Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3736

Pages:98

Published On:October 2025

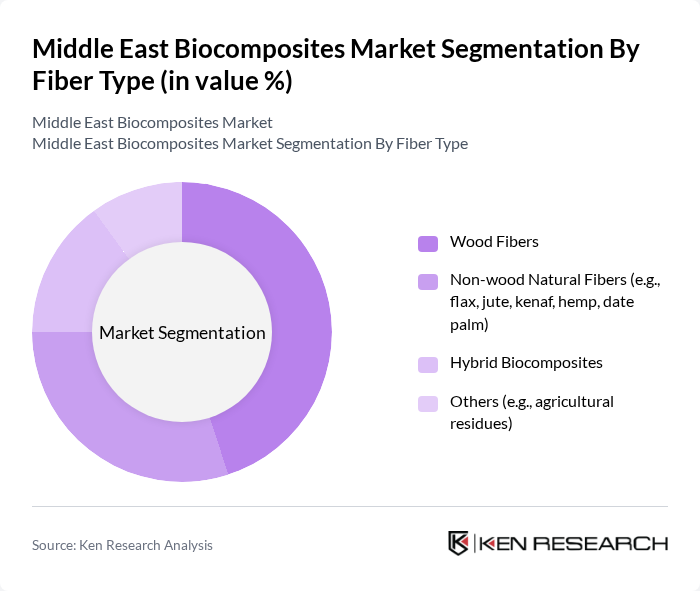

By Fiber Type:The fiber type segmentation includes various subsegments such as wood fibers, non-wood natural fibers (including flax, jute, kenaf, hemp, and date palm), hybrid biocomposites, and others (like agricultural residues). Among these, wood fibers are currently leading the market due to their widespread availability and favorable properties for construction and automotive applications. Non-wood natural fibers are also gaining traction as consumers and industries seek more sustainable and locally sourced options. Hybrid biocomposites are emerging as a versatile choice for applications requiring tailored material properties, while agricultural residues are increasingly used in niche and cost-sensitive applications .

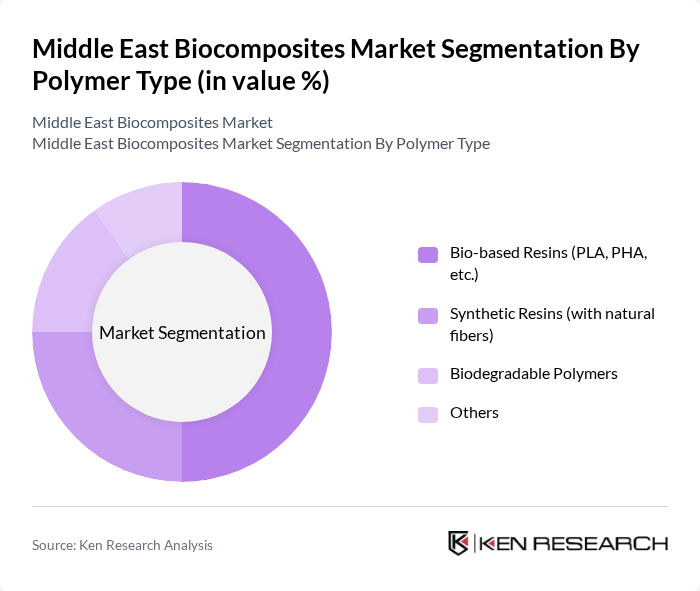

By Polymer Type:The polymer type segmentation encompasses bio-based resins (such as PLA and PHA), synthetic resins (with natural fibers), biodegradable polymers, and others. Bio-based resins are leading this segment due to their eco-friendly nature and increasing adoption in construction, automotive, and packaging industries. Synthetic resins remain significant, particularly in applications requiring enhanced durability and performance. Biodegradable polymers are gaining popularity as environmental regulations and consumer preferences shift toward sustainable solutions, while other polymer types are used in specialized or emerging applications .

The Middle East Biocomposites Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Advanced Composites Company (ACC, Saudi Arabia), BASF SE, Trex Company, Inc., NatureWorks LLC, Green Dot Bioplastics, Bioworks (UAE), FlexForm Technologies, Stora Enso, Novamont S.p.A., Mitsubishi Chemical Corporation, DuPont de Nemours, Inc., UPM-Kymmene Corporation, Green Science Alliance, Bio-on S.p.A., Ahlstrom-Munksjö, Tetra Pak International S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East biocomposites market appears promising, driven by increasing investments in research and development, which are projected to exceed $1 billion in the future. The region's commitment to sustainability and innovation is expected to foster the development of new biocomposite products, enhancing their applicability across various industries. Furthermore, the integration of biocomposites into circular economy initiatives will likely create new market opportunities, positioning the region as a leader in sustainable material solutions.

| Segment | Sub-Segments |

|---|---|

| By Fiber Type | Wood Fibers Non-wood Natural Fibers (e.g., flax, jute, kenaf, hemp, date palm) Hybrid Biocomposites Others (e.g., agricultural residues) |

| By Polymer Type | Bio-based Resins (PLA, PHA, etc.) Synthetic Resins (with natural fibers) Biodegradable Polymers Others |

| By Product | Wood Plastic Composites Natural Fiber Composites Hybrid Composites Others |

| By End-Use Industry | Construction & Infrastructure Automotive & Transportation Consumer Goods Packaging Agriculture Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Egypt Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Biocomposite Applications | 50 | Product Engineers, R&D Managers |

| Construction Material Innovations | 60 | Architects, Project Managers |

| Packaging Solutions Using Biocomposites | 70 | Packaging Designers, Supply Chain Managers |

| Consumer Goods Sustainability Practices | 80 | Brand Managers, Sustainability Officers |

| Research and Development in Biocomposite Materials | 90 | Material Scientists, Innovation Directors |

The Middle East Biocomposites Market is valued at approximately USD 340 million, reflecting a significant growth trend driven by increasing environmental awareness and demand for sustainable materials across various industries.