Region:Asia

Author(s):Dev

Product Code:KRAA3527

Pages:92

Published On:September 2025

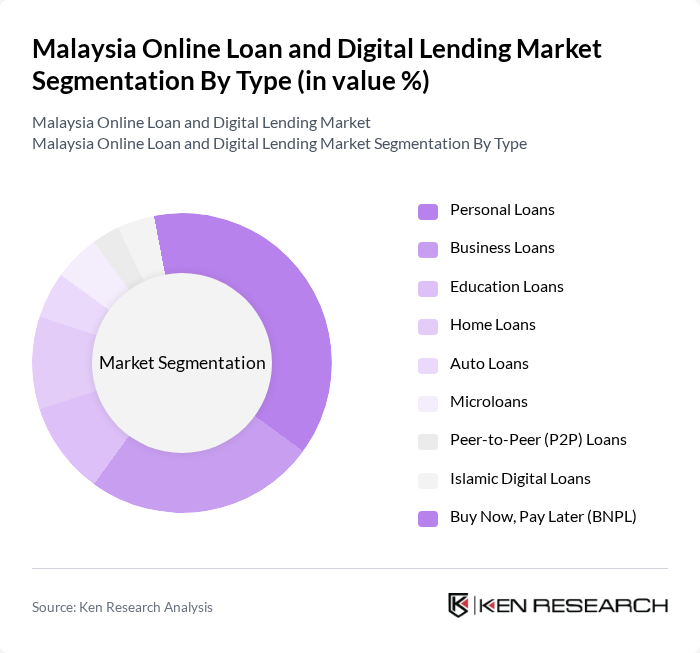

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Education Loans, Home Loans, Auto Loans, Microloans, Peer-to-Peer (P2P) Loans, Islamic Digital Loans, and Buy Now, Pay Later (BNPL). Personal Loans dominate the market due to their flexibility and ease of access, appealing to a wide range of consumers seeking quick financial solutions. Business Loans are also significant, driven by the growing number of startups and SMEs in Malaysia. The rise of BNPL and P2P lending reflects changing consumer preferences for alternative credit options and digital-first experiences .

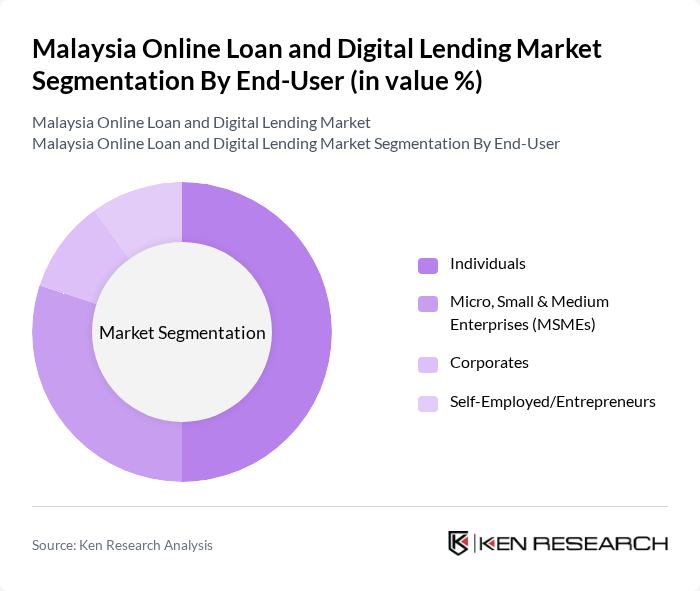

By End-User:The market is segmented by end-users, including Individuals, Micro, Small & Medium Enterprises (MSMEs), Corporates, and Self-Employed/Entrepreneurs. Individuals represent the largest segment, driven by the increasing need for personal financing solutions and the convenience of digital platforms. MSMEs are also a significant segment, as they seek accessible funding options to support their growth and operational needs. The digital lending ecosystem is increasingly tailored to address the unique requirements of these diverse user groups .

The Malaysia Online Loan and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maybank (Malayan Banking Berhad), CIMB Bank Berhad, RHB Bank Berhad, Hong Leong Bank Berhad, Bank Islam Malaysia Berhad, Grab Financial Group (GrabFin Malaysia), Funding Societies Malaysia, CapBay, RinggitPlus (Jirnexu Sdn Bhd), Axiata Digital (Aspirasi), Jirnexu Sdn Bhd, Finology Sdn Bhd, MoneyMatch, MBSB Bank Berhad, MyCash Online contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's online loan and digital lending market appears promising, driven by technological advancements and evolving consumer preferences. As fintech companies continue to innovate, the integration of artificial intelligence and machine learning for credit scoring will enhance lending efficiency. Additionally, the increasing focus on financial literacy initiatives will empower consumers to make informed borrowing decisions. These trends, coupled with the expansion of digital payment systems, are expected to create a more robust and accessible lending environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Education Loans Home Loans Auto Loans Microloans Peer-to-Peer (P2P) Loans Islamic Digital Loans Buy Now, Pay Later (BNPL) |

| By End-User | Individuals Micro, Small & Medium Enterprises (MSMEs) Corporates Self-Employed/Entrepreneurs |

| By Loan Amount | Below RM 1,000 RM 1,000 - RM 5,000 RM 5,001 - RM 10,000 Above RM 10,000 |

| By Loan Tenure | Short-term Loans (up to 1 year) Medium-term Loans (1-3 years) Long-term Loans (above 3 years) |

| By Interest Rate Type | Fixed Rate Variable Rate |

| By Distribution Channel | Online Platforms Mobile Applications Embedded Finance/E-commerce Platforms Digital Bank Platforms |

| By Customer Segment | First-time Borrowers Repeat Borrowers High-risk Borrowers Low-risk Borrowers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 100 | Consumers aged 25-45, Middle-income earners |

| Small Business Loan Applicants | 60 | Small business owners, Entrepreneurs |

| Microloan Recipients | 50 | Low-income individuals, First-time borrowers |

| Fintech Service Users | 80 | Tech-savvy consumers, Digital natives |

| Financial Advisors | 40 | Financial consultants, Investment advisors |

The Malaysia Online Loan and Digital Lending Market is valued at approximately USD 120 million, reflecting significant growth driven by the increasing adoption of digital financial services and consumer preference for quick loan solutions.