Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2309

Pages:98

Published On:October 2025

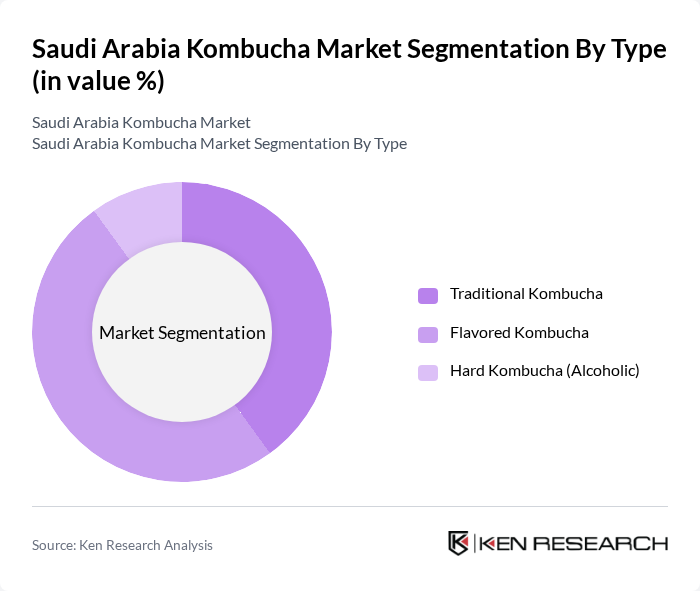

By Type:The market is segmented into Traditional Kombucha, Flavored Kombucha, and Hard Kombucha (Alcoholic). Traditional Kombucha is the original form, while Flavored Kombucha has gained popularity due to its variety and taste. Hard Kombucha, which contains alcohol, is emerging as a niche segment appealing to adult consumers seeking alternative alcoholic beverages. Flavored Kombucha is increasingly preferred by younger consumers and urban populations, driven by demand for innovative flavors and premium beverage experiences .

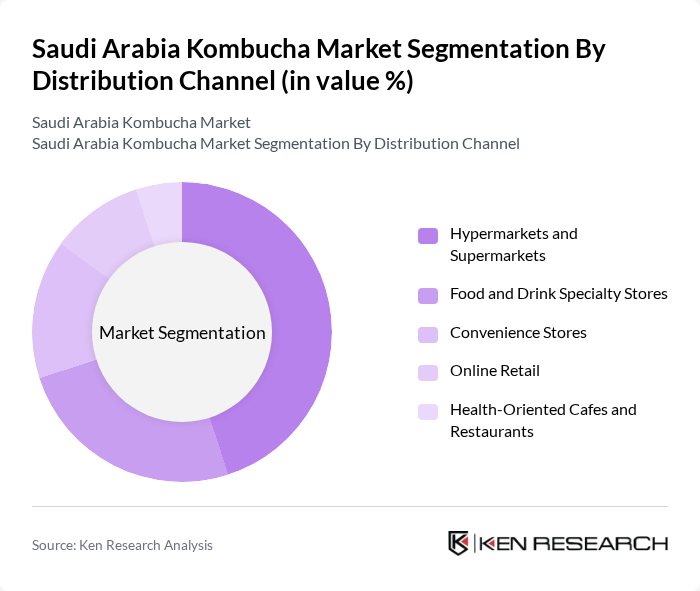

By Distribution Channel:The distribution channels include Hypermarkets and Supermarkets, Food and Drink Specialty Stores, Convenience Stores, Online Retail, and Health-Oriented Cafes and Restaurants. Hypermarkets and Supermarkets are the primary channels due to their extensive reach and established logistics, while Online Retail is gaining traction among tech-savvy and health-conscious consumers seeking convenience and access to a broader product range. Food and Drink Specialty Stores and cafes are expanding their kombucha offerings to cater to premium and wellness-focused clientele .

The Saudi Arabia Kombucha Market is characterized by a dynamic mix of regional and international players. Leading participants such as GT's Living Foods, Health-Ade Kombucha, Remedy Drinks, The Humm Kombucha LLC, KeVita (PepsiCo), Reed's Inc., Buchi Kombucha, Revive Kombucha, Kosmic Kombucha, The Hain Celestial Group, Kombucha Wonder Drink, Townshend's Tea Company, Live Soda Kombucha, Red Bull GmbH, Nesalla Kombucha contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kombucha market in Saudi Arabia appears promising, driven by increasing health awareness and a shift towards functional beverages. As consumer preferences evolve, brands that innovate with unique flavors and health benefits are likely to thrive. Additionally, the expansion of online retail channels will facilitate greater accessibility, allowing consumers to explore diverse kombucha options. Collaborations with health and wellness brands will further enhance market visibility, positioning kombucha as a staple in health-conscious diets across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Kombucha Flavored Kombucha Hard Kombucha (Alcoholic) |

| By Distribution Channel | Hypermarkets and Supermarkets Food and Drink Specialty Stores Convenience Stores Online Retail Health-Oriented Cafes and Restaurants |

| By Packaging Type | Glass Bottles Cans PET Bottles |

| By Flavor Profile | Ginger-Turmeric Berry Citrus Herbal and Botanical Exotic Fruits |

| By Consumer Segment | Young Urban Consumers Health and Wellness Enthusiasts Lifestyle Disease Management Consumers |

| By Price Range | Premium Mid-Range |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Dhahran) Western Region (Jeddah, Mecca) Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kombucha Retailers | 60 | Store Managers, Beverage Buyers |

| Health-Conscious Consumers | 120 | Fitness Enthusiasts, Organic Product Shoppers |

| Health and Wellness Experts | 40 | Nutritionists, Dietitians |

| Food and Beverage Distributors | 50 | Distribution Managers, Supply Chain Coordinators |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

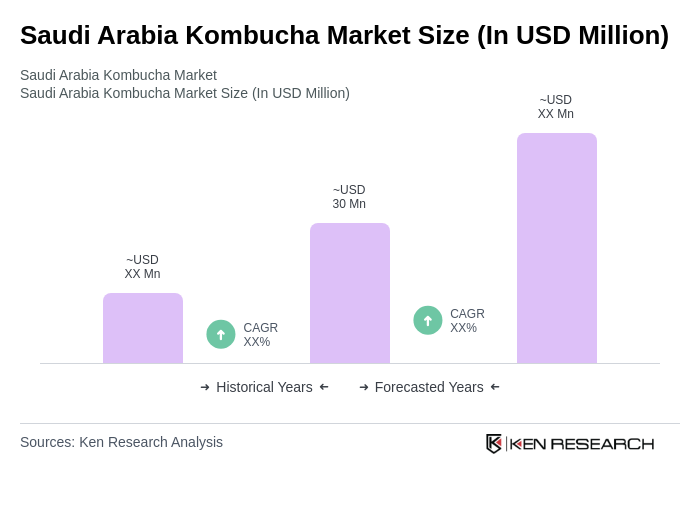

The Saudi Arabia Kombucha Market is valued at approximately USD 30 million, reflecting a growing interest in health-conscious beverages and the increasing demand for functional drinks that support digestion and immunity among consumers.