Region:Asia

Author(s):Rebecca

Product Code:KRAB4183

Pages:97

Published On:October 2025

By Type:The market is segmented into various types of loans, including personal loans, business loans, payday loans, salary loans, OFW loans, auto loans, home loans, SME loans, and others. Personal loans are the most popular segment, driven by their flexibility, ease of access, and the ability to address a wide range of consumer needs. Business loans also hold significant market share, fueled by the increasing number of small and medium enterprises (SMEs) seeking funding for operational growth and expansion. The rapid uptake of buy now, pay later (BNPL) services and installment loans is also contributing to market diversification .

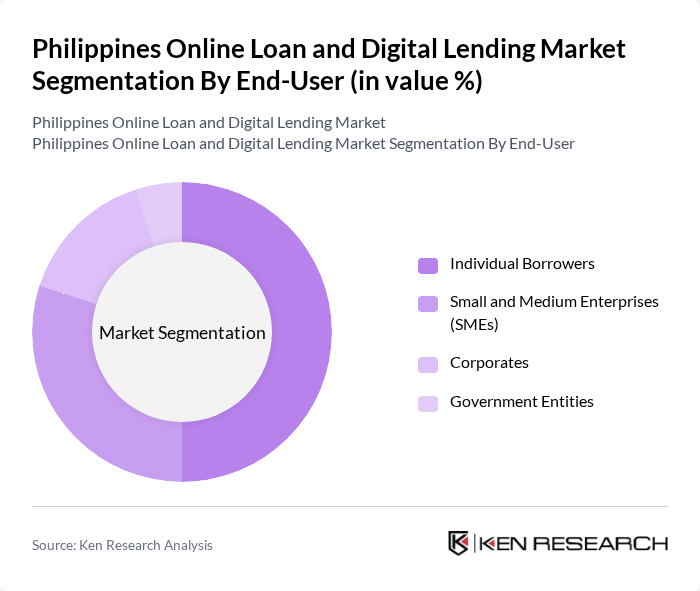

By End-User:The end-user segmentation includes individual borrowers, small and medium enterprises (SMEs), corporates, and government entities. Individual borrowers are the dominant segment, reflecting the increasing need for personal financing solutions, particularly among younger and digitally savvy populations. SMEs also represent a significant share, as they require accessible funding for operational expenses and business growth, while corporates and government entities comprise a smaller but stable segment .

The Philippines Online Loan and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cashalo, Home Credit Philippines, Tala Philippines, GCredit (by GCash/Mynt), Loan Ranger, LenddoEFL, Digido, JuanHand, Atome Credit, BillEase, UnionBank of the Philippines, RCBC (Rizal Commercial Banking Corporation), AUB (Asia United Bank), CIMB Bank Philippines, Maya Bank, Investree Philippines, SeedIn Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines online loan and digital lending market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals are expected to engage with online lending platforms. Additionally, the integration of artificial intelligence and machine learning in credit assessments will enhance risk management. This trend, coupled with the increasing collaboration between traditional banks and fintech companies, is likely to foster a more inclusive financial ecosystem, benefiting both lenders and borrowers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Payday Loans Salary Loans OFW Loans Auto Loans Home Loans SME Loans Others |

| By End-User | Individual Borrowers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Loan Amount | Micro Loans (Below PHP 10,000) Small Loans (PHP 10,001–PHP 50,000) Medium Loans (PHP 50,001–PHP 250,000) Large Loans (Above PHP 250,000) |

| By Loan Tenure | Short-term Loans (Up to 12 months) Medium-term Loans (1–3 years) Long-term Loans (Above 3 years) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Distribution Channel | Online Platforms Mobile Applications Agent Networks Direct Sales |

| By Customer Segment | First-time Borrowers Repeat Borrowers High-risk Borrowers Underbanked/Unbanked Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Online Loan Users | 120 | Individuals who have taken online loans in the past year |

| Small Business Owners | 80 | Owners of SMEs utilizing digital lending for business financing |

| Fintech Industry Experts | 40 | Consultants and analysts specializing in digital finance |

| Regulatory Authorities | 40 | Officials from financial regulatory bodies overseeing digital lending |

| Financial Advisors | 40 | Professionals providing advice on personal finance and loans |

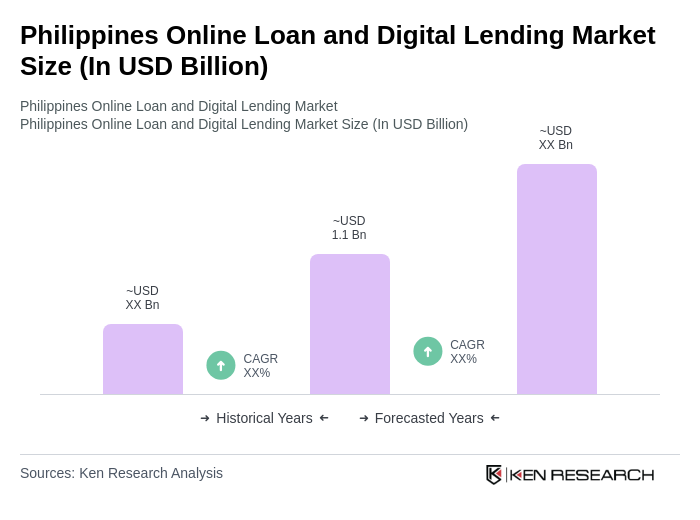

The Philippines Online Loan and Digital Lending Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of digital financial services and the demand for quick credit solutions among consumers and businesses.