Saudi Arabia Bone Grafts Substitutes Market Overview

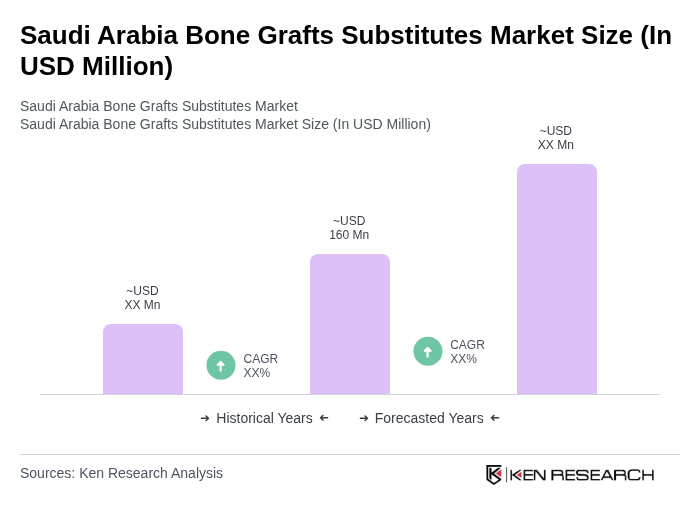

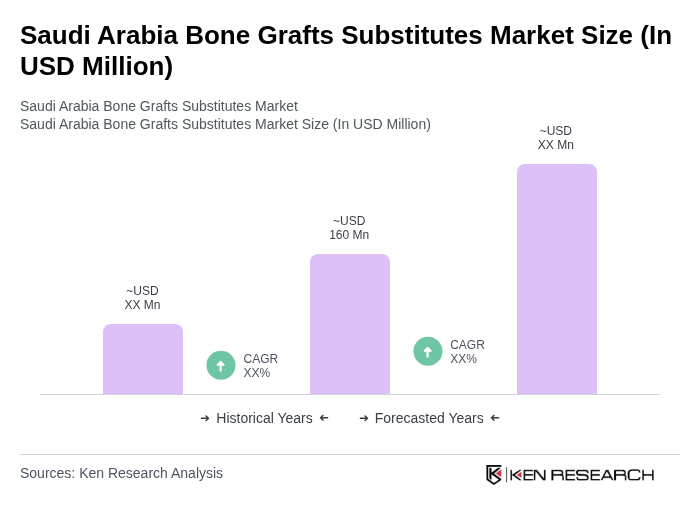

- The Saudi Arabia Bone Grafts Substitutes Market is valued at USD 160 million, based on a five-year historical analysis integrating overall orthopedic and spinal bone grafts with the rapidly expanding dental bone graft substitute segment in the Kingdom. This growth is primarily driven by the increasing prevalence of orthopedic, spine, and dental surgeries, the rising incidence of trauma and road traffic injuries, and a growing geriatric population requiring joint replacement and fracture fixation procedures. The market is also supported by advancements in synthetic and biomimetic materials, wider adoption of minimally invasive spine and dental implant procedures, and greater availability of preformed bone graft products that improve handling, effectiveness, and safety.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their advanced healthcare infrastructure, tertiary care referral hospitals, and high concentration of orthopedic, spine, and dental specialists. These urban centers host state-of-the-art public and private hospitals, high-volume dental implant clinics, and specialty orthopedic and trauma centers that perform a significant share of joint replacement, spine fusion, and implant-based dental procedures, thereby driving the demand for bone graft substitutes. Additionally, the presence of leading healthcare providers and better reimbursement and private insurance coverage in these regions further supports utilization of premium graft materials.

- In 2023, the Saudi Food and Drug Authority (SFDA) strengthened the regulatory framework for medical devices, including bone graft and bone substitute products, under the Medical Devices Law and the Implementing Regulations for Medical Devices and Products issued by the Saudi Food and Drug Authority in 2021. These rules require manufacturers and importers of bone graft substitutes to obtain SFDA marketing authorization, comply with conformity assessment and quality management requirements aligned with international standards, and submit clinical evaluation or performance data demonstrating safety and efficacy before products can be placed on the Saudi market. The regulations also mandate post?market surveillance, vigilance reporting of adverse events, proper labeling in Arabic and English, and registration of devices and economic operators in the SFDA Ghad system, collectively enhancing patient safety and product quality in the bone graft substitutes segment.

Saudi Arabia Bone Grafts Substitutes Market Segmentation

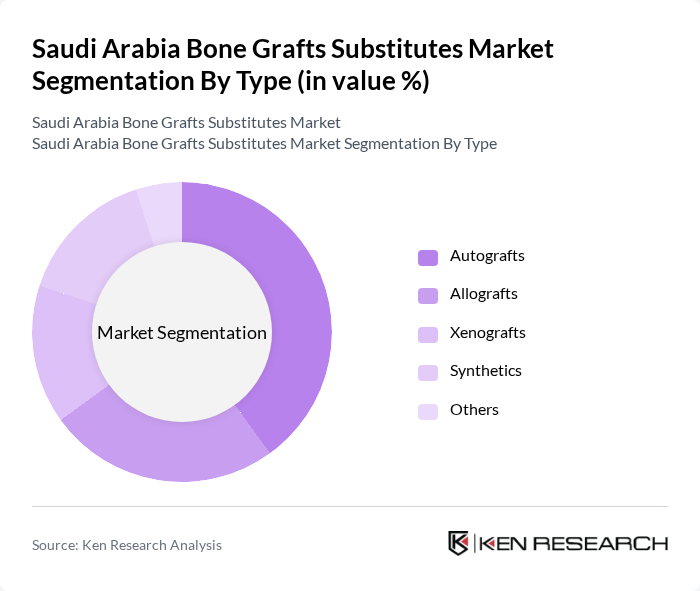

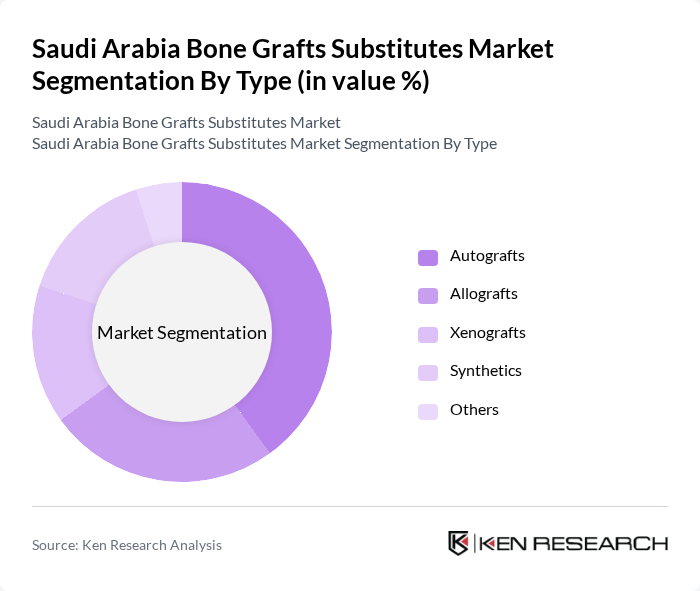

By Type:The market can be segmented into various types of bone graft substitutes, including Autografts, Allografts, Xenografts, Synthetics, and Others. Autografts remain widely used because of their osteogenic potential and biocompatibility, but their use is increasingly complemented or replaced by allografts and synthetic substitutes to reduce donor site morbidity and operative time. Allografts are common in orthopedic and spine procedures, while xenografts and specialized bovine- or porcine-derived materials are extensively used in dental bone grafting across Saudi Arabia. Synthetic grafts, including ceramic, composite, and polymer-based products, are gaining share due to consistent availability, absence of disease transmission risk, and favorable handling characteristics.

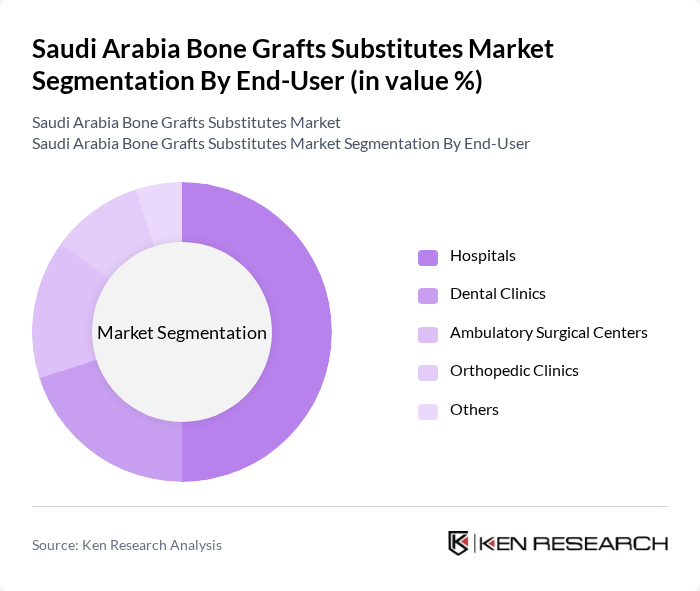

By End-User:The end-user segmentation includes Hospitals, Dental Clinics, Ambulatory Surgical Centers, Orthopedic Clinics, and Others. Hospitals are the leading end-users due to their comprehensive orthopedic, trauma, spine, and maxillofacial surgery capabilities, as well as their role as referral centers for complex cases. Dental clinics, particularly implant-focused and oral surgery centers, represent a growing share of demand in line with the strong expansion of the Saudi dental bone graft substitute market. Ambulatory surgical centers and specialized orthopedic clinics also contribute meaningfully as they increasingly perform day?care arthroscopy, sports injury, and minor spine procedures utilizing advanced graft materials.

Saudi Arabia Bone Grafts Substitutes Market Competitive Landscape

The Saudi Arabia Bone Grafts Substitutes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Stryker Corporation, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), Integra LifeSciences, Dentsply Sirona, BioHorizons, Inc., Henry Schein, Inc., RTI Surgical, AlloSource, Thimar Al Jazirah Medical Company, Bioventus, Orthofix Medical, Xtant Medical, Geistlich Pharma North America contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Bone Grafts Substitutes Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Orthopedic Surgeries:The demand for bone graft substitutes in Saudi Arabia is significantly driven by the rising number of orthopedic surgeries, which reached approximately 160,000 procedures in future. This increase is attributed to factors such as sports injuries, road accidents, and degenerative diseases. The Saudi Ministry of Health has reported a 10% annual increase in orthopedic surgeries, indicating a growing need for effective bone grafting solutions to support recovery and rehabilitation.

- Rising Geriatric Population:The geriatric population in Saudi Arabia is projected to reach 5 million in future, representing a significant demographic shift. This increase is associated with a higher incidence of bone-related disorders, such as osteoporosis and fractures, necessitating advanced bone graft substitutes. The World Health Organization estimates that 25% of the elderly population will require orthopedic interventions, further driving the demand for innovative grafting solutions tailored to this age group.

- Advancements in Bone Grafting Technologies:Technological innovations in bone grafting, including the development of synthetic and bioactive materials, are enhancing the effectiveness of treatments. In future, investments in R&D for bone graft substitutes in Saudi Arabia exceeded SAR 250 million, leading to the introduction of products with improved biocompatibility and faster healing times. These advancements are crucial in meeting the growing expectations of both healthcare providers and patients for safer and more effective surgical outcomes.

Market Challenges

- High Cost of Advanced Bone Graft Substitutes:The financial burden associated with advanced bone graft substitutes poses a significant challenge in Saudi Arabia. The average cost of these substitutes can range from SAR 6,000 to SAR 18,000 per procedure, which may limit accessibility for many patients. This high cost is often compounded by limited insurance coverage, leading to a disparity in treatment options available to different socioeconomic groups within the population.

- Regulatory Hurdles and Approval Processes:The regulatory landscape for medical devices in Saudi Arabia is complex, with stringent approval processes that can delay the introduction of new bone graft substitutes. The Saudi Food and Drug Authority (SFDA) requires extensive clinical data and compliance with international standards, which can take several years to fulfill. This regulatory environment can hinder innovation and slow down market entry for potentially beneficial products, impacting overall market growth.

Saudi Arabia Bone Grafts Substitutes Market Future Outlook

The future of the bone graft substitutes market in Saudi Arabia appears promising, driven by ongoing advancements in medical technology and an increasing focus on patient-centered care. As healthcare infrastructure expands, particularly in rural areas, access to orthopedic services is expected to improve. Additionally, the integration of minimally invasive surgical techniques will likely enhance the adoption of innovative bone graft substitutes, catering to the evolving needs of patients and healthcare providers alike.

Market Opportunities

- Expansion of Healthcare Infrastructure:The Saudi government is investing heavily in healthcare infrastructure, with plans to build over 35 new hospitals in future. This expansion will increase access to orthopedic services, creating a larger market for bone graft substitutes. Enhanced facilities will also facilitate the adoption of advanced technologies, improving patient outcomes and driving demand for innovative grafting solutions.

- Increasing Investment in R&D for Innovative Products:With over SAR 350 million allocated for healthcare R&D in future, there is a significant opportunity for the development of novel bone graft substitutes. This investment will likely lead to breakthroughs in materials and techniques, fostering a competitive market environment. Companies that capitalize on this trend can position themselves as leaders in the evolving landscape of orthopedic solutions.