Region:Middle East

Author(s):Rebecca

Product Code:KRAD1405

Pages:99

Published On:November 2025

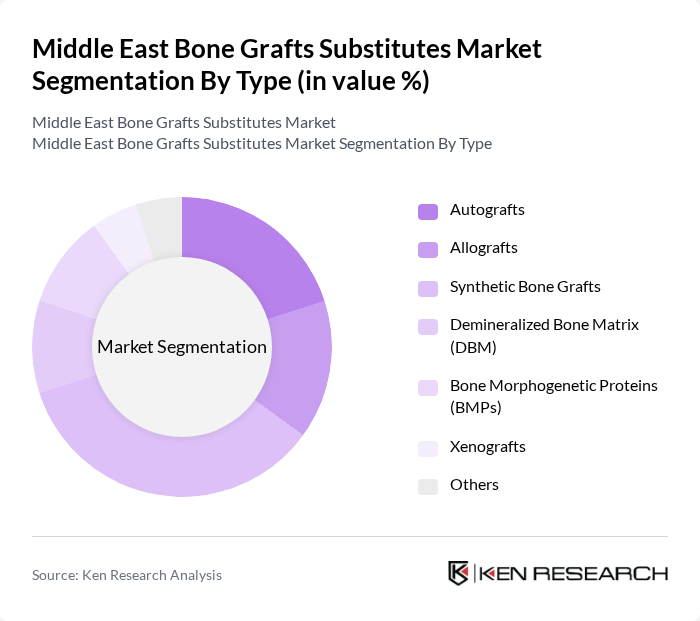

By Type:The market is segmented into various types of bone graft substitutes, including Autografts, Allografts, Synthetic Bone Grafts, Demineralized Bone Matrix (DBM), Bone Morphogenetic Proteins (BMPs), Xenografts, and Others. Synthetic Bone Grafts are gaining significant traction due to their biocompatibility, ease of use, and ability to be tailored for specific applications. The increasing preference for synthetic options is driven by their availability, reduced risk of disease transmission, and improved patient outcomes such as faster recovery and lower complication rates compared to allografts and xenografts.

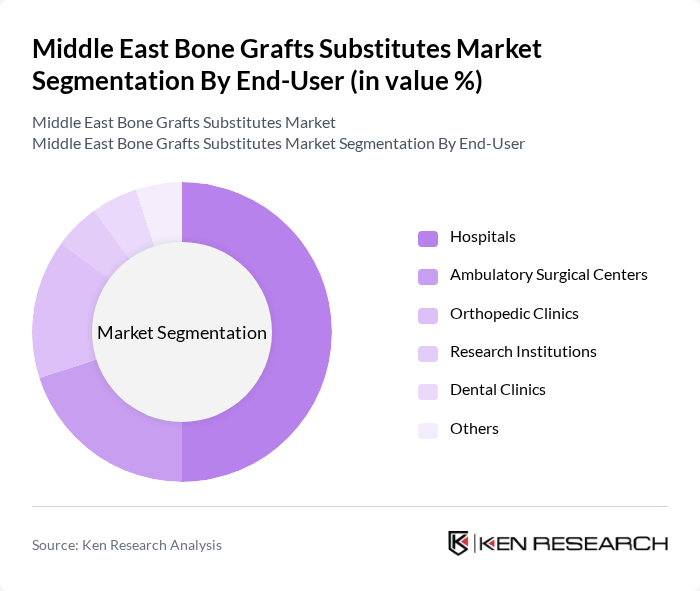

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, Research Institutions, Dental Clinics, and Others. Hospitals are the leading end-user segment, primarily due to the high volume of surgical procedures performed in these facilities. The increasing number of orthopedic surgeries, availability of advanced medical technologies, and adoption of innovative bone graft substitutes in hospitals contribute to their dominance in the market. Ambulatory Surgical Centers and Orthopedic Clinics are also experiencing growth due to the rising demand for outpatient procedures and specialized orthopedic care.

The Middle East Bone Grafts Substitutes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Smith & Nephew plc, Baxter International Inc., Orthofix Medical Inc., Geistlich Pharma AG, AlloSource, RTI Surgical, Bioventus Inc., TBF Tissue Engineering, MTF Biologics, OST Laboratoires, Biobank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East bone graft substitutes market appears promising, driven by technological advancements and demographic shifts. As the geriatric population continues to grow, the demand for orthopedic surgeries will likely increase, necessitating innovative solutions. Additionally, the integration of bioactive materials and 3D printing technology is expected to enhance the effectiveness of graft substitutes. Collaborations between healthcare providers and technology firms will further accelerate the development of tailored solutions, ensuring improved patient outcomes and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Autografts Allografts Synthetic Bone Grafts Demineralized Bone Matrix (DBM) Bone Morphogenetic Proteins (BMPs) Xenografts Others |

| By End-User | Hospitals Ambulatory Surgical Centers Orthopedic Clinics Research Institutions Dental Clinics Others |

| By Application | Spinal Fusion Trauma Repair Joint Reconstruction Dental Applications Craniomaxillofacial Surgery Others |

| By Material Source | Human-derived (Autograft/Allograft) Animal-derived (Xenograft) Synthetic Sources Composite Materials Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Product Formulation | Injectable Forms Pre-formed Shapes Granules Putty Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Surgeons specializing in joint reconstruction and trauma |

| Hospital Procurement Managers | 80 | Managers responsible for purchasing medical supplies and devices |

| Biomaterials Researchers | 50 | Researchers focused on the development of bone graft materials |

| Regulatory Affairs Specialists | 40 | Professionals involved in compliance and regulatory processes |

| Medical Device Distributors | 60 | Distributors specializing in orthopedic and surgical products |

The Middle East Bone Grafts Substitutes Market is valued at approximately USD 1.1 billion, driven by factors such as the increasing prevalence of orthopedic surgeries, a growing geriatric population, and advancements in surgical techniques and biomaterials.