Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4050

Pages:84

Published On:December 2025

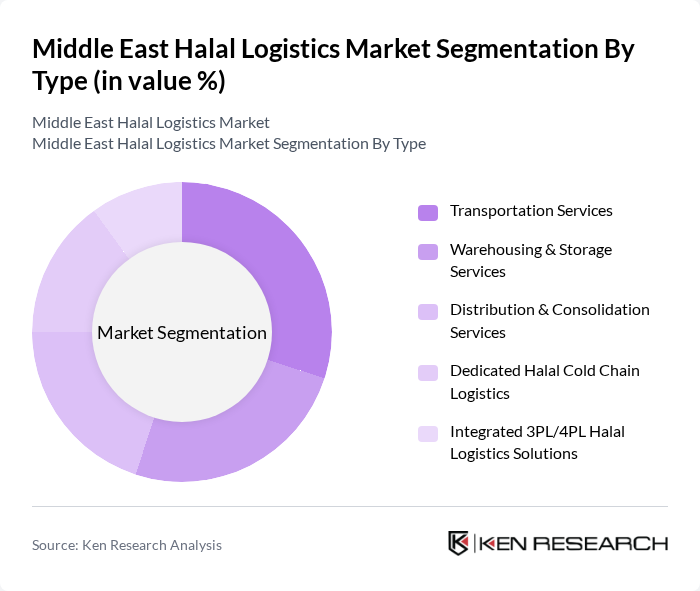

By Type:The market is segmented into various types, including Transportation Services, Warehousing & Storage Services, Distribution & Consolidation Services, Dedicated Halal Cold Chain Logistics, and Integrated 3PL/4PL Halal Logistics Solutions. Each of these segments plays a crucial role in ensuring the efficient movement and storage of halal products, catering to the specific needs of the halal supply chain.

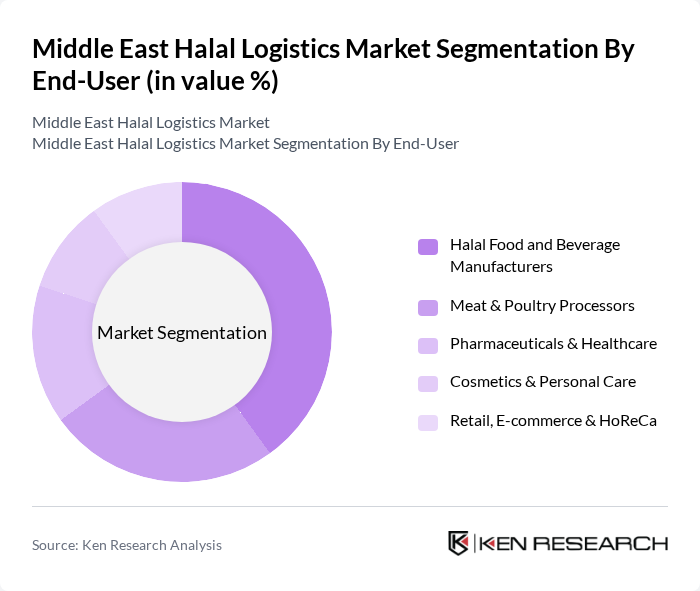

By End-User:The end-user segmentation includes Halal Food and Beverage Manufacturers, Meat & Poultry Processors, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, and Retail, E-commerce & HoReCa. Each of these sectors has unique requirements for halal logistics, driving the demand for specialized services tailored to their needs.

The Middle East Halal Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding (DHL Logistics Middle East FZE), Aramex PJSC, GAC Group (Gulf Agency Company), Agility Logistics (Agility Public Warehousing Company K.S.C.P.), Kuehne + Nagel Middle East, DB Schenker Middle East, CEVA Logistics Middle East, Emirates Logistics LLC (UAE), Al-Futtaim Logistics LLC, Almajdouie Logistics Company (Saudi Arabia), Gulf Warehousing Company Q.P.S.C. (GWC, Qatar), Saudi Arabian Logistics (SAL Saudi Logistics Services), Abu Dhabi Ports Logistics / AD Ports Group Logistics, Dubai South – Dubai Logistics District & Halal Trade Hub Operators, Jebel Ali Free Zone (JAFZA) Logistics & Halal Cluster Operators contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East halal logistics market appears promising, driven by technological advancements and increasing consumer awareness. As e-commerce continues to expand, logistics providers are likely to adopt innovative solutions such as blockchain for traceability and AI for supply chain optimization. Additionally, the growing emphasis on sustainability will push companies to implement eco-friendly practices, aligning with consumer preferences for transparency and ethical sourcing in halal products.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing & Storage Services Distribution & Consolidation Services Dedicated Halal Cold Chain Logistics Integrated 3PL/4PL Halal Logistics Solutions |

| By End-User | Halal Food and Beverage Manufacturers Meat & Poultry Processors Pharmaceuticals & Healthcare Cosmetics & Personal Care Retail, E-commerce & HoReCa |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq, Others) North Africa (Egypt, Morocco, Algeria, Others) Rest of Middle East |

| By Service Type | Freight Forwarding (Air, Sea, Land) Customs Clearance & Compliance Last-Mile & Urban Delivery Contract Logistics & Value-Added Services |

| By Packaging Type | Bulk & Containerized Packaging Retail & Secondary Packaging Temperature-Controlled & Insulated Packaging Specialized Halal-Segregated Packaging |

| By Distribution Channel | B2B (Manufacturers, Importers, Wholesalers) Modern Trade & Organized Retail Online & E-commerce Platforms Traditional Trade & Others |

| By Technology Utilization | Automated & Halal-Segregated Warehousing Real-Time Tracking, Monitoring & IoT Systems Inventory & Warehouse Management Software Blockchain & Digital Halal Traceability Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Halal Food Logistics | 120 | Logistics Managers, Quality Assurance Officers |

| Halal Pharmaceuticals Distribution | 90 | Supply Chain Directors, Regulatory Compliance Managers |

| Halal Cosmetics Supply Chain | 70 | Product Managers, Operations Supervisors |

| Halal Certification Bodies | 50 | Certification Auditors, Compliance Officers |

| Halal E-commerce Logistics | 80 | E-commerce Managers, Fulfillment Center Managers |

The Middle East Halal Logistics Market is valued at approximately USD 90100 billion, driven by increasing demand for halal products, the expansion of halal e-commerce, and rising consumer awareness regarding halal certification.