Italy Online Loan and Digital Lending Market Overview

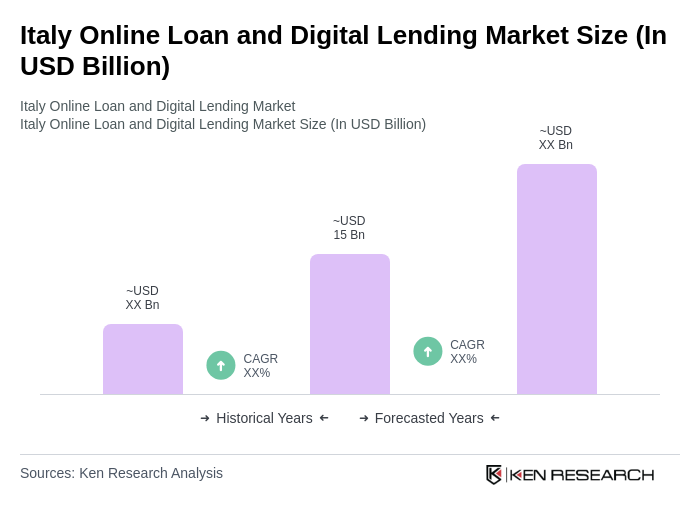

- The Italy Online Loan and Digital Lending Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the expansion of fintech companies offering innovative lending solutions. The market has seen a significant shift towards online platforms, making borrowing more convenient for consumers.

- Key cities such as Milan, Rome, and Turin dominate the market due to their economic significance and high population density. These urban centers are hubs for financial services and technology, fostering a conducive environment for digital lending. The concentration of businesses and consumers in these areas drives demand for various loan products, making them critical to the market's growth.

- In 2023, the Italian government implemented regulations aimed at enhancing consumer protection in the digital lending sector. This includes mandatory transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees. Such regulations are designed to promote responsible lending practices and safeguard consumers from predatory lending.

Italy Online Loan and Digital Lending Market Segmentation

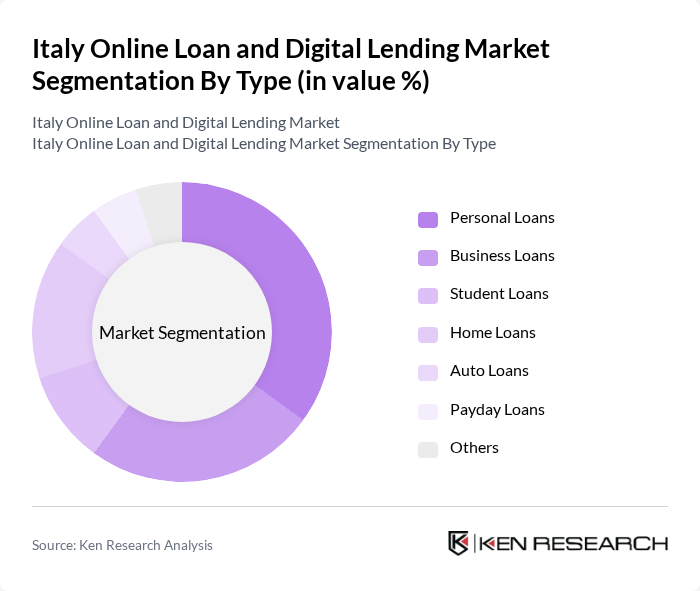

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, home loans, auto loans, payday loans, and others. Personal loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business loans are also significant, driven by the growing number of startups and small businesses seeking funding. Each type serves distinct consumer needs and preferences, contributing to the overall market dynamics.

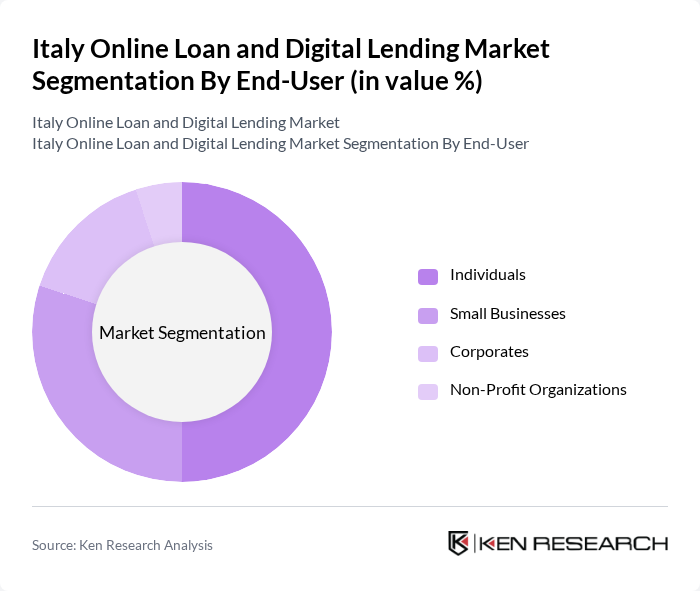

By End-User:The end-user segmentation includes individuals, small businesses, corporates, and non-profit organizations. Individuals represent the largest segment, driven by the increasing need for personal financing solutions. Small businesses also play a crucial role, as they often require loans for operational expenses and growth. Corporates and non-profits, while smaller in number, contribute to the market by seeking specialized financing options tailored to their unique needs.

Italy Online Loan and Digital Lending Market Competitive Landscape

The Italy Online Loan and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Credimi S.p.A., Younited Credit, Soisy S.p.A., PrestitiOnline, Findomestic Banca S.p.A., Agos Ducato S.p.A., Banca Sella S.p.A., Hype S.r.l., Banca IFIS S.p.A., Lendico Italia, MoneyFarm, Sella Personal Credit, Credito Fondiario S.p.A., Banca Nazionale del Lavoro S.p.A., Intesa Sanpaolo S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

Italy Online Loan and Digital Lending Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital adoption rate in Italy has surged, with over 85% of the population using the internet as of future. This shift has facilitated the growth of online loan platforms, allowing consumers to access financial services conveniently. The Italian government’s initiatives to enhance digital infrastructure, including investments exceeding €1.2 billion in broadband expansion, further support this trend. As more users engage online, the demand for digital lending solutions continues to rise, driving market growth.

- Demand for Quick Loan Processing:In future, the average loan processing time in Italy has decreased to approximately 22 hours, significantly appealing to consumers seeking immediate financial solutions. This rapid processing is largely due to advancements in technology and streamlined application processes. With over 65% of borrowers prioritizing speed in loan approvals, lenders are increasingly adopting digital platforms to meet this demand, thereby enhancing customer satisfaction and expanding their market reach.

- Rise of Fintech Innovations:The Italian fintech sector has witnessed remarkable growth, with over 350 fintech startups operating in future, focusing on innovative lending solutions. These companies leverage technologies such as blockchain and artificial intelligence to enhance credit assessment and risk management. The total investment in Italian fintech reached €1.7 billion in the previous year, indicating strong investor confidence. This innovation fosters competition and drives the development of more tailored lending products, attracting a diverse consumer base.

Market Challenges

- Regulatory Compliance Issues:The online lending market in Italy faces significant regulatory challenges, particularly with the Consumer Credit Directive, which mandates strict compliance measures. In future, the cost of compliance for lenders is estimated to exceed €250 million annually. This financial burden can deter smaller fintech companies from entering the market, limiting competition and innovation. Additionally, the evolving regulatory landscape requires constant adaptation, which can strain resources and operational efficiency.

- Consumer Trust and Security Concerns:Despite the growth of digital lending, consumer trust remains a critical challenge. In future, approximately 45% of potential borrowers express concerns over data security and privacy. High-profile data breaches in the financial sector have heightened these fears, leading to hesitance in adopting online lending solutions. Building robust security measures and transparent communication strategies will be essential for lenders to gain consumer confidence and drive market acceptance.

Italy Online Loan and Digital Lending Market Future Outlook

As the Italian online loan and digital lending market evolves, several trends are expected to shape its future. The integration of advanced technologies, such as artificial intelligence and machine learning, will enhance credit scoring and risk assessment processes, making lending more efficient. Additionally, the collaboration between fintech companies and traditional banks is likely to increase, creating a more diverse range of financial products. These developments will cater to the growing demand for personalized financial solutions, ultimately driving market expansion.

Market Opportunities

- Expansion of Digital Payment Solutions:The rise of digital payment platforms presents a significant opportunity for online lenders. With over 75% of Italians using digital wallets in future, integrating lending services with these platforms can enhance customer convenience and drive loan uptake. This synergy can lead to increased transaction volumes and customer loyalty, benefiting both lenders and payment providers.

- Growth in E-commerce Financing:The booming e-commerce sector in Italy, projected to reach €55 billion in future, offers substantial opportunities for online lenders. By providing tailored financing solutions for e-commerce businesses, lenders can tap into a rapidly expanding market. This collaboration can facilitate growth for both lenders and online retailers, creating a win-win scenario that enhances overall market dynamics.