Region:Middle East

Author(s):Shubham

Product Code:KRAC4256

Pages:88

Published On:October 2025

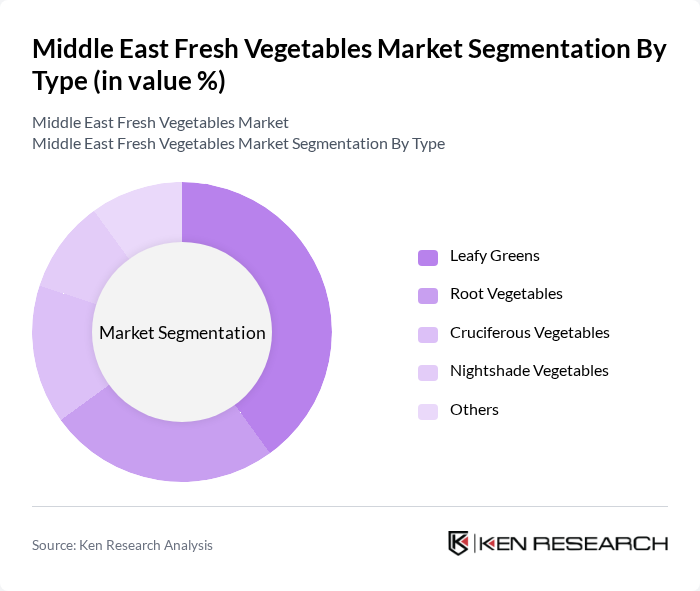

By Type:The fresh vegetables market can be segmented into various types, including leafy greens, root vegetables, cruciferous vegetables, nightshade vegetables, and others. Among these, leafy greens are currently the most dominant segment due to their high nutritional value and increasing popularity in salads and health-conscious diets. The demand for organic leafy greens has surged, driven by consumer preferences for fresh and healthy food options.

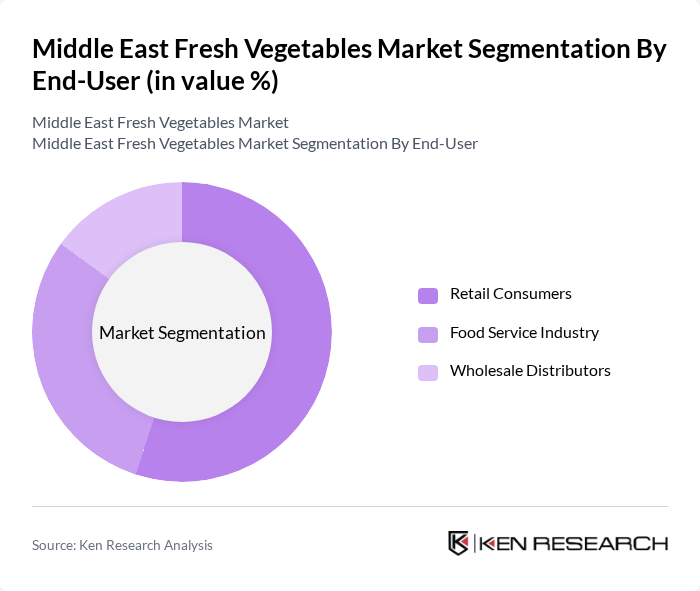

By End-User:The market can also be segmented based on end-users, which include retail consumers, the food service industry, and wholesale distributors. The retail consumer segment is the largest, driven by the increasing trend of home cooking and the demand for fresh produce in households. The food service industry is also growing, as restaurants and cafes increasingly focus on sourcing fresh, local vegetables to enhance their menu offerings.

The Middle East Fresh Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Farms (UAE), Emirates Fresh (UAE), Al Dahra Agricultural Company (UAE), Fresh Del Monte Produce Inc. (Regional operations), Al Watania Agriculture (Saudi Arabia), Al Jazeera Agricultural Company (Saudi Arabia), Al Falah Farms (UAE), Al Rawabi Dairy Company (UAE, diversified into fresh produce), Tanimura & Antle (Regional operations), Savola Group (Saudi Arabia, via its agribusiness arm), National Agricultural Development Company (NADEC, Saudi Arabia), Aujan Group (Saudi Arabia, via fresh produce division), Gulf Fresh Produce (Qatar), Almarai Company (Saudi Arabia, via fresh produce segment), Barakat Group (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East fresh vegetables market appears promising, driven by increasing health consciousness and government support for local agriculture. As urbanization continues, the demand for fresh produce is expected to rise, prompting innovations in farming practices. Additionally, the integration of technology in agriculture will likely enhance productivity and sustainability. With a focus on local sourcing and organic produce, the market is poised for growth, aligning with global trends towards healthier eating habits and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Leafy Greens Root Vegetables Cruciferous Vegetables Nightshade Vegetables Others |

| By End-User | Retail Consumers Food Service Industry Wholesale Distributors |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail Farmers' Markets Direct Sales |

| By Distribution Mode | Fresh Delivery Services Cold Chain Logistics Traditional Distribution |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Organic Certification | Certified Organic Non-Organic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fresh Vegetable Sales | 120 | Store Managers, Category Buyers |

| Wholesale Distribution Channels | 90 | Wholesale Distributors, Supply Chain Managers |

| Consumer Purchasing Behavior | 150 | Household Consumers, Health-Conscious Shoppers |

| Farm Production Insights | 75 | Farm Owners, Agricultural Consultants |

| Market Trends and Innovations | 65 | Market Analysts, Industry Experts |

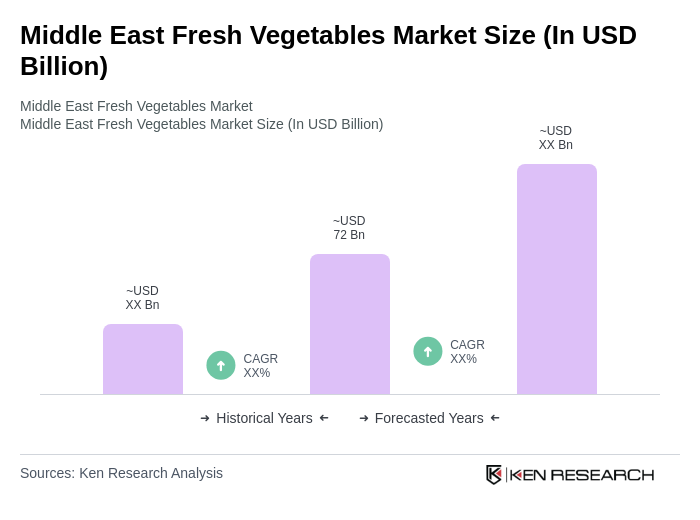

The Middle East Fresh Vegetables Market is valued at approximately USD 72 billion, reflecting a significant growth trend driven by increasing health consciousness, demand for organic produce, and the expansion of modern retail formats.