Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB0101

Pages:89

Published On:August 2025

By Type:The commercial real estate market in Mexico is segmented into office spaces, retail properties, industrial warehouses, logistics facilities, mixed-use developments, hospitality properties, multi-family residential, land development, and others. Industrial warehouses and logistics facilities have seen the fastest growth, driven by nearshoring and e-commerce. Office spaces are adapting to new workplace models emphasizing flexibility and sustainability, while retail properties are shifting toward mixed-use and experiential formats. Mixed-use developments and hospitality properties are also expanding, reflecting evolving consumer and business demands .

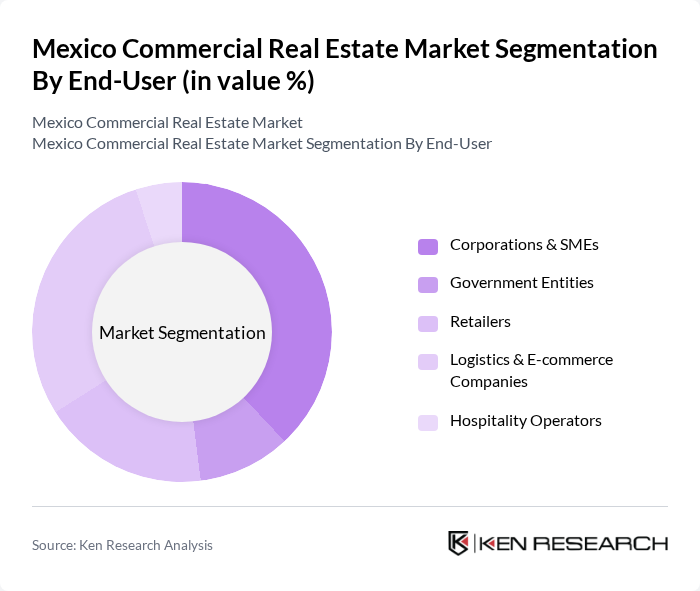

By End-User:The end-user segmentation of the commercial real estate market includes corporations and SMEs, government entities, retailers, logistics and e-commerce companies, and hospitality operators. Corporations and SMEs remain the largest end-user group, with logistics and e-commerce companies rapidly increasing their share due to the rise in nearshoring and digital retail. Retailers and hospitality operators continue to adapt to shifting consumer preferences and tourism trends .

The Mexico Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fibra Uno (FUNO), Prologis México, Vesta, Grupo Sordo Madaleno, Grupo Danhos, JLL México, CBRE México, Cushman & Wakefield México, Colliers México, Inmuebles24, Grupo Lar México, Desarrolladora Homex, Grupo Gigante, Grupo Acosta Verde, Hines México, Savills México, Flat.mx, Grupo Posadas contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico commercial real estate market is poised for a transformative period driven by urbanization, technological advancements, and evolving consumer preferences. As remote work continues to influence office space demand, flexible leasing options are likely to gain traction. Additionally, the focus on sustainability will drive investments in green buildings, aligning with global trends. The integration of smart technologies in property management will enhance operational efficiency, making the market more attractive to investors and tenants alike, fostering a dynamic growth environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Spaces Retail Properties Industrial Warehouses Logistics Facilities Mixed-Use Developments Hospitality Properties (Hotels & Resorts) Multi-family Residential Land Development Others |

| By End-User | Corporations & SMEs Government Entities Retailers Logistics & E-commerce Companies Hospitality Operators |

| By Investment Source | Domestic Institutional Investors Foreign Direct Investment (FDI) Real Estate Investment Trusts (REITs / FIBRAs) Public-Private Partnerships (PPP) Government Schemes |

| By Property Class | Class A Class B Class C |

| By Location | Mexico City Metropolitan Area Monterrey Metropolitan Area Guadalajara Metropolitan Area Bajío Region Border States (e.g., Tijuana, Ciudad Juárez) Other Urban Areas Suburban Areas Rural Areas |

| By Lease Type | Long-term Leases Short-term Leases Flexible/Co-working Leases |

| By Development Stage | Pre-Construction Under Construction Completed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Leasing | 100 | Property Managers, Corporate Real Estate Executives |

| Retail Market Trends | 80 | Retail Store Owners, Leasing Agents |

| Industrial Property Demand | 60 | Logistics Managers, Industrial Developers |

| Investment Sentiment Analysis | 90 | Real Estate Investors, Financial Analysts |

| Urban Development Projects | 50 | City Planners, Urban Developers |

The Mexico Commercial Real Estate Market is valued at approximately USD 64 billion, driven by urbanization, foreign direct investment, and increased demand for logistics and industrial spaces, particularly due to trends like nearshoring and e-commerce expansion.