Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0279

Pages:80

Published On:August 2025

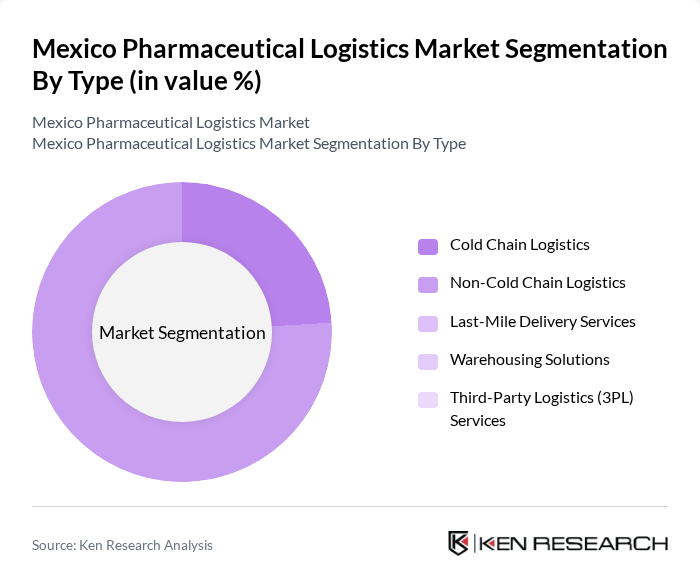

By Type:The market is segmented into Cold Chain Logistics, Non-Cold Chain Logistics, Last-Mile Delivery Services, Warehousing Solutions, and Third-Party Logistics (3PL) Services. Cold Chain Logistics is essential for transporting temperature-sensitive products like vaccines and biologics, supported by significant investment in cold storage and monitoring technologies. Non-Cold Chain Logistics addresses the distribution of standard pharmaceuticals. Last-Mile Delivery Services are gaining prominence due to the rise of e-commerce and direct-to-patient delivery models. Warehousing Solutions provide secure and compliant storage, while 3PL Services offer integrated logistics management, including inventory control, transportation, and regulatory compliance .

Note: Market share data is primarily available for Cold Chain and Non-Cold Chain Logistics. Other segments are significant but not separately quantified in available sources .

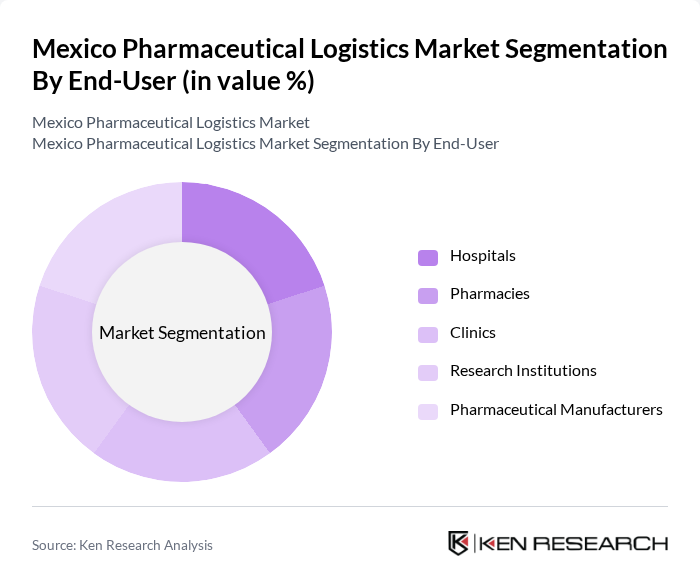

By End-User:The end-user segmentation includes Hospitals, Pharmacies, Clinics, Research Institutions, and Pharmaceutical Manufacturers. Hospitals are the largest consumers of pharmaceutical logistics services due to their extensive medication needs and requirement for timely, compliant deliveries. Pharmacies, especially with the growth of e-commerce and home delivery, represent a major logistics demand segment. Clinics and Research Institutions require specialized logistics for clinical trials and research products, while Pharmaceutical Manufacturers rely on robust logistics networks to distribute products efficiently to healthcare providers .

Note: Specific market share data by end-user is not available in the latest published sources. Hospitals and pharmacies are consistently identified as the largest end-user segments .

The Mexico Pharmaceutical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Mexico, FedEx Express México, UPS Healthcare México, Kuehne + Nagel México, DB Schenker México, Envirotainer, Farmacos Nacionales S.A. de C.V., Medistik, Grupo TMM, World Courier México, Solistica, Cardinal Health, AmerisourceBergen, McKesson Corporation, and Maersk Logistics México contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pharmaceutical logistics market in Mexico appears promising, driven by technological innovations and a growing focus on patient-centric solutions. As e-commerce continues to expand, logistics providers will need to adapt to meet the demands of online pharmaceutical sales. Additionally, the increasing emphasis on sustainability will likely shape logistics strategies, encouraging companies to adopt eco-friendly practices while ensuring compliance with regulatory standards. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Chain Logistics Non-Cold Chain Logistics Last-Mile Delivery Services Warehousing Solutions Third-Party Logistics (3PL) Services |

| By End-User | Hospitals Pharmacies Clinics Research Institutions Pharmaceutical Manufacturers |

| By Product Type | Prescription Medications Over-the-Counter Drugs Biologics & Biosimilars Vaccines Medical Devices |

| By Distribution Channel | Direct Distribution Third-Party Logistics Providers E-commerce Platforms Wholesale Distributors |

| By Service Type | Transportation Services Warehousing Services Inventory Management Value-Added Services (e.g., packaging, labeling) |

| By Temperature Control | Ambient Temperature Refrigerated Temperature Frozen Temperature Ultra-Low Temperature |

| By Policy Support | Subsidies for Logistics Providers Tax Exemptions for Pharmaceutical Imports Regulatory Support for Cold Chain Infrastructure Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Cold Chain Management | 60 | Operations Managers, Quality Assurance Heads |

| Regulatory Compliance in Logistics | 50 | Compliance Officers, Regulatory Affairs Managers |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Customer Service Representatives |

| Pharmaceutical Returns Management | 45 | Inventory Managers, Procurement Officers |

The Mexico Pharmaceutical Logistics Market is valued at approximately USD 1.8 billion, driven by increasing demand for pharmaceuticals, healthcare infrastructure expansion, and the adoption of advanced logistics technologies.