Region:Middle East

Author(s):Geetanshi

Product Code:KRVN1357

Pages:103

Published On:December 2025

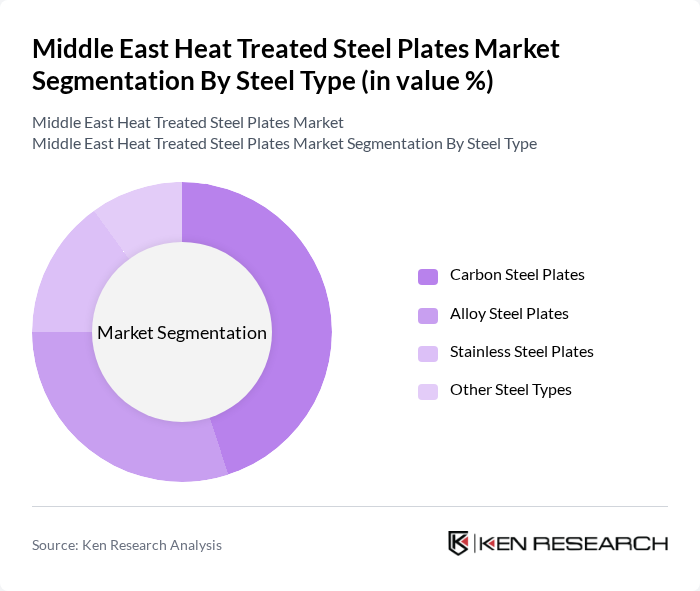

By Steel Type:The market is segmented into Carbon Steel Plates, Alloy Steel Plates, Stainless Steel Plates, and Other Steel Types, in line with global industry practice for heat-treated plate classification. Carbon Steel Plates are widely used due to their cost-effectiveness, availability in thick gauges, and suitability for structural and pressure applications, making them the leading subsegment in construction, general fabrication, and energy projects. Alloy Steel Plates are gaining traction due to their enhanced mechanical properties, wear resistance, and ability to withstand high pressure and temperature, which is critical in oil and gas, mining, and heavy machinery applications. Stainless Steel Plates are preferred in applications requiring corrosion resistance, hygiene, or exposure to aggressive media, including petrochemical, desalination, and process industries. Other Steel Types include specialized grades such as high-strength low-alloy (HSLA), wear-resistant, and armor plates serving niche markets like defense, mining, and offshore structures.

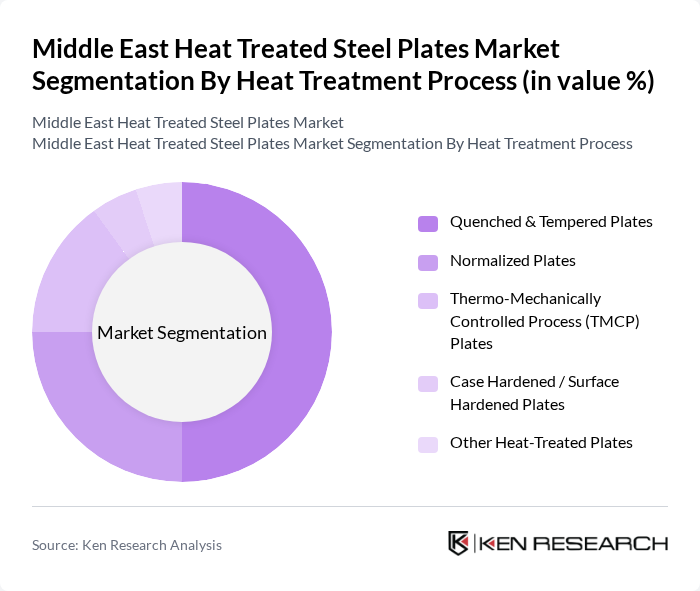

By Heat Treatment Process:The market is categorized into Quenched & Tempered Plates, Normalized Plates, Thermo-Mechanically Controlled Process (TMCP) Plates, Case Hardened / Surface Hardened Plates, and Other Heat-Treated Plates, consistent with prevailing process-based segmentation in global plate markets. Quenched & Tempered Plates dominate the market due to their superior strength, hardness, and toughness, making them ideal for heavy-duty applications such as mining equipment, lifting machinery, and high-strength structural components. Normalized Plates are also significant, offering good mechanical properties, improved toughness, and weldability for building and construction, bridges, and general structural uses. TMCP Plates are increasingly adopted in the region for high-strength, thick-gauge applications that require improved weldability and reduced plate weight, particularly in shipbuilding, offshore structures, and large-diameter pipelines. Case Hardened / Surface Hardened Plates and Other Heat-Treated Plates serve more specialized wear, tooling, or localized hardening requirements in industrial equipment and components.

The Middle East Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players, with demand anchored in GCC construction, oil and gas, and heavy industrial projects. Leading participants such as Emirates Steel Arkan, Qatar Steel Company, Al Jazeera Steel Products Co. SAOG, Saudi Iron and Steel Company (Hadeed), National Steel Company (NASCO), Oman Steel Industries, Arabian International Company for Steel Structures, Jindal Shadeed Iron & Steel LLC, Suez Steel Company, United Steel Company (SULB), Al-Falak Steel, Al Rajhi Steel Industries Co., Hadid Al Sharq Steel, Al Muhaidib Group, and other regional plate fabricators and service centers contribute to innovation, geographic expansion, and service delivery in this space by expanding plate rolling capacity, diversifying into higher-strength and alloy grades, and offering value-added services such as cutting, profiling, and welding.

The future of the Middle East heat-treated steel plates market appears promising, driven by ongoing investments in infrastructure and the automotive sector. As countries in the region continue to diversify their economies, the demand for high-quality steel products is expected to rise. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and product customization, aligning with industry trends. Companies that adapt to these changes and focus on sustainability will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Steel Type | Carbon Steel Plates Alloy Steel Plates Stainless Steel Plates Other Steel Types |

| By Heat Treatment Process | Quenched & Tempered Plates Normalized Plates Thermo-Mechanically Controlled Process (TMCP) Plates Case Hardened / Surface Hardened Plates Other Heat-Treated Plates |

| By End-Use Industry | Construction & Infrastructure Oil & Gas and Petrochemicals Power Generation (Conventional & Renewables) Automotive & Transportation Shipbuilding & Marine Industrial Machinery & Heavy Equipment Other Industrial End-Users |

| By Application | Structural Components Pressure Vessels & Boilers Wear-Resistant & Abrasion-Resistant Components Line Pipes & Offshore Structures Shipbuilding Plates Others |

| By Thickness | Up to 20 mm –40 mm –80 mm Above 80 mm |

| By Distribution Channel | Direct Sales (Mills to End-Users) Distributors & Service Centers Trading Companies Online & E-Marketplaces |

| By Country | Saudi Arabia United Arab Emirates Qatar Oman Kuwait Bahrain Turkey Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Steel Usage | 120 | Project Managers, Procurement Officers |

| Automotive Manufacturing Steel Requirements | 90 | Production Managers, Quality Control Engineers |

| Oil & Gas Industry Steel Applications | 80 | Operations Managers, Safety Engineers |

| Shipbuilding Sector Steel Specifications | 60 | Naval Architects, Supply Chain Managers |

| Heavy Machinery Manufacturing Steel Needs | 70 | Design Engineers, Procurement Managers |

The Middle East Heat Treated Steel Plates market is valued at approximately USD 10 billion, driven by demand in construction, oil and gas, and heavy machinery applications, particularly in Gulf Cooperation Council (GCC) countries.