Region:Global

Author(s):Dev

Product Code:KRAA2555

Pages:80

Published On:August 2025

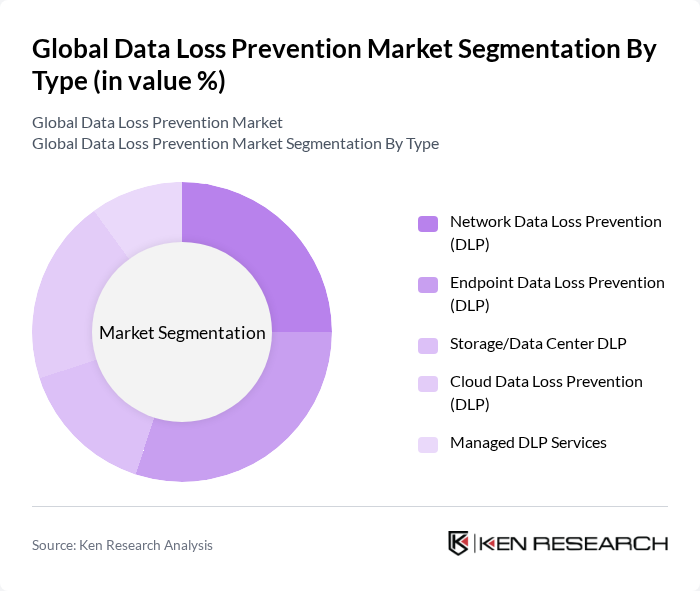

By Type:The market is segmented into various types, including Network Data Loss Prevention (DLP), Endpoint Data Loss Prevention (DLP), Storage/Data Center DLP, Cloud Data Loss Prevention (DLP), and Managed DLP Services. Each of these subsegments plays a crucial role in addressing specific data protection needs across different environments .

The Endpoint Data Loss Prevention (DLP) subsegment is currently dominating the market due to the increasing number of remote workers and the need for organizations to secure sensitive data on employee devices. As businesses adopt flexible work arrangements, the risk of data breaches from endpoints has escalated, prompting a surge in demand for endpoint DLP solutions. These solutions provide comprehensive protection against data leaks, ensuring that sensitive information remains secure regardless of where it is accessed or stored. The integration of AI and automation in endpoint DLP further enhances real-time detection and response capabilities .

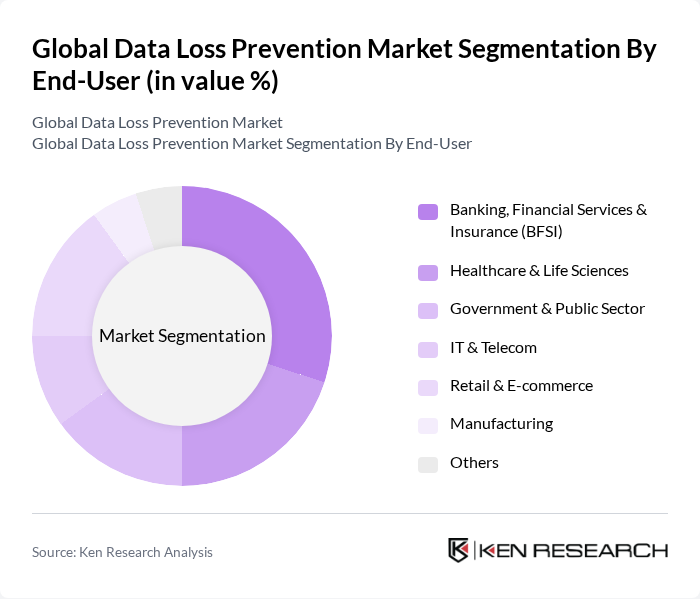

By End-User:The market is segmented by end-users, including Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Government & Public Sector, IT & Telecom, Retail & E-commerce, Manufacturing, and Others. Each sector has unique data protection requirements, driving the demand for tailored DLP solutions .

The Banking, Financial Services & Insurance (BFSI) sector is the leading end-user of DLP solutions, driven by stringent regulatory requirements and the critical need to protect sensitive financial data. With the increasing incidence of cyber threats targeting financial institutions, BFSI organizations are investing heavily in DLP technologies to safeguard customer information and maintain compliance with regulations. This sector's focus on data security is a significant factor contributing to its dominance in the market .

The Global Data Loss Prevention Market is characterized by a dynamic mix of regional and international players. Leading participants such as Symantec Corporation (Broadcom Inc.), McAfee LLC, Digital Guardian, Forcepoint LLC, Trend Micro Incorporated, Check Point Software Technologies Ltd., IBM Corporation, Microsoft Corporation, Proofpoint Inc., RSA Security LLC, Varonis Systems Inc., Palo Alto Networks Inc., Zscaler Inc., Cisco Systems Inc., Netskope Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data loss prevention market appears promising, driven by technological advancements and increasing awareness of data security. Organizations are expected to prioritize integrated DLP solutions that combine various security measures into a cohesive framework. Additionally, the rise of remote work will necessitate enhanced security protocols, leading to greater investment in DLP technologies. As businesses adapt to evolving cyber threats, the demand for innovative and comprehensive data protection strategies will continue to grow, shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Data Loss Prevention (DLP) Endpoint Data Loss Prevention (DLP) Storage/Data Center DLP Cloud Data Loss Prevention (DLP) Managed DLP Services |

| By End-User | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Government & Public Sector IT & Telecom Retail & E-commerce Manufacturing Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Retail Education Manufacturing Energy & Utilities Others |

| By Component | Solutions Services (Consulting, Integration, Training, Managed Services) |

| By Pricing Model | Subscription-Based One-Time License Pay-As-You-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services DLP Implementation | 50 | CISOs, IT Security Managers |

| Healthcare Data Protection Strategies | 45 | Data Protection Officers, Compliance Managers |

| Government Sector DLP Challenges | 40 | IT Directors, Risk Management Officers |

| Retail Industry Data Loss Prevention | 40 | Operations Managers, IT Security Analysts |

| Manufacturing Sector DLP Solutions | 45 | IT Managers, Data Governance Leads |

The Global Data Loss Prevention Market is valued at approximately USD 2.6 billion, driven by the increasing frequency of data breaches, regulatory compliance requirements, and the need for organizations to protect sensitive information across various environments.