Region:Asia

Author(s):Geetanshi

Product Code:KRAC3125

Pages:95

Published On:October 2025

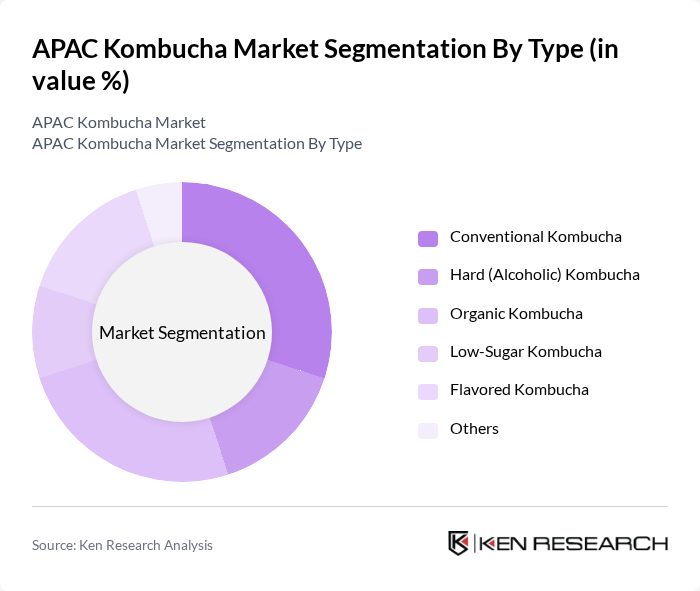

By Type:The kombucha market is segmented into various types, including Conventional Kombucha, Hard (Alcoholic) Kombucha, Organic Kombucha, Low-Sugar Kombucha, Flavored Kombucha, and Others. Among these, Organic Kombucha is gaining significant traction due to the increasing consumer preference for organic products and the perceived health benefits associated with them. The demand for Low-Sugar Kombucha is also on the rise as health-conscious consumers seek alternatives with lower sugar content. Conventional Kombucha remains popular due to its traditional appeal, while Hard Kombucha is carving out a niche among adult consumers looking for alcoholic options. Flavored variants are also popular, catering to diverse taste preferences.

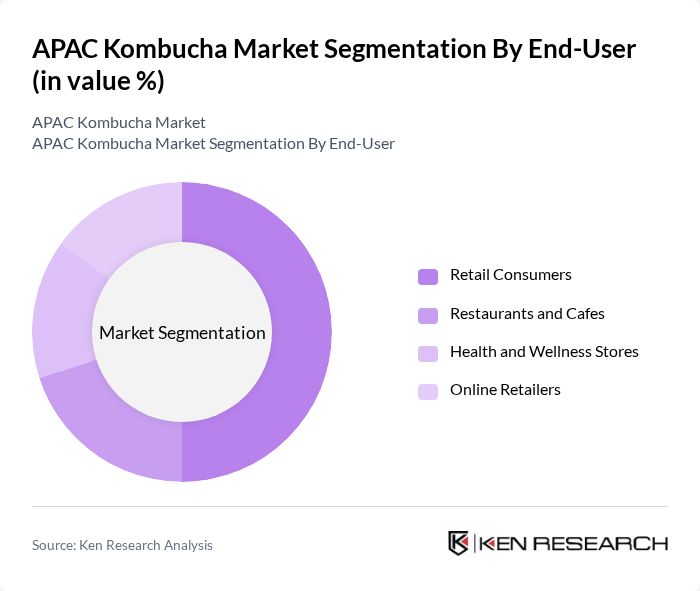

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Health and Wellness Stores, and Online Retailers. Retail Consumers dominate the market as they represent the largest segment, driven by the increasing availability of kombucha in supermarkets and health food stores. Restaurants and Cafes are also significant contributors, as they offer kombucha as part of their beverage menus, appealing to health-conscious diners. Health and Wellness Stores cater to a niche market focused on organic and health-oriented products, while Online Retailers are gaining traction due to the convenience of e-commerce.

The APAC Kombucha Market is characterized by a dynamic mix of regional and international players. Leading participants such as Remedy Drinks (Australia), Equinox Kombucha (Australia), Soulfresh (Australia), Brothers and Sisters (Australia), MOMO Kombucha (Australia), Real Raw Organics (Australia), Vogue UK (Australia), Fermenthe (Thailand), SoulSmith Kombucha (South Korea), GT's Living Foods (Global, with APAC presence), Kombucha Wonder Drink (Global, with APAC presence), Humm Kombucha (Global, with APAC presence), Brew Dr. Kombucha (Global, with APAC presence), KeVita (Global, with APAC presence), Wild Tonic (Global, with APAC presence) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC kombucha market is poised for significant evolution, driven by increasing consumer demand for health-oriented beverages and innovative product offerings. As brands focus on sustainability and organic ingredients, the market is likely to witness a shift towards eco-friendly packaging and production methods. Furthermore, the rise of personalized nutrition will encourage companies to develop tailored kombucha products, catering to specific health needs, thereby enhancing consumer engagement and loyalty in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional Kombucha Hard (Alcoholic) Kombucha Organic Kombucha Low-Sugar Kombucha Flavored Kombucha Others |

| By End-User | Retail Consumers Restaurants and Cafes Health and Wellness Stores Online Retailers |

| By Region | North Asia (China, Japan, South Korea) Southeast Asia (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam) South Asia (India, Pakistan, Bangladesh, Sri Lanka) Oceania (Australia, New Zealand) |

| By Packaging Type | Glass Bottles Cans PET Bottles Kegs |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores E-commerce |

| By Price Range | Premium Mid-Range Economy |

| By Flavor Profile | Fruity Herbal Spicy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kombucha Producers | 100 | Founders, Production Managers |

| Retailers of Health Beverages | 70 | Store Managers, Category Buyers |

| Consumers of Functional Beverages | 120 | Health-conscious Consumers, Millennials |

| Distributors in Beverage Sector | 60 | Logistics Coordinators, Sales Representatives |

| Industry Experts and Analysts | 40 | Market Analysts, Beverage Consultants |

The APAC Kombucha Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing health consciousness and the rising demand for functional beverages among consumers in the region.