Middle East Corrugated Boxes Market Overview

- The Middle East Corrugated Boxes Market is valued at approximately USD 6 billion, based on a five-year analysis. Growth is primarily driven by the increasing demand for sustainable packaging solutions, rapid expansion of the e-commerce sector, and a heightened focus on recyclable and eco-friendly materials. The surge in online retail, food delivery, and consumer awareness regarding environmental sustainability continues to propel market growth, with manufacturers investing in advanced coatings and digital printing to enhance durability and branding appeal .

- Key players in this market include the GCC countries, particularly Saudi Arabia and the United Arab Emirates, which dominate due to their robust industrial base, significant investments in infrastructure, and leadership in e-commerce adoption. The Levant region, including Jordan and Lebanon, is also witnessing growth, attributed to increasing urbanization, a burgeoning retail sector, and rising exports of consumer goods .

- In 2023, the government of Saudi Arabia issued the “Technical Regulation for Biodegradable Plastic Products” (SASO TR 2869:2023) through the Saudi Standards, Metrology and Quality Organization (SASO). This regulation mandates the use of biodegradable and eco-friendly packaging materials in multiple sectors, as part of the broader Vision 2030 strategy to promote sustainability and environmental responsibility, thereby enhancing demand for corrugated boxes as a compliant alternative .

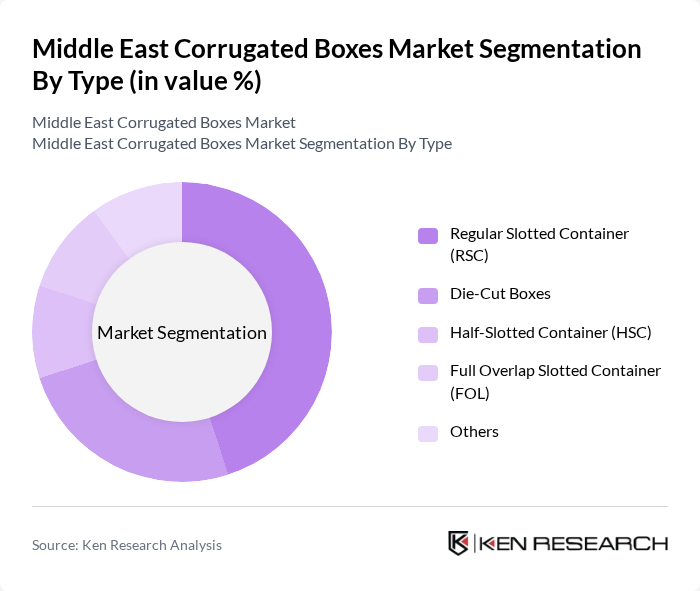

Middle East Corrugated Boxes Market Segmentation

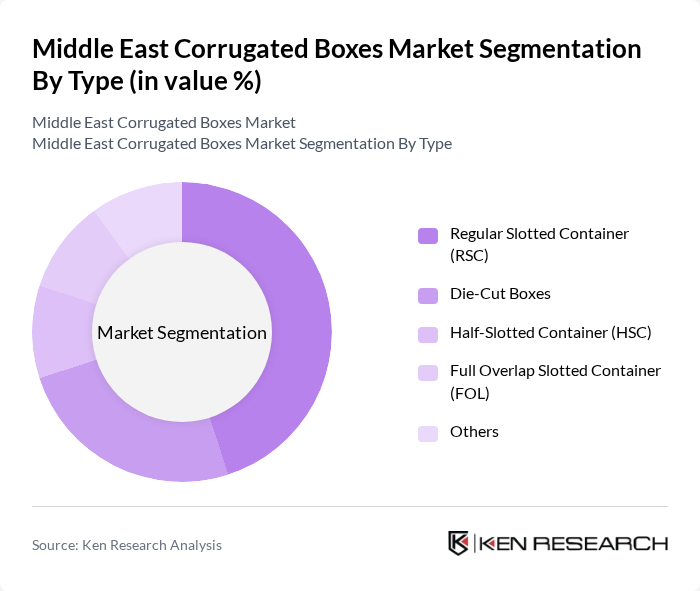

By Type:The corrugated boxes market is segmented into Regular Slotted Container (RSC), Die-Cut Boxes, Half-Slotted Container (HSC), Full Overlap Slotted Container (FOL), and Others. Regular Slotted Containers (RSC) remain the most widely used due to their versatility, cost-effectiveness, and suitability for a broad range of applications, especially in e-commerce and retail logistics. Die-Cut Boxes are gaining traction in the retail and food sectors, where customized and branded packaging solutions are increasingly preferred for product differentiation and enhanced consumer experience .

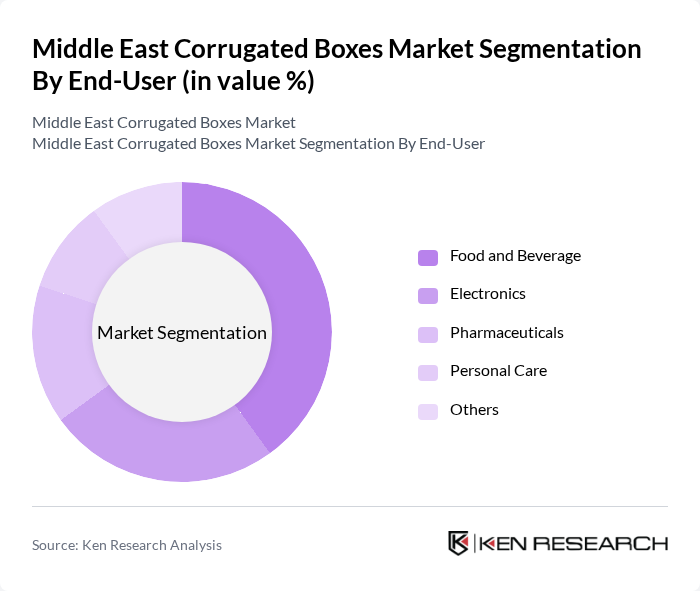

By End-User:The end-user segmentation includes Food and Beverage, Electronics, Pharmaceuticals, Personal Care, and Others. The Food and Beverage sector is the largest consumer of corrugated boxes, driven by the growing demand for packaged foods, beverages, and ready-to-eat products, as well as the need for safe and hygienic transportation. The Electronics sector is also significant, with manufacturers requiring robust packaging to protect sensitive and high-value items during distribution and export. Pharmaceuticals and Personal Care segments are experiencing steady growth, supported by rising healthcare investments and personal care consumption trends .

Middle East Corrugated Boxes Market Competitive Landscape

The Middle East Corrugated Boxes Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, Smurfit Kappa Group, Mondi Group, WestRock Company, DS Smith Plc, Stora Enso, Packaging Corporation of America, Sonoco Products Company, Georgia-Pacific LLC, Rengo Co., Ltd., Ahlstrom-Munksjö, Klabin S.A., Sappi Limited, Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, TCDD Ta??mac?l?k A.?., Knauf Industries, Sealed Air Corporation, UPM-Kymmene Corporation, Orkla Packaging contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Corrugated Boxes Market Industry Analysis

Growth Drivers

- Increasing Demand from E-commerce Sector:The Middle East's e-commerce sector is projected to reach $28.5 billion in future, driven by a 20% annual growth rate. This surge in online shopping is significantly boosting the demand for corrugated boxes, which are essential for packaging and shipping products. The rise in consumer preference for home delivery services further fuels this trend, as businesses seek reliable and efficient packaging solutions to meet customer expectations.

- Rising Awareness of Sustainable Packaging Solutions:With the global push towards sustainability, the Middle East is witnessing a shift in consumer preferences towards eco-friendly packaging. In future, the demand for sustainable packaging is expected to increase by 15%, driven by heightened awareness of environmental issues. Companies are increasingly adopting corrugated boxes made from recycled materials, aligning with consumer expectations and regulatory pressures, thus enhancing their market position and brand loyalty.

- Growth in the Food and Beverage Industry:The food and beverage sector in the Middle East is anticipated to grow to $200 billion in future, creating a substantial demand for corrugated packaging solutions. This growth is attributed to changing consumer lifestyles and increased spending on food products. As the industry expands, the need for efficient, safe, and sustainable packaging options will drive the demand for corrugated boxes, which are ideal for preserving product integrity during transportation and storage.

Market Challenges

- Fluctuating Raw Material Prices:The corrugated box industry faces significant challenges due to the volatility of raw material prices, particularly for paper and recycled materials. In future, the price of recycled paper is expected to fluctuate between $150 to $200 per ton, impacting production costs. This unpredictability can lead to increased operational expenses for manufacturers, potentially affecting profit margins and pricing strategies in a competitive market.

- Intense Competition Among Manufacturers:The corrugated box market in the Middle East is characterized by intense competition, with over 200 manufacturers vying for market share. This saturation leads to price wars and reduced profit margins, as companies strive to differentiate their products. In future, the average profit margin for corrugated box manufacturers is projected to decline to 5%, compelling firms to innovate and enhance operational efficiencies to maintain profitability.

Middle East Corrugated Boxes Market Future Outlook

The future of the Middle East corrugated boxes market appears promising, driven by the increasing adoption of sustainable practices and technological advancements. As businesses prioritize eco-friendly packaging solutions, the demand for innovative materials and designs will rise. Additionally, the integration of smart packaging technologies is expected to enhance supply chain efficiency and consumer engagement. These trends will likely shape the market landscape, fostering growth and encouraging investment in advanced manufacturing capabilities.

Market Opportunities

- Adoption of Advanced Manufacturing Technologies:The implementation of automation and digital technologies in manufacturing processes presents a significant opportunity for corrugated box producers. By investing in advanced machinery, companies can enhance production efficiency, reduce waste, and improve product quality, positioning themselves competitively in the market.

- Growing Demand for Customized Packaging Solutions:As consumer preferences shift towards personalized experiences, the demand for customized packaging solutions is on the rise. In future, the market for bespoke corrugated boxes is expected to grow by 10%, providing manufacturers with opportunities to cater to niche markets and enhance customer satisfaction through tailored packaging options.