Region:Central and South America

Author(s):Dev

Product Code:KRAB0414

Pages:98

Published On:August 2025

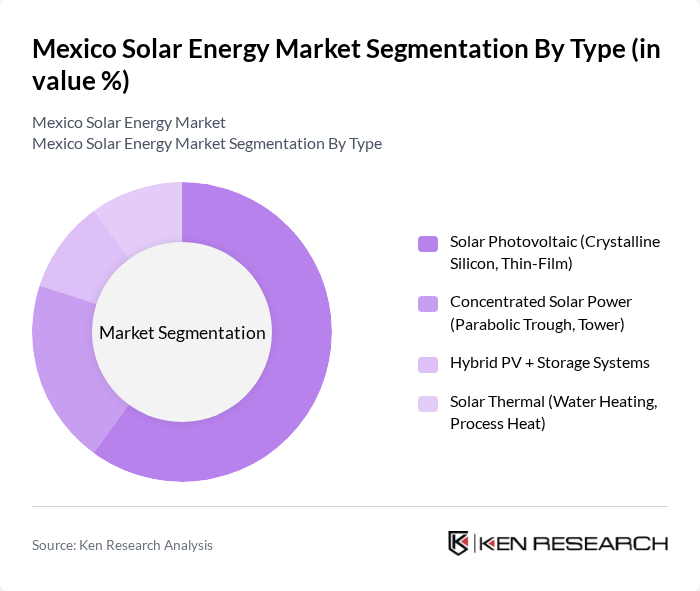

By Type:The market is segmented into various types, including Solar Photovoltaic (Crystalline Silicon, Thin-Film), Concentrated Solar Power (Parabolic Trough, Tower), Hybrid PV + Storage Systems, and Solar Thermal (Water Heating, Process Heat). Among these, Solar Photovoltaic systems dominate the market due to their versatility, declining levelized cost of electricity, and widespread adoption across utility-scale and distributed generation; Mexico’s cumulative PV capacity sits in the low-teens GW range, while CSP presence remains limited. The increasing efficiency and cost-competitiveness of crystalline silicon technology further enhances its appeal for new installations in residential, commercial, and utility applications.

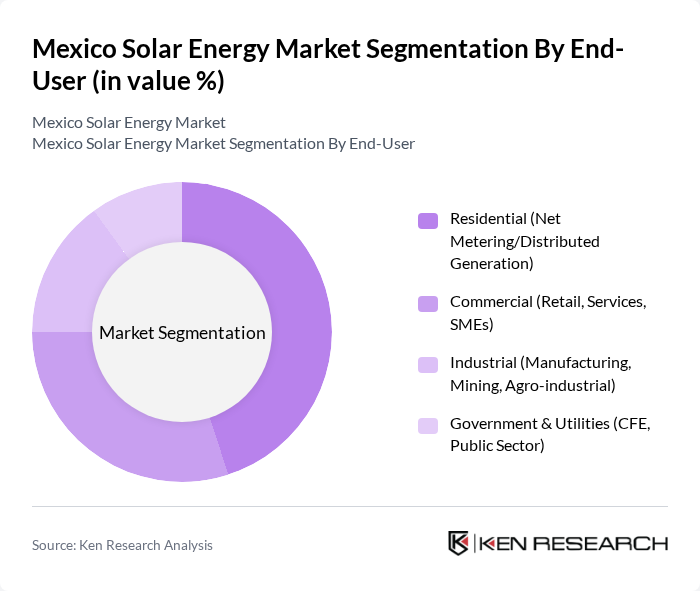

By End-User:The end-user segmentation includes Residential (Net Metering/Distributed Generation), Commercial (Retail, Services, SMEs), Industrial (Manufacturing, Mining, Agro-industrial), and Government & Utilities (CFE, Public Sector). The residential segment is currently leading the market, driven by net metering policies that allow homeowners to offset their electricity costs. The increasing affordability of solar panels and the growing trend of energy independence among consumers further bolster this segment's growth.

The Mexico Solar Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enel Green Power México, ACCIONA Energía México, Canadian Solar Inc., First Solar, Inc., SunPower Corporation, JinkoSolar Holding Co., Ltd., Trina Solar Co., Ltd., TotalEnergies SE, ENGIE México, Iberdrola México, EDF Renewables México, Risen Energy Co., Ltd., Hanwha Qcells, Zuma Energía, Solaria Energía y Medio Ambiente, S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar energy market in Mexico appears promising, driven by increasing energy demands and supportive government policies. In future, the integration of solar energy into the national grid is expected to enhance energy security and reduce reliance on fossil fuels. Additionally, advancements in energy storage technologies will facilitate greater solar adoption, allowing for more efficient energy management. As regulatory frameworks stabilize, investor confidence is likely to grow, paving the way for a more robust solar energy landscape in Mexico.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Photovoltaic (Crystalline Silicon, Thin-Film) Concentrated Solar Power (Parabolic Trough, Tower) Hybrid PV + Storage Systems Solar Thermal (Water Heating, Process Heat) |

| By End-User | Residential (Net Metering/Distributed Generation) Commercial (Retail, Services, SMEs) Industrial (Manufacturing, Mining, Agro?industrial) Government & Utilities (CFE, Public Sector) |

| By Region | Northwest & North (Sonora, Chihuahua, Baja California) Northeast & Gulf (Nuevo León, Tamaulipas, Veracruz) Central (CDMX, Estado de México, Querétaro, Puebla) West & South (Jalisco, Oaxaca, Yucatán, Quintana Roo) |

| By Technology | Photovoltaic Systems (Utility?scale, Distributed Generation) Concentrated Solar Power Systems Solar Thermal Systems (DHW, Industrial Heat) Floating PV and BIPV |

| By Application | Grid-Connected Systems (Utility?scale, C&I DG) Off-Grid and Microgrids (Rural, Remote, Islanded) Rooftop Installations (Residential, C&I) Utility-Scale Projects (Solar Parks) |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs (CFE, Development Banks) |

| By Policy Support | Net Metering/Distributed Generation Schemes Tax Incentives (Accelerated Depreciation, VAT/Import) Clean Energy Certificates (CELs/RECs) Corporate PPAs and Self-Supply Legacy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 120 | Homeowners, Solar Installers |

| Commercial Solar Projects | 100 | Facility Managers, Business Owners |

| Utility-Scale Solar Farms | 80 | Project Developers, Energy Analysts |

| Government Policy Impact | 60 | Regulatory Officials, Policy Makers |

| Investment Trends in Solar Energy | 70 | Investors, Financial Analysts |

The Mexico Solar Energy Market is valued at approximately USD 7.9 billion, reflecting significant growth driven by increasing demand for renewable energy, government incentives, and heightened awareness of environmental sustainability among consumers and businesses.