Region:Middle East

Author(s):Dev

Product Code:KRAC4194

Pages:89

Published On:October 2025

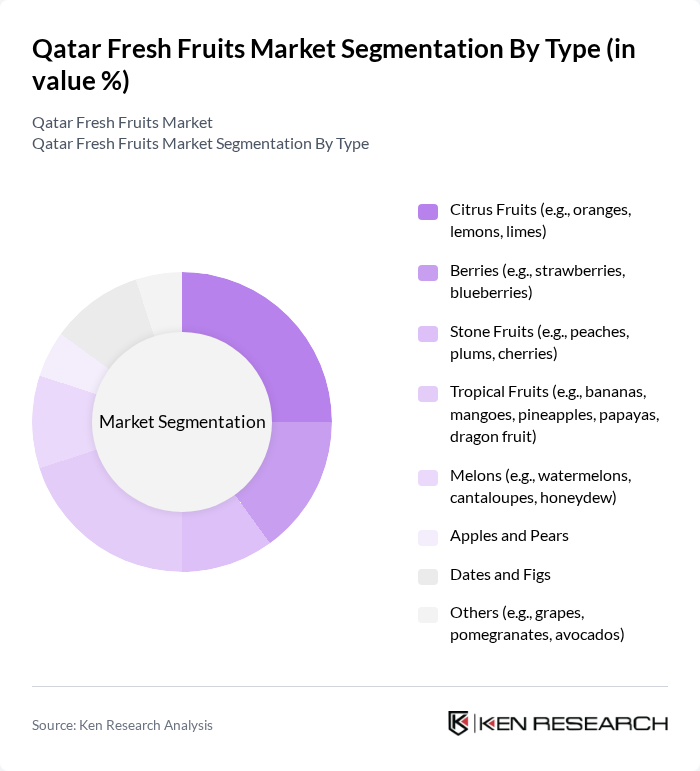

By Type:The fresh fruits market can be segmented into various types, including citrus fruits, berries, stone fruits, tropical fruits, melons, apples and pears, dates and figs, and others. Each type caters to different consumer preferences and seasonal availability, influencing purchasing behavior and market dynamics. Citrus fruits and tropical fruits are particularly popular due to their year-round availability and cultural significance, while dates and figs hold strong demand during religious and festive periods. The market also reflects a growing interest in berries and stone fruits, driven by health trends and premium positioning .

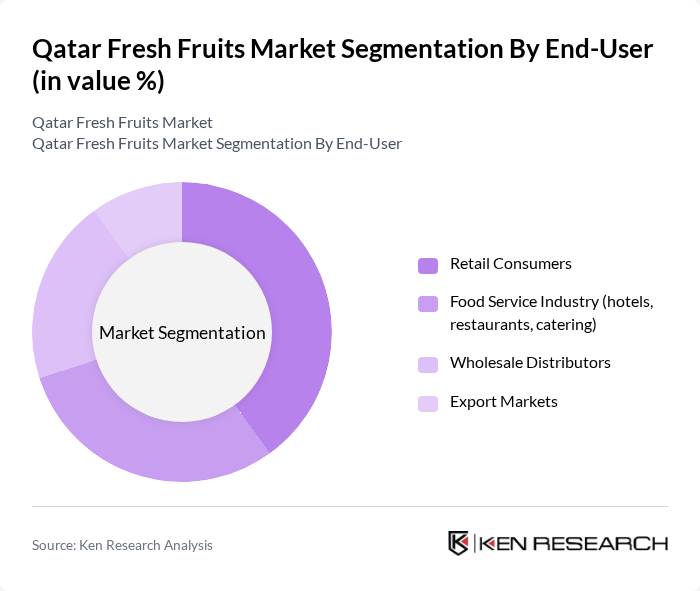

By End-User:The market can also be segmented based on end-users, which include retail consumers, the food service industry (hotels, restaurants, catering), wholesale distributors, and export markets. Each segment has distinct purchasing patterns and requirements, influencing the overall market landscape. Retail consumers drive the largest share, supported by the expansion of organized retail formats and the increasing availability of fresh and high-quality produce. The food service industry is a significant contributor, reflecting the growth of hospitality and tourism in Qatar. Wholesale distributors and export markets are influenced by regional trade flows and logistics capabilities .

The Qatar Fresh Fruits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Meera Consumer Goods Company, Lulu Hypermarket Qatar, Carrefour Qatar, Monoprix Qatar, Qatar National Import and Export Co., Fresh Fruits Company (Qatar), Al Watania Agriculture Qatar, Qatari Farmers Cooperative, Al Jazeera Fruits and Vegetables, Al Fardan Group, Al Rayyan Foods, Doha Fresh Fruits, Qatar Fruits and Vegetables Company, Al Sulaiteen Agricultural and Industrial Complex, Al Khor Fruits, Baladna Food Industries, Agrico Qatar, Mahaseel for Marketing and Agri Services contribute to innovation, geographic expansion, and service delivery in this space .

The Qatar fresh fruits market is poised for significant transformation driven by evolving consumer preferences and technological advancements. As e-commerce continues to grow, online grocery shopping is expected to account for 30% of fresh produce sales in future. Additionally, the increasing focus on sustainability will likely lead to more local sourcing initiatives, enhancing food security. These trends indicate a shift towards a more resilient and consumer-oriented market, fostering innovation and growth in the fresh fruits sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Citrus Fruits (e.g., oranges, lemons, limes) Berries (e.g., strawberries, blueberries) Stone Fruits (e.g., peaches, plums, cherries) Tropical Fruits (e.g., bananas, mangoes, pineapples, papayas, dragon fruit) Melons (e.g., watermelons, cantaloupes, honeydew) Apples and Pears Dates and Figs Others (e.g., grapes, pomegranates, avocados) |

| By End-User | Retail Consumers Food Service Industry (hotels, restaurants, catering) Wholesale Distributors Export Markets |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail and E-commerce Local Markets (traditional retail, wet markets) Direct Farm Sales (farmers’ markets, farm shops) |

| By Distribution Mode | Direct Distribution Indirect Distribution Cold Chain Logistics |

| By Price Range | Premium Fruits Mid-Range Fruits Budget Fruits |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Quality Grade | Grade A (export quality, premium) Grade B (standard retail quality) Grade C (processing or value segment) |

| By Region | Doha Metropolitan Area Al Dhakira and Al Khor Al Wakrah Al Rayyan |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Grocery Chains | 50 | Store Managers, Category Buyers |

| Local Fruit Importers | 40 | Import Managers, Sales Directors |

| Supermarket Chains | 45 | Merchandising Managers, Procurement Officers |

| Consumer Surveys | 100 | Household Decision Makers, Health-Conscious Consumers |

| Food Service Providers | 50 | Restaurant Owners, Catering Managers |

The Qatar Fresh Fruits Market is valued at approximately USD 600 million, reflecting a significant growth trend driven by increasing consumer demand for healthy eating, rising disposable incomes, and a preference for fresh produce over processed foods.