Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8253

Pages:95

Published On:December 2025

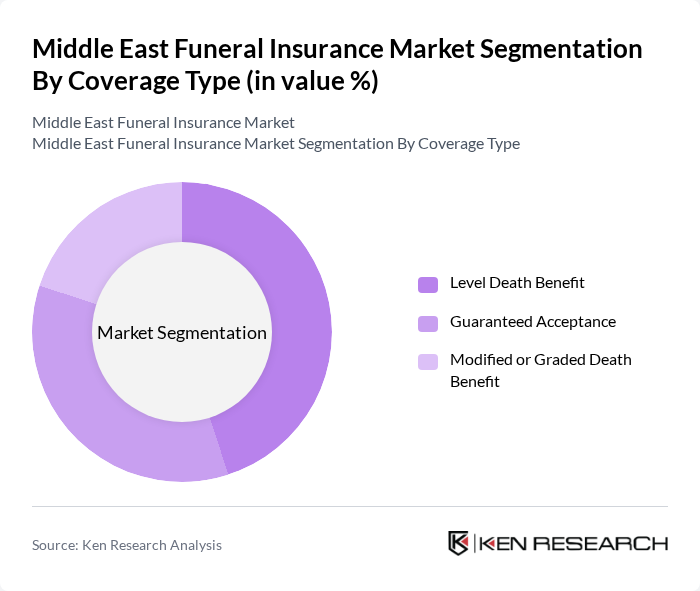

By Coverage Type:The coverage type segmentation includes various plans that cater to different consumer needs. The subsegments are Level Death Benefit, Guaranteed Acceptance, and Modified or Graded Death Benefit. Each of these subsegments offers unique features that appeal to different demographics and financial situations.

The Level Death Benefit subsegment is currently dominating the market due to its straightforward nature and appeal to consumers seeking predictable costs for funeral expenses. This type of coverage provides a fixed benefit amount, which is attractive to individuals looking for financial certainty. The Guaranteed Acceptance subsegment is also gaining traction, particularly among older adults who may have health concerns that make traditional underwriting difficult. Overall, the demand for these coverage types reflects a growing trend towards financial planning for end-of-life expenses.

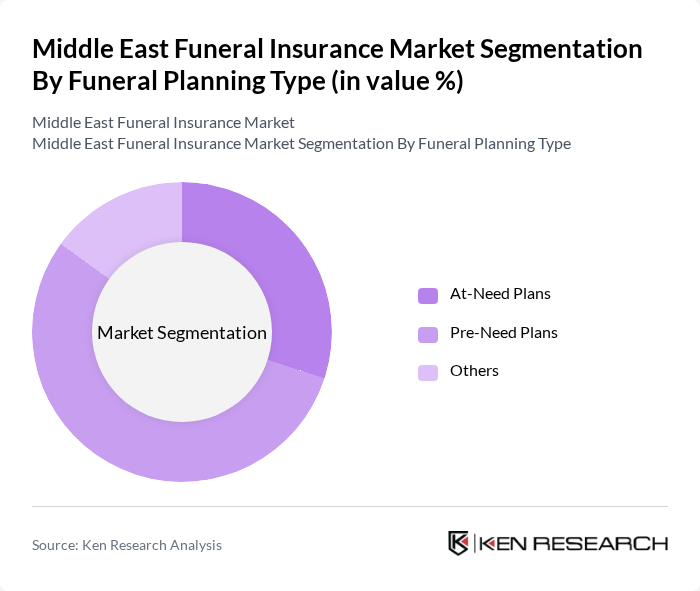

By Funeral Planning Type:This segmentation includes At-Need Plans, Pre-Need Plans, and Others. Each type serves different consumer preferences and needs regarding funeral arrangements.

The Pre-Need Plans subsegment is leading the market, driven by a growing awareness of the benefits of planning ahead for funeral expenses. Consumers are increasingly opting for these plans to relieve their families of financial burdens during difficult times. At-Need Plans, while still significant, are less popular as they require immediate decisions during emotional distress. The trend towards pre-need arrangements indicates a shift in consumer behavior towards proactive financial planning.

The Middle East Funeral Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Hilal Takaful, Abu Dhabi National Insurance Company, Qatar Insurance Company, Oman Insurance Company, Dubai Islamic Insurance & Reinsurance Company, AXA Gulf, MetLife Alico, Takaful Emarat, National Life & General Insurance Company, Al Ain Ahlia Insurance Company, Daman National Health Insurance Company, Al Fujairah National Insurance Company, Union Insurance Company, Bahrain National Holding Company, Saudi Aramco Employee Benefits Program contribute to innovation, geographic expansion, and service delivery in this space.

The future of the funeral insurance market in the Middle East appears promising, driven by demographic changes and increasing consumer awareness. As the population ages and funeral costs continue to rise, more individuals are likely to seek insurance solutions. Additionally, advancements in technology and digital platforms will facilitate easier access to insurance products, enhancing customer engagement. The market is expected to evolve with innovative offerings that cater to diverse cultural needs, ensuring that families can secure dignified end-of-life arrangements.

| Segment | Sub-Segments |

|---|---|

| By Coverage Type | Level Death Benefit Guaranteed Acceptance Modified or Graded Death Benefit |

| By Funeral Planning Type | At-Need Plans Pre-Need Plans Others |

| By Distribution Channel | Direct Sales Funeral Homes Cemeteries Online Retail and E-commerce Platforms Company Websites Funeral Product Retailers Specialty Stores |

| By Service Type | Traditional Funeral Services Memorial Services Immediate Services |

| By Age Demographics | Senior Citizens (65+) Middle-Aged (45-64) Young Adults (18-44) Others |

| By Customer Type | Individuals Families Corporations and Employers Government Programs |

| By Geographic Coverage | Saudi Arabia United Arab Emirates Turkey Egypt Qatar Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Policyholders in Urban Areas | 150 | Individuals aged 30-60, with varying income levels |

| Funeral Service Providers | 100 | Owners and managers of funeral homes and service providers |

| Insurance Agents and Brokers | 80 | Licensed insurance agents specializing in life and funeral insurance |

| Cultural and Religious Leaders | 60 | Community leaders and representatives from various religious organizations |

| Financial Advisors | 70 | Financial planners and advisors with experience in insurance products |

The Middle East Funeral Insurance Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by factors such as rising disposable incomes, increasing awareness of funeral planning, and the expansion of digital insurance platforms.