Region:Middle East

Author(s):Rebecca

Product Code:KRAD4357

Pages:90

Published On:December 2025

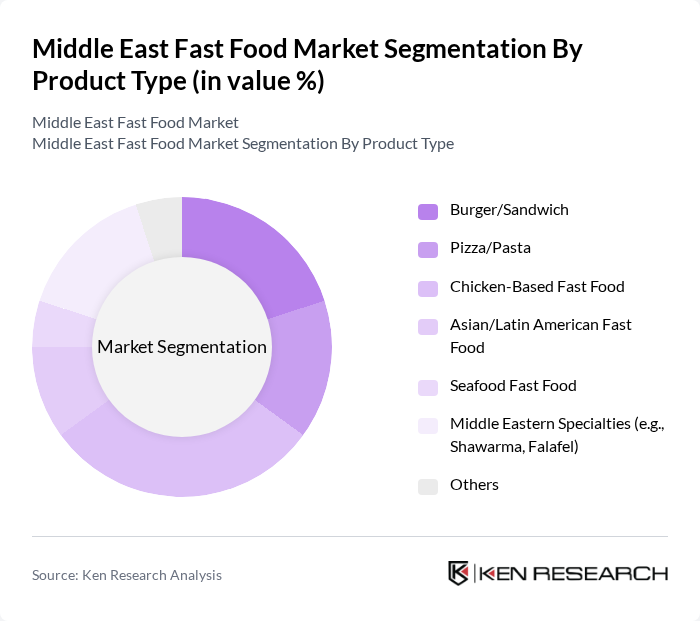

By Product Type:The product type segmentation includes various categories such as Burger/Sandwich, Pizza/Pasta, Chicken-Based Fast Food, Asian/Latin American Fast Food, Seafood Fast Food, Middle Eastern Specialties (e.g., Shawarma, Falafel), and Others. Industry sources commonly break the Middle East fast food market into similar categories, with chicken, burger/sandwich, pizza/pasta and regional specialties recognized as major product clusters. Chicken-based fast food holds a particularly strong position in the region, reflecting consumer preference for poultry over red meat on both price and perceived health grounds and the popularity of fried and grilled chicken concepts.

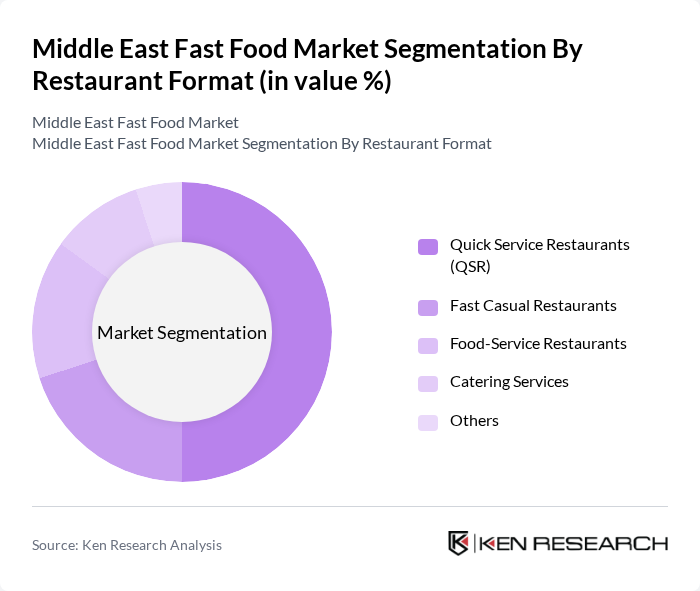

By Restaurant Format:This segmentation includes Quick Service Restaurants (QSR), Fast Casual Restaurants, Food-Service Restaurants, Catering Services, and Others. The Quick Service Restaurants (QSR) segment is leading the market, driven by the increasing demand for fast, affordable meals. The convenience of QSRs, coupled with their ability to cater to a busy lifestyle, has made them the preferred choice for consumers seeking quick dining options.

The Middle East Fast Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as McDonald's, KFC, Burger King, Subway, Domino's Pizza, Hardee's (CKE Restaurants), Papa Johns, Pizza Hut, Tim Hortons, Shake Shack, Five Guys, Al Baik, Zaatar w Zeit, Herfy Food Services, Jollibee contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East fast food market is poised for transformation, driven by evolving consumer preferences and technological advancements. As health-conscious dining becomes more prevalent, fast food chains will need to innovate their menus to include nutritious options. Additionally, the integration of technology in ordering and delivery processes will enhance customer experiences. With urbanization continuing to rise, the market will likely see increased demand for convenient dining solutions, positioning fast food as a staple in the region's culinary landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Burger/Sandwich Pizza/Pasta Chicken-Based Fast Food Asian/Latin American Fast Food Seafood Fast Food Middle Eastern Specialties (e.g., Shawarma, Falafel) Others |

| By Restaurant Format | Quick Service Restaurants (QSR) Fast Casual Restaurants Food-Service Restaurants Catering Services Others |

| By Country | Saudi Arabia United Arab Emirates Turkey Qatar Kuwait Others (Bahrain, Oman, Jordan, etc.) |

| By Service Type | Dine-In Takeaway Delivery (Aggregator and Direct) Drive-Thru Others |

| By Price Positioning | Premium Mid-Range Budget Value Meals/Combo Offers Others |

| By Consumer Demographics | By Age Group By Income Level By Lifestyle/Working Professionals Others |

| By Health Orientation | Health-Conscious/Better-for-You Options Indulgence-Oriented Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Fast Food Preferences | 120 | Regular Fast Food Consumers, Age 18-45 |

| Market Trends in Delivery Services | 90 | Delivery Service Managers, Restaurant Owners |

| Health Conscious Eating Habits | 70 | Nutritionists, Health Food Advocates |

| Impact of Social Media on Fast Food Choices | 100 | Social Media Influencers, Marketing Professionals |

| Regional Fast Food Market Dynamics | 80 | Local Franchise Owners, Market Analysts |

The Middle East Fast Food Market is valued at approximately USD 51 billion, driven by factors such as urbanization, a youthful population, rising disposable incomes, and a shift towards convenient meal options.