Region:Central and South America

Author(s):Dev

Product Code:KRAA0445

Pages:100

Published On:August 2025

By Type:The market is segmented into a comprehensive range of security solutions designed to address the diverse requirements of cargo protection. The subsegments include Physical Security Solutions (such as guards, barriers, and locks), Electronic Security Systems (including alarms and access control), Surveillance and Monitoring Services (real-time video and sensor monitoring), Risk Assessment Services (threat analysis and vulnerability audits), Security Consulting Services (strategy and compliance advisory), Cargo Insurance (coverage for loss or theft), Cargo Screening and Inspection (scanning and verification), Tracking and Tracing Systems (GPS, RFID, and IoT-enabled tracking), Access Control and Authentication (biometric and digital access), and Others. Each subsegment plays a vital role in strengthening the security framework for cargo transportation .

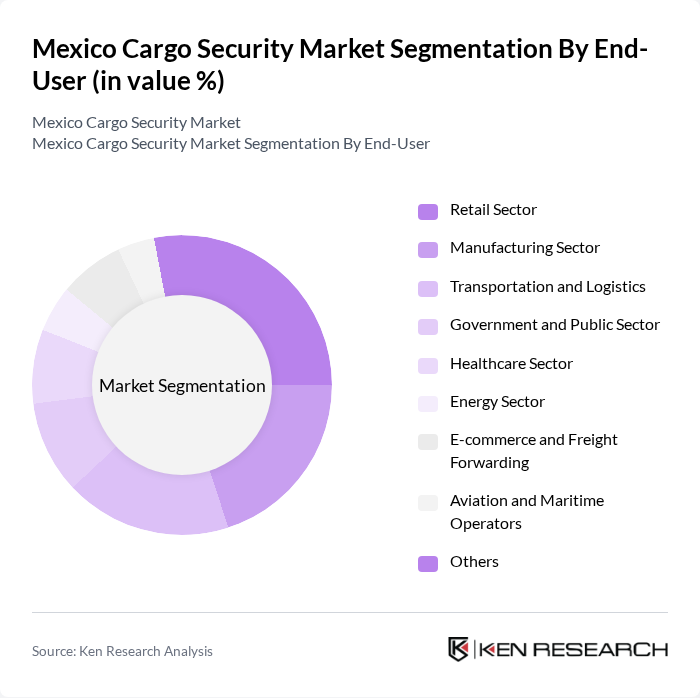

By End-User:The end-user segmentation encompasses a wide array of sectors utilizing cargo security solutions. These sectors include the Retail Sector (protection of high-value goods and supply chain integrity), Manufacturing Sector (securing raw materials and finished products), Transportation and Logistics (fleet and shipment monitoring), Government and Public Sector (compliance and regulatory enforcement), Healthcare Sector (safe transport of pharmaceuticals and medical devices), Energy Sector (protection of critical infrastructure and hazardous materials), E-commerce and Freight Forwarding (real-time tracking and loss prevention), Aviation and Maritime Operators (port and airport security), and Others. Each sector has distinct security needs, driving demand for customized solutions .

The Mexico Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Multisistemas de Seguridad Industrial, Securitas Mexico, G4S Secure Solutions Mexico, Prosegur Mexico, Control Risks, ADT Security Services Mexico, DHL Supply Chain Mexico, FedEx Express Mexico, Kuehne + Nagel Mexico, Brink's Mexico, Seguritech Privada, Veritas Global, Grupo Protexa, C3S Security, Seguridad Privada de Mexico contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico cargo security market is poised for significant evolution as businesses increasingly prioritize security in their operations. With the integration of advanced technologies such as IoT and AI, companies are expected to enhance their security protocols, leading to improved risk management. Additionally, the growing emphasis on regulatory compliance will drive investments in security solutions, fostering a more secure logistics environment. As the market matures, collaboration between technology providers and logistics firms will be crucial in addressing emerging security challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions Electronic Security Systems Surveillance and Monitoring Services Risk Assessment Services Security Consulting Services Cargo Insurance Cargo Screening and Inspection Tracking and Tracing Systems Access Control and Authentication Others |

| By End-User | Retail Sector Manufacturing Sector Transportation and Logistics Government and Public Sector Healthcare Sector Energy Sector E-commerce and Freight Forwarding Aviation and Maritime Operators Others |

| By Cargo Type | Perishable Goods Electronics Pharmaceuticals Textiles Heavy Machinery Consumer Goods Others |

| By Security Technology | GPS Tracking Systems RFID Technology Biometric Systems Video Surveillance Systems Alarm Systems Access Control Systems X-ray Scanners Explosive Detection Systems (EDS) Others |

| By Service Type | Consulting Services Installation Services Maintenance Services Monitoring Services Emergency Response Services Training Services Others |

| By Mode of Transport | Road Cargo Security Rail Cargo Security Air Cargo Security Maritime Cargo Security Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Baja California Yucatan Peninsula Others |

| By Market Maturity | Emerging Market Growth Market Mature Market Declining Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Security Solutions | 100 | Security Managers, Operations Directors |

| Cargo Theft Prevention Strategies | 80 | Risk Management Officers, Compliance Managers |

| Technology Adoption in Cargo Security | 70 | IT Managers, Technology Managers |

| Insurance and Liability in Cargo Transport | 50 | Insurance Underwriters, Claims Adjusters |

| Regulatory Compliance and Cargo Security | 90 | Legal Advisors, Regulatory Affairs Managers |

The Mexico Cargo Security Market is valued at approximately USD 1.85 billion, driven by the increasing need for secure transportation of goods, rising cargo theft incidents, and the growth of e-commerce requiring robust security measures throughout the supply chain.