address mental health issues. As the government continues to support digital health initiatives, the market is poised for significant transformation, improving healthcare access and outcomes nationwide.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Remote Patient Monitoring Mobile Health Applications Health Information Systems Electronic Health Records Teletherapy Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Mobile Applications Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Technologies Others |

| By User Demographics | Age Groups Gender Socioeconomic Status Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Telemedicine | 150 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patients Engaging in Telehealth Services | 120 | Patients, Caregivers, Health Advocates |

| Technology Vendors in Digital Health | 80 | Product Managers, Business Development Executives |

| Regulatory Bodies and Health Policy Makers | 50 | Health Policy Analysts, Government Officials |

| Insurance Providers Offering Telemedicine Coverage | 70 | Insurance Underwriters, Claims Managers |

The Nigeria Digital Health and Telemedicine Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by mobile technology adoption, internet penetration, and increased demand for accessible healthcare services, particularly accelerated by the COVID-19 pandemic.