Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5953

Pages:91

Published On:October 2025

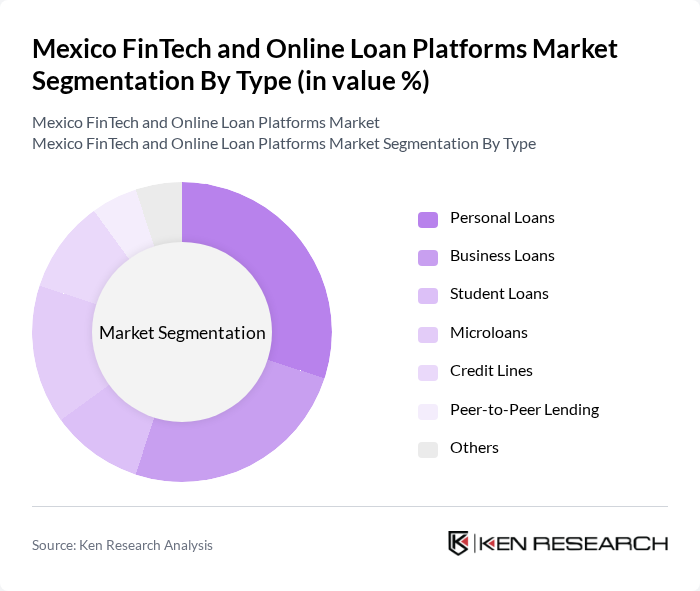

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Microloans, Credit Lines, Peer-to-Peer Lending, and Others. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse financial requirements of the population.

The Personal Loans subsegment is currently dominating the market due to the increasing need for quick and accessible credit among individuals. This trend is driven by a growing number of consumers seeking financial solutions for personal expenses, such as home improvements, medical bills, and unexpected emergencies. The ease of application and rapid approval processes offered by online platforms have further fueled the popularity of personal loans, making them a preferred choice for many borrowers.

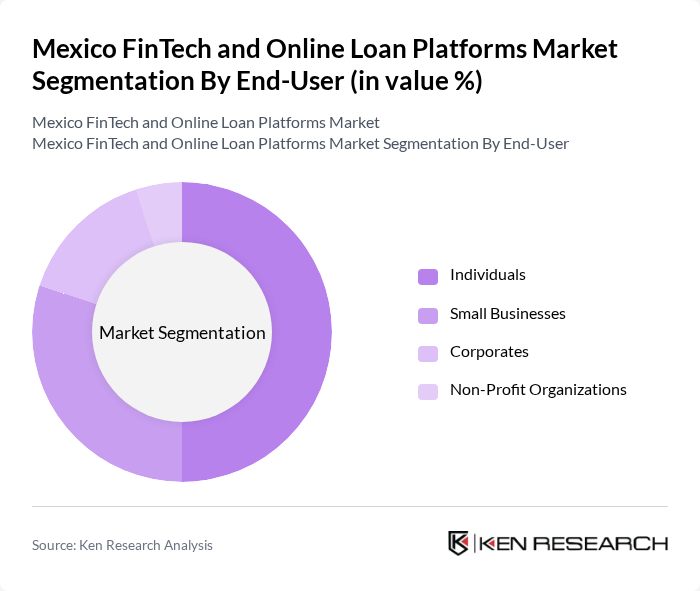

By End-User:The market is segmented by end-users, including Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Each segment has unique financial needs and preferences, influencing the types of loans they seek and the platforms they use.

The Individuals segment is the largest in the market, driven by the increasing number of consumers seeking personal loans for various purposes. The convenience of online applications and the ability to access funds quickly have made this segment particularly attractive. Additionally, the rise of digital banking and financial literacy among consumers has led to a greater acceptance of online loan platforms, further solidifying the dominance of this segment.

The Mexico FinTech and Online Loan Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kueski, Creditea, Konfío, Creditea, Fintech Mexico, CrediJusto, Afluenta, Banorte, Coppel, Banco Azteca, Kubo Financiero, Lendico, Zaveapp, Yotepresto, Dineromail contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico FinTech and online loan platforms market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves and more users embrace online financial services, platforms will likely see increased engagement. Additionally, the integration of AI and machine learning in credit scoring will enhance risk assessment, allowing for more personalized loan offerings. This evolution will create a more competitive landscape, fostering innovation and potentially leading to better financial products for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Microloans Credit Lines Peer-to-Peer Lending Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Loan Amount | Small Loans (up to $5,000) Medium Loans ($5,001 - $50,000) Large Loans (above $50,000) |

| By Loan Duration | Short-term Loans (up to 1 year) Medium-term Loans (1-3 years) Long-term Loans (above 3 years) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Millennials Gen X Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Loan Users | 150 | Individuals who have used online loan platforms |

| FinTech Executives | 100 | CEOs, CTOs, and Product Managers from FinTech firms |

| Regulatory Authorities | 50 | Officials from financial regulatory bodies in Mexico |

| Financial Advisors | 75 | Advisors specializing in personal finance and loans |

| Market Analysts | 60 | Analysts focusing on the FinTech and lending sectors |

The Mexico FinTech and Online Loan Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rising demand for accessible credit solutions among consumers and small businesses.