Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1178

Pages:88

Published On:November 2025

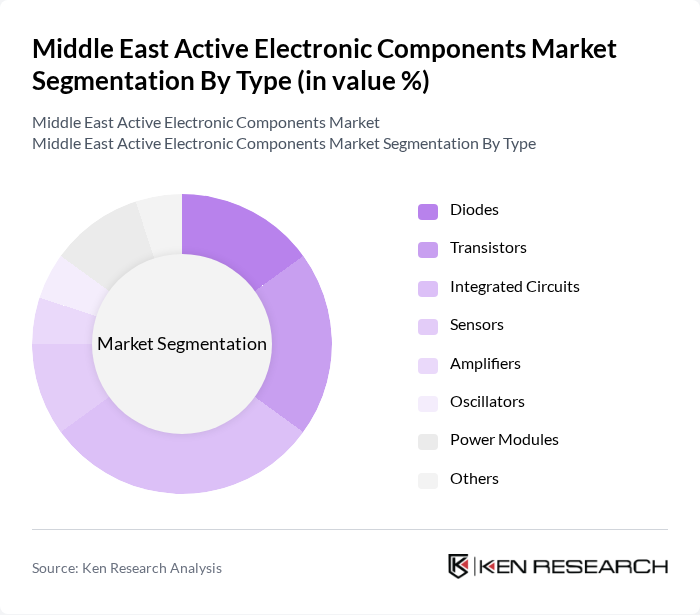

By Type:The active electronic components market is segmented into various types, including diodes, transistors, integrated circuits, sensors, amplifiers, oscillators, power modules, and others. Among these, integrated circuits are the most dominant sub-segment due to their extensive use in consumer electronics, telecommunications, and industrial automation. The increasing complexity of electronic devices, demand for miniaturization, and the adoption of advanced manufacturing technologies have led to a surge in the use of integrated circuits, making them essential for modern applications .

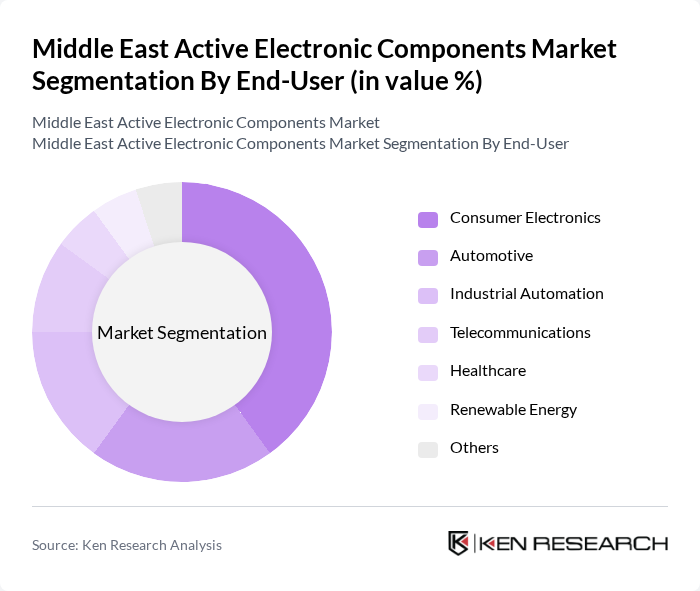

By End-User:The market is also segmented by end-user applications, which include consumer electronics, automotive, industrial automation, telecommunications, healthcare, renewable energy, and others. The consumer electronics segment leads the market, driven by the increasing demand for smartphones, tablets, and smart home devices. Rapid technological advancements, the expansion of IoT devices, and the rollout of 5G infrastructure have further fueled the growth of this segment, making it a key driver in the active electronic components market .

The Middle East Active Electronic Components Market is characterized by a dynamic mix of regional and international players. Leading participants such as STMicroelectronics, Texas Instruments, NXP Semiconductors, Infineon Technologies, Analog Devices, onsemi, Microchip Technology, Renesas Electronics, Broadcom Inc., Maxim Integrated, Cypress Semiconductor, Qualcomm, MediaTek, Skyworks Solutions, Marvell Technology Group, Alfanar, Gulf Electronic Components, Advanced Electronics Company (AEC), Masar Printing and Electronic Systems, ECI (Electronic Components Industries Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East active electronic components market appears promising, driven by technological advancements and increasing consumer demand. The integration of artificial intelligence in electronic devices is expected to enhance functionality and user experience, while the shift towards sustainable manufacturing practices will attract environmentally conscious consumers. As smart city initiatives gain momentum, the demand for innovative electronic solutions will further propel market growth, creating a dynamic landscape for industry players in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Diodes Transistors Integrated Circuits Sensors Amplifiers Oscillators Power Modules Others |

| By End-User | Consumer Electronics Automotive Industrial Automation Telecommunications Healthcare Renewable Energy Others |

| By Application | Communication Equipment Computing Devices Home Appliances Medical Devices Automotive Systems Power Generation & Distribution Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Turkey Others |

| By Technology | Analog Technology Digital Technology Mixed-Signal Technology Others |

| By Market Maturity | Emerging Markets Established Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Supply Chain Analysts |

| Automotive Electronics Suppliers | 60 | Procurement Managers, Engineering Managers |

| Telecommunications Equipment Providers | 50 | Technical Directors, Operations Managers |

| Industrial Electronics Manufacturers | 40 | Quality Assurance Managers, R&D Engineers |

| Distributors of Electronic Components | 70 | Sales Managers, Market Analysts |

The Middle East Active Electronic Components Market is valued at approximately USD 13 billion, driven by increasing demand for consumer electronics, automotive applications, and industrial automation, alongside technological advancements and infrastructure development.