Region:Africa

Author(s):Rebecca

Product Code:KRAB5924

Pages:86

Published On:October 2025

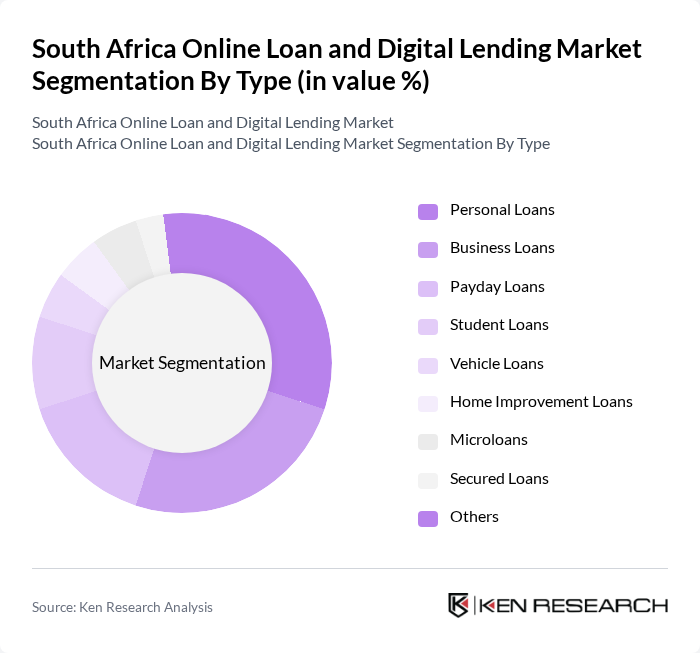

By Type:The market is segmented into various types of loans, each catering to different consumer needs. Personal loans are popular for individual financial needs, while business loans support SMEs in their growth. Payday loans offer quick cash solutions, and student loans help finance education. Vehicle loans and home improvement loans are also significant, alongside microloans and secured loans that provide options for lower-income borrowers. The digital lending platforms now integrate automotive loans, SME finance loans, home loans, and consumer durable financing to meet diverse market demands.

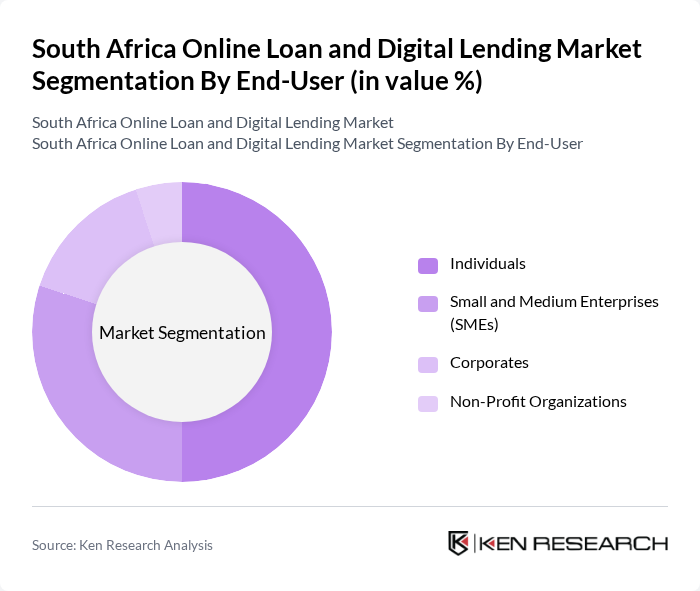

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individuals primarily seek personal loans for various needs, while SMEs often require business loans for expansion and operational costs. Corporates may utilize loans for larger projects, and non-profit organizations often seek funding for specific initiatives. The market serves both business and consumer segments through banking, financial services, insurance companies, peer-to-peer lenders, credit unions, and mortgage providers.

The South Africa Online Loan and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capitec Bank, African Bank, Wonga, Lendico, GetBucks, Finbond, DirectAxis, Bayport Financial Services, Standard Bank, Absa Bank, Nedbank, FNB, Finchoice, Capfin, Lulalend, Weaver Fintech, PayJustNow, Sanlam contribute to innovation, geographic expansion, and service delivery in this space.

The South African online loan and digital lending market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As mobile lending solutions become more prevalent, the integration of artificial intelligence for credit scoring will enhance risk assessment processes. Additionally, partnerships with e-commerce platforms are expected to create new avenues for customer acquisition, further expanding the market. The focus on personalized customer experiences will also play a crucial role in shaping the future landscape of digital lending.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Payday Loans Student Loans Vehicle Loans Home Improvement Loans Microloans Secured Loans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Amount | Small Loans (up to ZAR 10,000) Medium Loans (ZAR 10,001 - ZAR 50,000) Large Loans (over ZAR 50,000) |

| By Loan Duration | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Customer Segment | Low-Income Borrowers Middle-Income Borrowers High-Income Borrowers |

| By Loan Purpose | Home Improvement Debt Consolidation Education Business Expansion Others |

| By Geographic Reach | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 120 | Consumers aged 18-65 who have taken personal loans online |

| Small Business Loan Recipients | 80 | Small business owners who have utilized digital lending services |

| Fintech Industry Experts | 45 | Consultants and analysts specializing in fintech and digital lending |

| Regulatory Stakeholders | 25 | Officials from financial regulatory bodies and consumer protection agencies |

| Online Lending Platform Executives | 35 | CEOs, CFOs, and product managers from leading online lending firms |

The South Africa Online Loan and Digital Lending Market is valued at approximately USD 3.8 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rising demand for accessible credit solutions.