Region:Europe

Author(s):Shubham

Product Code:KRAB6576

Pages:87

Published On:October 2025

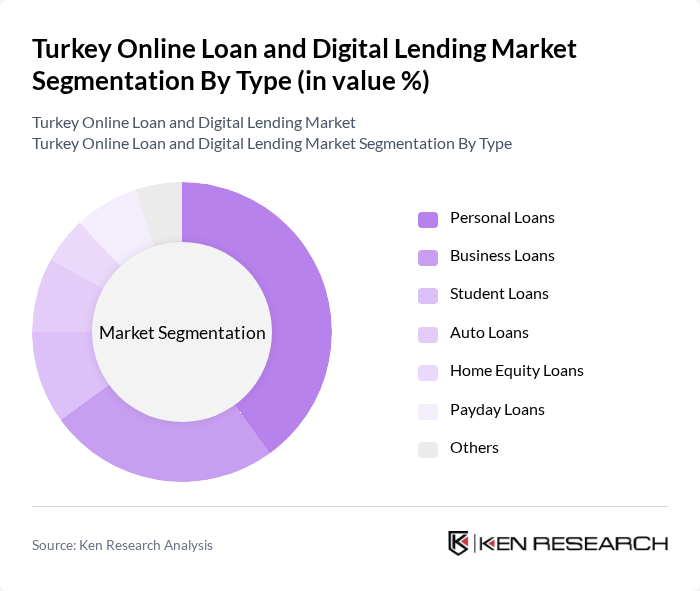

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Payday Loans, and Others. Personal Loans dominate the market due to their flexibility and the increasing need for consumers to finance personal expenses. Business Loans are also significant, driven by the growth of small and medium enterprises seeking funding for expansion.

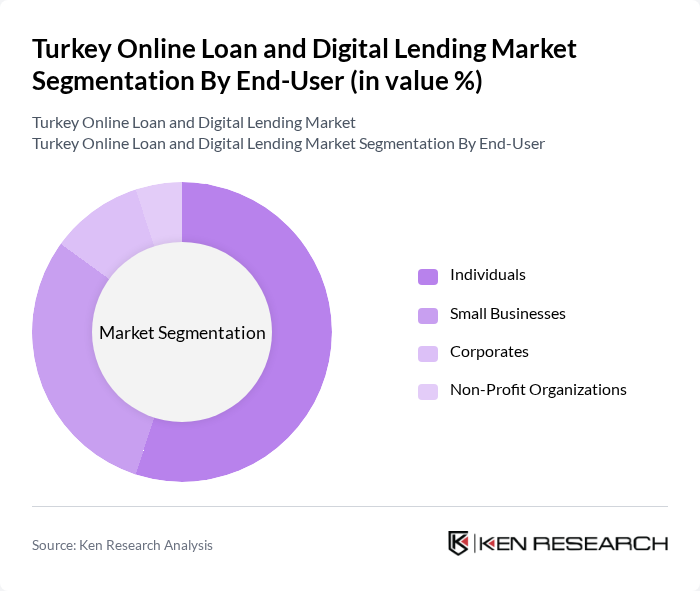

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals represent the largest segment, driven by the increasing need for personal financing solutions. Small Businesses also play a crucial role, as they often seek loans for operational costs and growth, reflecting the entrepreneurial spirit in Turkey.

The Turkey Online Loan and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Akbank T.A.S., Garanti BBVA, Yap? Kredi Bankas?, ?? Bankas?, QNB Finansinvest, Fibabanka A.S., Türkiye Finans Kat?l?m Bankas?, Ziraat Bankas?, DenizBank A.S., Anadolubank A.S., TEB (Türk Ekonomi Bankas?), Alternatif Bank A.S., PTT Bank, Odea Bank A.S., Enpara.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's online loan and digital lending market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, more consumers will seek digital financial solutions. Additionally, the integration of artificial intelligence in loan processing is expected to enhance efficiency and risk assessment. The market is likely to witness increased collaboration between fintech firms and traditional banks, fostering innovation and expanding access to credit for underserved populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Equity Loans Payday Loans Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Loan Amount | Micro Loans Small Loans Medium Loans Large Loans |

| By Loan Duration | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Customer Segment | First-Time Borrowers Repeat Borrowers High-Risk Borrowers |

| By Credit Score | Low Credit Score Medium Credit Score High Credit Score |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 150 | Individuals aged 25-45, employed, with varying income levels |

| Small Business Owners | 100 | Entrepreneurs, business managers, and financial decision-makers |

| Fintech Industry Experts | 80 | Consultants, analysts, and executives in the digital lending space |

| Regulatory Authorities | 50 | Officials from BRSA and other financial regulatory bodies |

| Consumer Finance Advisors | 70 | Financial advisors, credit counselors, and personal finance educators |

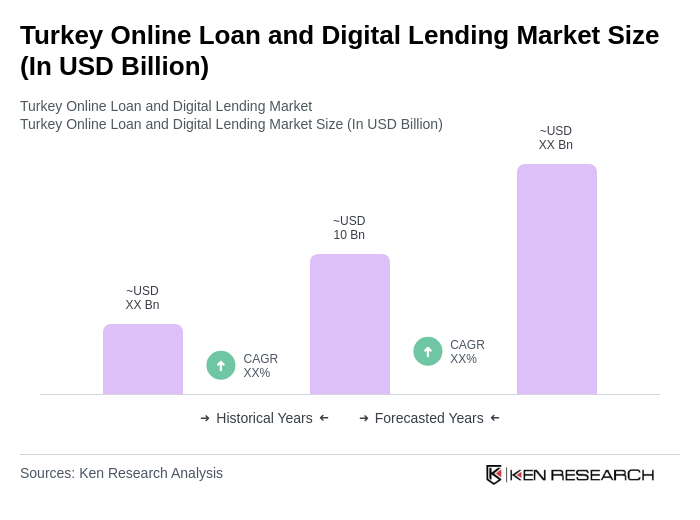

The Turkey Online Loan and Digital Lending Market is valued at approximately USD 10 billion, reflecting significant growth driven by the adoption of digital banking solutions and consumer demand for accessible loan options.