Region:Europe

Author(s):Rebecca

Product Code:KRAB5977

Pages:90

Published On:October 2025

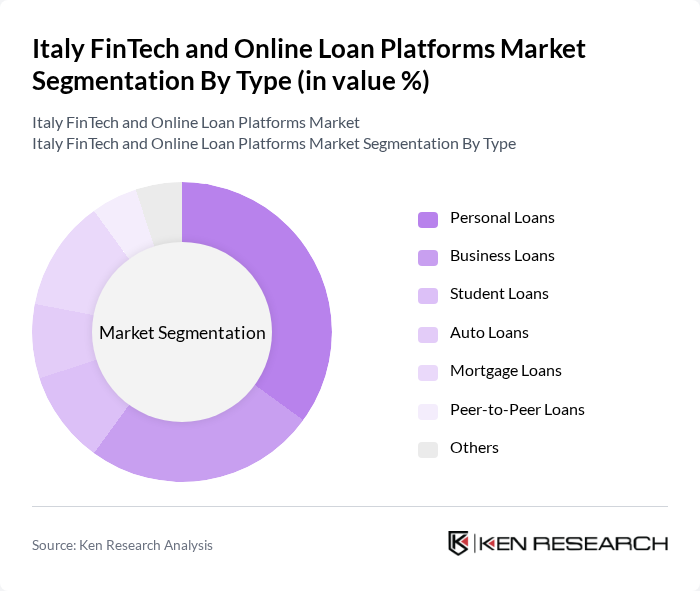

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Mortgage Loans, Peer-to-Peer Loans, and Others. Personal Loans are currently the most dominant segment, driven by consumer demand for flexible financing options for personal expenses. Business Loans follow closely, as SMEs increasingly seek funding to support growth and innovation.

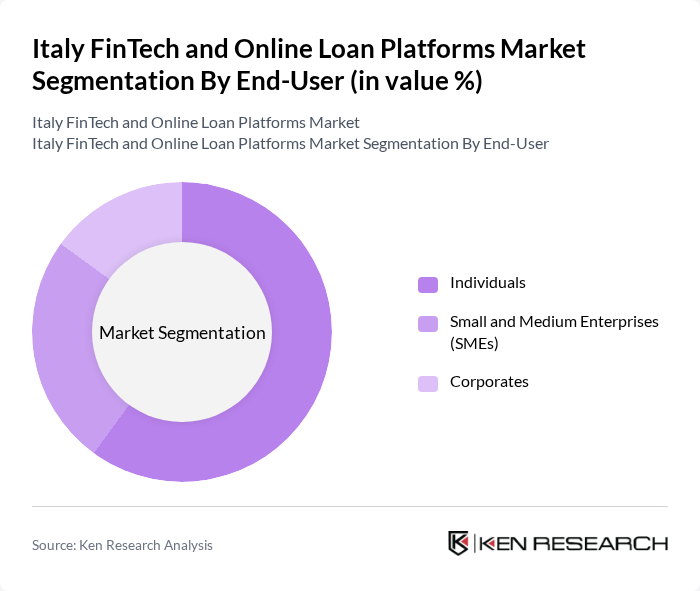

By End-User:The market is segmented by end-users into Individuals, Small and Medium Enterprises (SMEs), and Corporates. Individuals represent the largest segment, as they seek personal loans for various needs, including home improvements and debt consolidation. SMEs are also significant contributors, as they require funding for operational expenses and growth initiatives.

The Italy FinTech and Online Loan Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Credimi S.p.A., Younited Credit S.A., Soisy S.p.A., PrestitiOnline S.p.A., Banca Sella S.p.A., Hype S.p.A., Lendix S.A., BorsadelCredito.it S.r.l., Findomestic Banca S.p.A., Agos Ducato S.p.A., Credito Fondiario S.p.A., Sella Personal Credit S.p.A., Kiva Italy, Banca Ifis S.p.A., Tink S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy FinTech and online loan platforms market appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, platforms are likely to enhance their offerings through innovative technologies such as artificial intelligence and blockchain. Additionally, the increasing collaboration between FinTechs and traditional banks is expected to create a more integrated financial ecosystem, fostering growth and improving customer experiences in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Mortgage Loans Peer-to-Peer Loans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates |

| By Loan Amount | Micro Loans Small Loans Medium Loans Large Loans |

| By Loan Duration | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Application Method | Online Applications Mobile Applications In-Branch Applications |

| By Credit Score Requirement | High Credit Score Medium Credit Score Low Credit Score |

| By Geographic Reach | National Regional Local |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 150 | Consumers aged 25-45, recent loan applicants |

| Small Business Loan Seekers | 100 | Small business owners, entrepreneurs |

| Peer-to-Peer Lending Participants | 80 | Investors and borrowers in P2P platforms |

| FinTech Service Users | 120 | Tech-savvy consumers, frequent online service users |

| Financial Advisors | 60 | Financial consultants, investment advisors |

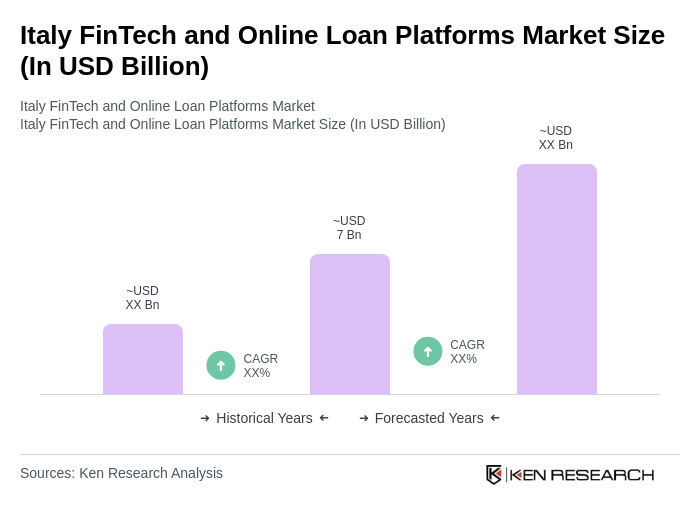

The Italy FinTech and Online Loan Platforms Market is valued at approximately USD 7 billion, reflecting significant growth driven by the increasing adoption of digital financial services and consumer demand for accessible loan options.